Stop paying for other people’s vacation homes

Going on vacation is the fun part. Paying for somewhere to stay on your trip is not.

But there’s a way you can have the best of both worlds.

If you own your own vacation home, you can get away at any time without having to book or pay for lodging.

Of course, you’ll still have mortgage costs (unless you can pay for the house with cash). But many people cover those by renting their vacation home out.

Here’s how to find out whether that’s an option for you.

Verify your ability to buy a vacation homeJump to:

- Who should buy a vacation home

- Types of second homes

- Choosing a location

- Financing a second home

- Renting out your vacation home

Does buying a second home make sense for you?

Who’s the ideal candidate for buying a vacation home?

- You vacation in the same area often

- You can afford two mortgages at once (or your primary home is paid off)

- You’ll put in the effort to rent the vacation home when you’re not using it

It’s “someone who takes a lot of vacations to the same geographic area,” says Eric Harvey, program director and instructor at the University of Indianapolis.

“Or else someone who needs to diversify their investment portfolio outside of traditional publicly traded investments like stocks and bonds.”

Suzanne Hollander is a real estate attorney and Florida International University senior instructor. Ask her and she’ll tell you that the ideal buyer is someone who already has a home.

“This person should be able to cover both their primary homeownership costs and vacation homeownership costs. These include mortgage, insurance, and property taxes on both properties,” she says.

“And he or she should be prepared to work closely with an accountant or tax professional. That’s because it’s smart for the vacation home buyer to structure an ownership, use, and exit strategy in order to account for tax and family planning implications.”

Ralph DiBugnara, president of Home Qualified, said the best prospects for buying a vacation home are those willing to rent it out, too.

“Vacation homes can be a great source of rental income — even on a part-time basis,” says DiBugnara.

See financing options for vacation homes today

What kind of vacation home should you buy?

You need to decide if you want to buy a single-family home, attached home (condo or townhome), or timeshare. Each has its pros and cons.

- Single-family home: Yours to use and rent, but often more expensive

- Condo/townhome: Yours to use and rent, cheaper to maintain

- Timeshare: Cheapest option, but subject to timeshare rules

“A buyer of a single-family home can control how the home is used and by who,” says Hollander.

“They can use it anytime and probably even rent it out as often as they’d like to — subject to local zoning regulations. But the buyer must maintain the home, which can be expensive and time-consuming.”

Purchasing a condo or townhome reduces your maintenance obligations. That’s true if you will be paying monthly homeowners association fees to cover upkeep.

But the condo or townhome may have rules that restrict rentals, Hollander adds.

“With a timeshare, you don’t purchase the real property; instead, you purchase a right to use it for a certain period of time. They’re often less expensive than property purchases,” she says.

“But you have to plan in advance to use the timeshare for popular dates like winter vacation and national holidays.”

What’s the best vacation home location?

The right vacation home location makes all the difference, says Harvey.

“Many counties, cities, and towns in vacation destinations prohibit short-term rentals. Or they restrict them to a limited number of days a month. You may also need a license and be forced to pay innkeeper taxes,” he says.

Hence, market research is critical.

>> Related: How to find affordable vacation homes

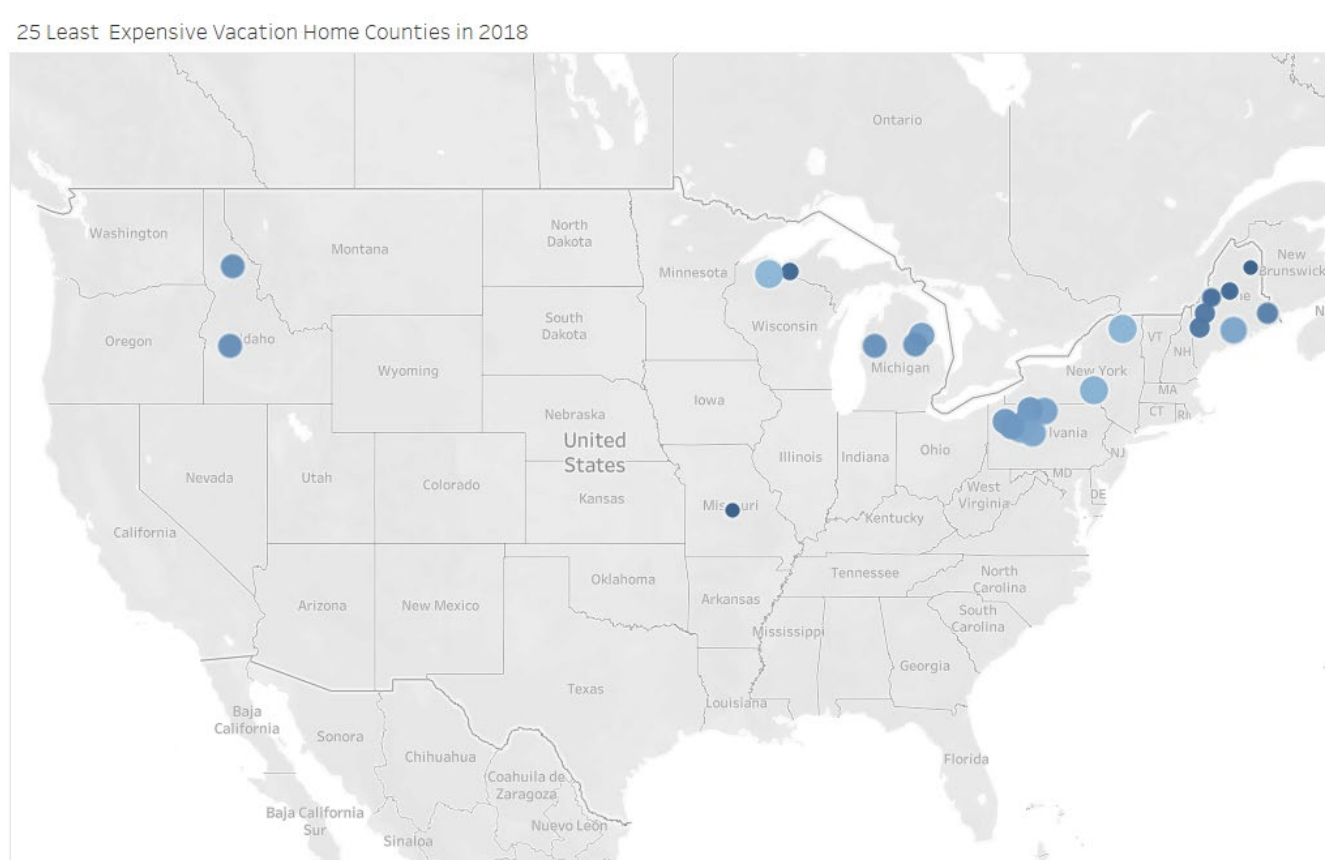

A 2019 report from the National Association of Realtors showed the 25 cheapest counties to buy a vacation home

You’ll likely be competing with hotels and established rentals listed through online portals. So you need to ensure that the home you choose is in a desirable location spot where, if you rent it out, you won’t get undersold on rates by competitors.

“Also, be aware that certain areas, such as along the coasts, have higher building standards. That may increase the cost of your insurance or prevent you from obtaining certain coverage,” Harvey notes.

How will you finance your second home?

Financing a vacation home can be tricky. That’s especially true if you still pay a mortgage on your primary residence.

Having an existing mortgage may make it tougher to qualify for a loan on a second home, but not always. Fortunately, new lending rules make it easier to purchase a vacation property.

“Most banks will treat this as an extension of your primary residence and offer financing along those terms,” says DiBugnara.

The three most common ways to buy a vacation property are:

- A cash-out refinance on your primary home

- A HELOC (home equity line of credit) on your current home

- A conventional loan on the second home itself.

Be aware that vacation home loans are often regarded as higher risk. The reason why is that you’re not using the home as your primary residence, and you may rent it out.

As a result, the interest rates can be slightly higher on these loans.

>> Related: Investment property mortgage rates — how much more will you pay?

Can vacation home rentals help you pay off your second mortgage?

Harvey owns his own vacation home in southwest Florida. He says owning one can be a great way to diversify your investment portfolio, if you plan to rent it out.

DiBugnara agrees.

“Savvy homeowners will rent the property partially during busy seasons and cover the majority of their mortgage payments for the year,” says DiBugnara.

“Savvy homeowners will rent the property partially during busy seasons and cover the majority of their mortgage payments for the year” —Ralph DiBugnara, President of Home Qualified

Services like HomeAway, Airbnb and Rented.com make it easier than ever to attract and cater to short-term rental clients.

But managing, maintaining and marketing a vacation home to renters is hard work. If the home is far from where you live, you may have to hire property management experts to handle these tasks. And there’s no guarantee that your rental will be in demand.

Lastly, if you’re looking to profit from this venture, “treat it like a business. Have a business plan, have a budget, and do your market research,” suggests Harvey.

>> Related: How to get a mortgage on a second home

Ready to buy a vacation home?

Owning a second home lets you vacation more for less. But a second mortgage is no small consideration. Make sure you can afford it or rent out the property to help cover costs.

See if you can afford vacation home financing using the link below.

Time to make a move? Let us find the right mortgage for you