In this article:

Buying rental property can be a great investment, but it is also challenging. In this guide we’ll cover:

- Why buying a rental property is a good investment, from tax benefits to financial security

- How to find a good rental property, including accurately estimating the costs and benefits, being honest with yourself about your ability to manage the property, and how to decide of a property is a bargain

- Your loan options for paying for an investment property

- The closing process when buying a rental property, including the extra issues you’ll need to address before closing day

- The pros and cons of buying a rental property with a partner

Rental property: a source of income — and headaches

So you’re thinking of buying rental property. Congratulations! Many find owning such homes to be an excellent investment.

But don’t expect an easy ride. For the best return, you’ll need to develop a new skillset. And expect to put in many hours of work. Owning investment property isn’t like the buy-and-forget model of stock ownership.

This comprehensive guide outlines how to invest in real estate successfully. It warns you of some common pitfalls and suggests ways to avoid them. And it will propose the investment property loans that might suit you best.

Verify your new rateWhy buying rental property is a good investment

Done well, investing in rental property can be a great way to make your money work hard for you. In fact, the deck’s stacked in your favor:

You can borrow cheaply

Of course, you’ll likely need some savings or a business partner for down payments (see below). But what other investment can you fund with ultra-low interest rates and fixed monthly payments?

Not ready to be a homeowner? Buy a rental and move in later

And your borrowing is secured by an asset that’s likely to appreciate handsomely over time. Yes, we all know home prices can go down as well as up. But in the long run, most markets see a long-term upward trajectory.

So there’s a good chance you’ll see the value of your asset rising as your mortgage balance gently falls away. And, assuming you’ve done your sums properly and aren’t horribly unlucky, it’s your tenants who will be paying down your debt.

Tax benefits are generous

Just how tax-efficient your rental property investment will depend on your personal circumstances. And how you structure your investment vehicle has an effect. So you need to talk your plans through with your tax adviser.

It is interesting that as your property (probably) appreciates over time, the IRS allows you to deduct depreciation, as though its value falls like that of other assets — such as business equipment.

In fact, many investors in these assets pay very little tax on their rental income. And some use legitimate deductions from their investment property businesses to reduce their overall tax liabilities. In other words, you may be able to pay lower taxes on your other earnings.

Your investment can provide financial security

All investments carry some risk. It’s the nature of the game. But buying rental property can deliver good and relatively safe gains, providing you do your homework first.

To start with, your mortgage will probably have a fixed rate. But your rents will certainly not be fixed. In most market conditions, they’re likely to rise, year after year after year.

Buy a home and convert your former home to a rental

And, depending on where you buy, your asset might appreciate similarly quickly. That’s the sort of double whammy nobody minds.

And, of course, once your tenants finish paying down your mortgages, all that lovely rental revenue is yours — after some ongoing expenses. Time your investment right, and you could find your retirement delightfully comfortable.

How to find a good rental property

You’re not buying a home

Well, obviously you are buying a home. Perhaps many. But that’s incidental: what you’re actually buying is a revenue stream. And the potential to make a profit.

Arguably the No. 1 mistake made by newbies buying rental property is to forget that. They’re still admiring the countertops, solid wood floors and open-plan concept instead of focusing on the numbers.

But those numbers are everything. It doesn’t matter how nice a rental home is; you don’t want to own it unless it’s going to make you a profit.

But it has to be marketable

Of course, that doesn’t mean you should buy a succession of hovels. Though that might work if you have a large pool of potential tenants nearby who love hovels.

But, generally, you need to buy an attractive, pleasant place that plenty of people in the area will want to rent. You need to deliver that at a price they can afford. And you must make a profit.

Live in your own duplex and call it a primary residence

That may well mean that you have to invest in fixing up a rundown home. But don’t spend one cent more than you need to get a good return on your investment.

There’s only one thing to do if the purchase price plus the renovation budget won’t generate a profit: Walk away.

Numbers? What numbers?

There are some numbers you know or can estimate with accuracy. For example, the purchase price of the property, your down payment, your mortgage interest rate (which may be different from that for a home for owner occupation — more below) and your monthly payments.

But others will have to be based on assumptions. Don’t be scared of that. Every business plan in the world is based on assumptions.

Investment property mortgage rates: How much more will you pay?

However, you need to base those assumptions on the best information you can get. And that involves a lot of homework.

Research when buying rental property

Your homework involves research. Study the local property market, looking at both the sale and rental sectors.

You can learn a huge amount online nowadays. And you should keep up with the local press.

But you also need to talk to property professionals in the area who have expert knowledge of the local markets. Realtors, real estate agents and brokers and property managers are often happy to have their brains picked.

Unless you’re in construction or have real and relevant expertise, get a home inspection on any property you’re thinking of buying.

Those assumptions

The aim of your research is to help you make realistic assumptions about things that could affect the profitability of your investment, including these 12:

- How much revenue the home’s going to generate from month 1 — The initial rental value of the property

- How quickly rents are rising (or falling) in the neighborhood — How much revenue it’s likely to generate in future

- How often and for how long the home’s likely to be vacant between tenancies (your “vacancy rate”) — Supply and demand in the local rental market

- How high your management, maintenance and repair bills are likely to be (see “Your role,” below), remembering to account for inflation in future years

- How quickly home prices are rising (or falling) in the neighborhood — Your capital appreciation

- How much (if anything) it will cost you initially to get the home into a marketable condition for rental purposes

- How likely it is you’ll end up with a bad tenant who saddles you with big repair bills or stiffs you over rental payments

- How much you’ll pay in property taxes and home insurance premiums — Sometimes these are higher (or much, much higher) on rental properties than owner-occupied ones. So investigate

- How much, where applicable, you’ll pay in homeowners’ association fees and what your HOA’s rules are — Make sure these aren’t onerous. And check that the HOA’s finances are sound

- How much, if anything, you’ll pay for utilities

- How much, if anything, you might pay to occasionally advertise for new tenants

- How great the risk factors are for the area — for example, whether local employment is dependent on a single employer and how likely that is to close

Those are among the basics, and you can read more about some of them below.

More than 4 financed properties? There are options for you

Your role

One of the factors that will have a significant effect on your numbers will be your own role. You need to choose how much time and effort you personally will commit to your investment property.

But this is a tough one. Because the tasks you can do yourself are limited by your skills as well as your schedule. Those tasks might include:

- Routine yard maintenance (if necessary)

- Routine building maintenance — painting, wallpapering, clearing gutters, cleaning between tenancies ...

- Building repairs — fixing a roof, installing a furnace or HVAC unit, mending a leaky tap, replacing sidings or windows ...

- Finding and screening tenants

- Collecting rents

- Fielding any complaints from tenants or neighbors

You may want to do all those yourself. But do you have the time, inclination and skills? If not, you’re going to need to use a property manager, contractors or maybe casual labor.

And you have to add their charges to your costs. Even if you do all of some of those tasks yourself, you should build in an hourly rate for your time. Since when do you work for nothing?

Refining some assumptions

Perhaps the hardest figures to pin down when buying rental property are your revenues. How do you know how much rent you’ll get each month? How much home value appreciation can you expect?

And how do you predict the number of months you’ll get nothing, either because you’re between tenants or because your current tenant isn’t paying — and perhaps never will?

Can Airbnb wreck your mortgage refinance?

You should do the research, of course. But before closing, make sure that you get an appraisal with a rental schedule. That’s a comparison between the subject property and similar homes in the area. The rental schedule tell renters should be willing to pay.

Before making an offer, though, you can get an idea of potential rental income. Real estate agents should want to cultivate you as a potential buyer of multiple homes.

You may consult websites, such as rentometer, that provide local rental data. And this rental property calculator predicts your return on investment based on based on your own assumptions about your monthly rent, annual increases and expected property appreciation rate.

Pay attention to the ones that offer homes that are closely comparable to the ones you’re thinking of buying. You may even want to contact the owners of the closest ones and see if they will tell you how the market is, how long they have been renting out the home, and what the challenges are.

How your lender runs the numbers

There are several formulas you can use to evaluate rental property.

Your lender, for example, will probably take 75 percent of the rent (or appraised rent if the property is not currently leased), and add that to your income. Then, it will hit you with the mortgage payment, property taxes, homeowners insurance, and HOA dues, if applicable.

You’ll know if after paying the mortgage and other regular monthly expenses whether you will have extra cash or not. But that number depends on so many other factors — the size of your down payment, for one — and may ignore things like tax deductions, maintenance and property management fees.

How investors run the numbers

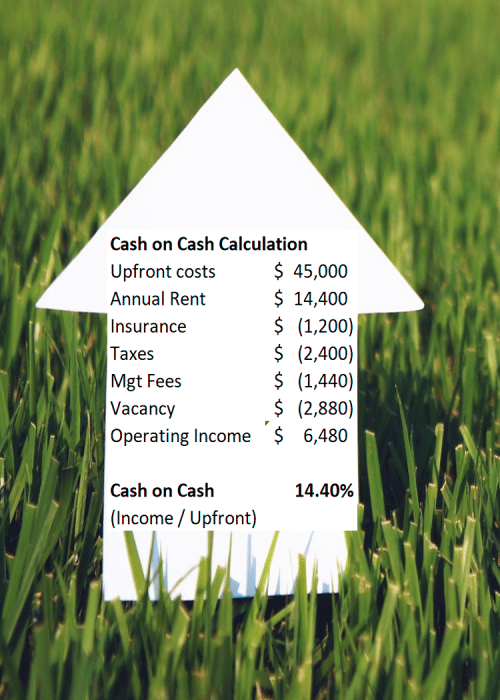

Some investors like to look at “cash on cash,” which tells you what the return is on your initial investment. For instance, if you buy a $200,000 property with $40,000 down and $5,000 in closing costs, what is the return on your investment if you get $1,200 a month in rent?

In this case, it’s 14.4 percent, a good number. And because the calculation is pretty simple, it allows you to compare properties easily.

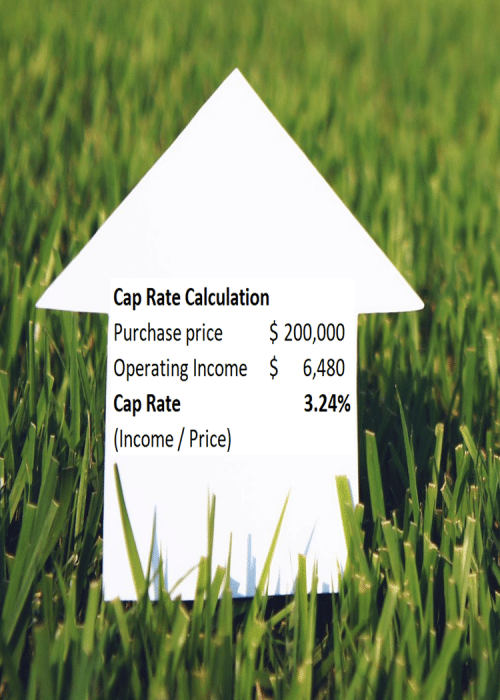

Your capitalization rate, or “cap rate,” is an even faster calculation. Take the income after operating expenses (the mortgage is not a factor), and divide by the sales price.

In general, the better the property and neighborhood, the lower the cap rate can be. If you’re looking at a run-down property in a not-great location, you’ll want a higher cap rate to offset these extra costs and risks.

These calculations are nice for comparing properties, but when it comes to buying in real life, you need to know what ownership of the property will do to your wallet.

Consider your mortgage payment and tax bracket — determining how much in taxes you’ll pay, and how much of a deduction you get for depreciation.

In this case, you’ll be out-of-pocket over $2,600 annually if you own this property. But there is a final piece in the puzzle — potential appreciation. If, for instance, this property appreciates at the oft-quoted national average for residential property of 4 percent, you’re looking at an $8,000 gain in value.

Buy cheaply

Buying a rental property at a bargain price gives you a flying start. Your down payment and monthly mortgage payments will be lower than if you’d paid full price. And that gives you a real advantage.

But don’t assume that every home you can buy below market value will deliver the sort of profit you want. Instead, run the numbers. And rely on those.

If the bargain is irresistible, you could try running different numbers for renovating and flipping it. But that’s a wholly different business model from the one under discussion here.

Home prices: how to get the best deal on a flip

How to find bargains

There are lots of ways to find a seller who is motivated to close a quick deal — and who may accept a low offer to get one.

One is to build personal relationships with local real estate agents. That way, you could get to be their first call when a likely home is about to be listed.

But suppose you plan to build a rental empire. And you need a stream of properties. You could go much further.

Some bloggers suggest getting a list of homeowners who are delinquent on their property taxes from county records. You can then contact them, saying you’re a willing buyer who’s ready to move quickly on a purchase. You might be the answer to their prayers. Meanwhile, some data providers specialize in foreclosure lists.

Caveat emptor

“Caveat emptor,” as they used to say in ancient Rome. It’s what lawyers still say when they mean “let the buyer beware.”

And few transactions require more caution on the part of individuals than the purchase of real estate. Once a home’s yours, so are its problems.

That means you need to check and double check everything. And, unless you’re an expert in building construction, you may need to pay for a home inspection. Even those with extensive specialist knowledge may want to download a checklist of potential flaws to look out for.

Where to buy investment property

Especially if you’re just starting out, buying rental property within an easy drive of where you live makes sense. It lets you keep a close eye on your investments. And you’ll be on hand to deal with any emergencies.

Buy a duplex with less than 5 percent down

Equally, you’ll be conveniently located to undertake any tasks you’ve decided to do yourself. Do you really want to have to drive for several hours just to chase some rent or carry out a minor repair?

Advantages of diversifying

Having said that, you may want to think twice before betting everything you have on a single asset or within a single location. After all, towns, cities and counties can go from prosperous to poor in rapid and unpredictable ways.

Suppose all your rental homes are in one town. And that gets hit by mass layoffs or some other misfortune. The direct (those laid off) and indirect (those who provide goods and services to those who are laid off) victims are your existing and potential tenants. And, eventually, you too could become one of the indirect victims.

But building a geographically diverse portfolio of investment properties that spreads your risk across different areas and economies isn’t easy. And, possibly, in the place you want to invest, the risks are too distant for you to need to address them.

However, it’s important you recognize the dangers and what’s at stake.

Should you be buying in hot spots?

Search online for the “best places to buy rental properties” and you’ll find plenty of advice about hot markets. And they’re the sorts of places where risk factors recede.

They’re mostly in extended metro areas, such as Dallas, Miami and New York City. And they’re doubtless full of opportunities for astute landlords.

But those are expensive places to buy rental properties: beyond the pockets of many investors. And, for many more, they’re too far from home to be sensible choices for those who want to monitor and manage their assets.

Luckily, there are markets across America that can deliver attractive returns. Just manage your risks, make your assumptions as reliable as possible ,and then trust your numbers. Those don’t guarantee success. But they dramatically reduce your exposure.

What about “bad” neighborhoods?

A point of lively debate among landlords is whether buying rental property is a good idea in “bad” neighborhoods, meaning ones you wouldn’t choose to live in yourself. Often, you can find opportunities in those that look like great investments.

Maybe, when you run the numbers through your spreadsheet or evaluation tool, they read like a dream. Especially on multifamily blocks, you may be able to buy cheaply and generate seriously attractive revenues.

But bear in mind the quality of tenants you’ll probably attract. There may be a higher incidence of deadbeats, moonlight flitters and out-and-out vandals.

And the number of extra hours you have to spend looking after the building might be considerable. All of these are costs you have to add to your calculations to get a realistic idea of your likely return.

Of course, most of the people who rent from you are likely to be good, law-abiding souls who happen to be poor. But you may also attract lowlifes and criminals. Are you the sort of person who could face them down?

The “moving on up” strategy

One popular way to begin buying rental property is not to buy a rental property. And that’s not as oxymoronic as it sounds.

Because with this model, you rent out your existing home and buy somewhere bigger and better to live. Your tenant pays your original mortgage, effectively buying that home for you. And you get to live somewhere larger, more comfortable, more prestigious or perhaps more convenient.

The advantage is that your financing for the rental is already in place, and at the more favorable terms of primary residences. In fact, if you’re considering this strategy, and you can improve on the terms of your current mortgage, refinancing while the house is still your primary residence could be a good idea.

Verify your new rateSome rules

Often, there’s nothing not to like. But there are some potential drawbacks (see below) and a number of rules you should follow:

- You should tell your mortgage lenders and insurers what you’re doing

- Unless you can afford to comfortably pay both mortgages out of your salary or other non-rental income, expect to jump through the following hoops:

- You’ll need a “single-family comparable rent schedule” — This is an independent appraisal of the rental income you’re likely to receive

- You’ll have to show you have savings in a bank or investment account of at least 2 percent of the balance on your mortgage on the rental home

- And that level of savings will apply to other homes you subsequently acquire to rent. But the percentage rises when you have five or more homes in your portfolio

Drawbacks to moving on up

Most of the drawbacks to moving on up are the same as those for all rental properties: The risks of extended rent-free periods between tenancies and the possibility of having a bad tenant.

But there’s one tax implication you should bear in mind. Suppose you have substantial equity in your existing home. (Equity is the difference between the current market value of the property and the amount you owe today on your mortgage.)

That sum is not currently taxable, because your gain has been made on your principal residence. If you sell it now, you’ll likely pay nothing.

How the mortgage interest tax deduction lowers your payment

But the moment the home becomes an investment property, you could acquire liability for your capital gain (the difference between the original purchase price and the sale price, perhaps less some allowances for improvement costs) when you eventually come to sell it.

(You can avoid taxes by purchasing another investment property with the profits — this is called a 1031 exchange.)

If the amount of equity you have is small, that might not bother you. And you might be prepared to swallow such a distant loss. But it’s something you should include in your calculations.

Making an offer

When you find a bargain property, you’re going to have to act quickly. Motivated sellers won’t deal with apparently unmotivated buyers. And you’re going to be in competition with other potential purchasers, whether they’re buying rental property or a home for themselves.

So keep your seller actively engaged with queries and negotiations. And do your desk research, make your calls and run your numbers within hours rather than days. Homes priced to sell quickly ... well, sell quickly.

The key to making a timely offer is preparation. To have the best chance of success, you need already to

- Know intimately the local sale and rental markets

- Have your home-made or off-the-shelf rental property evaluation tool tested and ready to go

- Have finance lined up and preapproved

How long does it take to get pre-approved for a mortgage?

Lining up your resources and knowledge in advance gives you the ability and confidence to act quickly and decisively.

Contingencies

Making an offer and signing a binding purchase contract before you know everything about a home is fine. But only if you build “contingencies” (get-out clauses) into the contract that let you walk away if everything isn’t as it seems.

The key contingency in most contracts concerns the home inspector’s report. In the event that uncovers significant and expensive problems with the property, the buyer can back out — or renegotiate the purchase price.

Is it safe to waive real estate contingencies when you buy a house?

But you can add any contingencies you want. The trouble is, the more you add, the less likely the seller is to sign the contract, especially if the price you’re offering is cheekily low. And there’s a risk other purchasers will make offers with fewer or no contingencies.

Applying the bird-in-the-hand principle, the seller may prefer a lower offer with few-to-no contingencies than a higher one with too many.

Investment property loans: your choices

When you’re buying rental property, you may have to choose between different types of mortgages. Those include:

- Conventional (non-government)

- Federal Housing Administration (FHA loans)

- Veterans Administration (VA loans)

You’ll find more information about each of those below.

Down payment requirements for investment properties

W buying rental property, you’ll usually need a larger down payment than you would for a primary residence. There are a few exceptions, which are described in the next section.

Typically, you’ll need a 20 percent down payment — sometimes even more. (Fannie Mae and Freddie Mac do allow you to buy with 15 percent down, but you have to pay for mortgage insurance.) That’s because lenders know that rentals are more likely to go into default than owner-occupied homes.

HELOC or fixed home equity loan? What’s best for you?

How do you come up with that much? Younger entrepreneurs tend to use savings and inheritances. But older ones often access the equity in their own home through a home equity loan or home equity line of credit (HELOC).

Because the latter is flexible (you pay interest only on outstanding balances, and can borrow and repay up to your limit as frequently as you wish), HELOCs can be especially helpful if you need to refurbish the home after purchase.

Buying rental property with a conventional mortgage

You have to be better-qualified to finance a rental than you do to buy your own home. That means higher credit scores, more cash reserves in the bank, and lower debt-to-income ratios.

You might also need to have sufficient existing income to comfortably afford both mortgage payments. Until you can prove that you’re an experienced landlord, lenders are likely to ignore all the potential rental income from the rental property you’re buying.

Comparing home loans: Which one is best for me?

When they do count the rental income, lenders typically deduct a 25 percent vacancy factor.

There may be a workaround for this. However, it’s one you should adopt with caution. Some non-mainstream private lenders may be willing to lend on different terms. But they’re likely to charge a considerably higher mortgage rate.

Other challenges

Your investment property mortgage rates are likely to be a little higher than the ones you’d pay when you’re buying a home for your own occupation. Expect to pay at least .75 percent more. If you’d qualify for a 4 percent rate for a primary residence, that means you’d be offered about 4.75 percent to finance a rental.

You’ve already read (above) about the rule that says you need savings in a bank or investment account of at least 2 percent of the balance on your mortgage on the rental home. This is to make sure you’re not going to miss a mortgage payment if you have a temporary vacancy or non-paying tenant.

Investment property and FHA and VA loans

Both VA and FHA loans are only available on the property where you’re going to live. But that doesn’t mean they bar you from getting rental income.

Suppose you buy a building with two, three or four residential units. Providing you live in one of those units, you can rent out the other(s).

VA loans

VA home loans are often the best mortgages any borrower can get. They don’t require any down payment at all, and they generally offer highly competitive rates. But they’re only available to those who qualify, including those on active service, veterans, certain surviving spouses and other closely defined categories.

Who is eligible for VA home loans?

You can buy a residential building with up to four units and rent out up to three of them. But you must live there yourself. And the VA takes its occupancy rules seriously. Having said that, you may eventually be able to rent out a home with a VA mortgage and move to a different property that you buy with a conventional loan.

What’s the catch? Well, you typically need cash reserves totaling at least 6 months mortgage payments. And that includes principal, interest, taxes, and insurance (PITI).

FHA loans

Again, these can be very good loans when buying rental property. They require a minimum 3.5 percent down payment. Rates generally aren’t bad but you’ll have to pay more to insure your loan.

And, providing you live in one unit, you can buy a residential building with up to four. But, as with VA loans, you may eventually be able to rent out a home with an FHA mortgage and move to a different property that you buy with a conventional loan.

FHA loan calculator with MIP — check your eligibility

Better yet, you may be able to count at least some of your future rental revenues as part of your income. But only if there are established leases already in place.

Chances are, you’ll need cash reserves to cover at least three months’ mortgage payments on a PITI basis.

Closing process when buying rental property

Assuming you’ve already bought your own home (and most purchasing investment property probably will have), you already know about closing.

Mortgage Closing: What Happens At Your Signing

There may be extra issues to address on or before closing day when you’re buying rental property, especially when tenanted units are involved. These include the following:

- Paying over of any security deposits/last month’s rent from existing tenants (you’ll probably need a new, separate bank account for those)

- Confirming that units you expect to be vacant are not occupied

- Ensuring units are up to code, which may require an inspection by a state or local authority

- Disclosure of any unresolved complaints from tenants or withholding of rents

- Handing over a schedule of existing tenancies

- Assigning of leases to the new owner and notifications to tenants

Laws covering these vary and may be governed by your state, city or county. So research them where you live. Better yet, hire a local attorney who specializes in these matters. The IRS lists those closing costs that are deductible.

Real estate investment strategies

By now, you may be wondering whether you’re cut out to be a landlord. There are risks, obstacles to borrowing and serious hours of work involved, some of which may be physical.

Renting can cost you more upfront than buying

You may be right. But don’t forget: Those risks may be lower than with some other investments. Those obstacles are designed to help prevent you getting into trouble. And that work is optional. Because you can choose to avoid it by hiring others to manage and maintain your investment properties. Trouble is, that will eat into your profitability.

Other investment vehicles

Still, if you’re questioning your suitability as a landlord, you might want to look at alternative ways of investing in real estate. Here are some:

- REITs — Real estate investment trusts let you buy shares in larger property projects, including industrial buildings, hotels, malls and so on. These often generate good dividends. And you’re sharing the risks with other investors. But you may prefer to stick to publicly traded trusts, at least to begin with, since those are easier to sell later

- Buy non-residential property — You still buy buildings, but they are commercial or industrial properties. These typically require a lot less day-to-day involvement on the part of the owner

- Invest online — Peer-to-peer lending websites, such as LendingClub and Prosper, can introduce you to entrepreneurs who need to fund real estate projects. But do your research

- Buy stock in construction companies — Let experts help you make money from real estate

- Flip — Buy sound but rundown homes. Do them up and sell them for a profit. But this is hands-on work, even if all you do is buy, design, supervise contractors and sell

- Buy your own home — Do that and you’re a real estate investor

- Rent out a spare room or guest cottage — Everyone has to start somewhere

These all come with varying levels of risk, which may be associated with the returns they offer.

Buying rental property with a partner

There is absolutely nothing to stop you having a partner in your real estate business. Indeed, if your partner is rich and you aren’t, it can be a fine way to kick-start an enterprise.

Buying a home with a partner or friend

You just have to negotiate a fair structure that repays your partner’s investments while fairly sharing the business’s rewards.

Tax and legal implications

Before you set up your business, you need to have a long talk with tax and legal professionals. It may be that your best vehicle is a simple partnership agreement.

But you may be better off establishing a business with a limited liability model, of which there are many. But laws for these vary from state to state.

And in many states there are newly introduced models that are still evolving. That’s why you need professional advice and a firm legal footing.

Personal implications

Many partnerships disintegrate because the people involved lack a common understanding. So it’s vital to reach that common understanding over the enterprise’s goals, decisionmaking structures and finances.

And put as much as you can in writing. Some aspects should be incorporated into the partnership agreement or its legal equivalent for your type of business.

But compromise is essential in any partnership. So if you or your partner are the sort of person who has to win every argument, you’re probably better off as a sole proprietor.

Spouse, family, friends or strangers?

However, this need for compatibility sets up a strange tension. You know your spouse, family and friends. So you stand a better chance of predicting the sort of business relationship you’ll have. But get that prediction wrong, and you could put one of your most precious personal relationships on the line.

Short on funds? Get a co-borrower to help fund your purchase

Partnering with a relative stranger increases the chances of incompatibility. But, counterintuitively, those relationships often flourish. Perhaps people are naturally respectful of strangers while familiarity breeds contempt with those who are closer.

But who knows? All you can do is talk through as many aspects of the business as you can with your prospective partner. And so resolve many future disputes before they arise.

And finally

In researching this guide, one piece of advice stood out in the many sources consulted. A successful real estate investor recalled the hardest thing about becoming a landlord was signing the first purchase offer.

It’s truly scary. And you imagine all the things that can go wrong. But, once you’ve bitten that bullet, you nearly always (though, sadly, not always) find that things get easier and easier. And your confidence and wealth typically grow with each new acquisition.

Still, you might not be temperamentally suited to being a landlord. Or maybe you lack the necessary interpersonal or practical skills. Or perhaps you understandably just lack the courage to sign that first offer. And that’s all fine.

Real (estate) opportunities

However, there are more than 111 million households renting in the United States. And the people who own those homes are probably on average no smarter than you. But they may be wealthier.

If you think you have what it takes, check out our guide to becoming a landlord. Perhaps you have a great future with one of the most time-proven investments around.

Time to make a move? Let us find the right mortgage for you