Securing a lower refinance rate

Mortgage and refinance rates have remained volatile heading into 2025, with periods of fluctuation creating both challenges and opportunities for homeowners. While rates are still higher than the historic lows of a few years ago, recent shifts may open the door for better refinancing options. That’s why it’s more important than ever to negotiate for the best possible rate.

So, how do you do that?

With the right knowledge, you can approach your lender with confidence, knowing how to compare one offer with another—and even use competing offers to your advantage.

Ready to secure the best refinance rate in today’s market? Here’s how.

Find your lowest refinance rate. Start hereIn this article (Skip to…)

- Check credit score and DTI

- Shop around

- Assess closing costs

- Compare loan estimates

- Know what costs you can shop for

- Consider buying discount points

- Keep your goals in mind

- Refinance rate FAQ

Shop for your best refinance rates in 7 steps:

Getting a good refinance rate doesn’t start when you apply for a new home loan.

It starts before that — with how you manage your personal finances. The better your finances look leading up to a refi, the more likely you are to get a competitive rate.

Follow these seven steps to set yourself up for success when you shop for refinance rates and compare offers.

1. Find out your credit score and debt-to-income ratio

To get your best rate from any lender, you should have a good credit score and a low debt-to-income ratio (DTI). Lenders offer the best rates to borrowers who have a track record of paying their bills on time and managing their debt.

These factors are key. In fact, low credit and high debts are the two main reasons lenders deny refi applications.

So, you’ll want to make sure your financial house is in order before you start shopping for the lowest refinance rates. Check the accuracy of your credit report and calculate your DTI. Keep paying your other bills — student loans and credit card payments, for example — on time.

Keep in mind that a less-than-ideal credit score or above-average DTI doesn’t necessarily disqualify you from a mortgage refinance. But it means you might not be able to get the best rates to maximize your savings.

2. Shop around for your best refinance rate

You can get as many mortgage refinance quotes as you want. But unfortunately, many borrowers get only one quote or apply with one lender.

By requesting a quote from just one lender, you could be leaving thousands of dollars — if not tens of thousands — in savings behind. Fortunately, the internet makes it easy to get quotes from multiple refinance lenders.

But here’s the kicker: You can’t just get multiple quotes. You must show the quotes to the other lenders.

Chances are that high quotes will come down. Lenders can lower their rates or fees to keep your business. Savvy shoppers come out on top when they use multiple quotes to their advantage.

3. Assess your estimated closing costs

After you receive your loan quotes (formally known as Loan Estimates), you have to decide which offer aligns with your refinance goals. You might think the lender offering the lowest rate is the obvious choice, but that isn’t always the case.

When you’re shopping for a refinance loan, you’re comparing rates as well as closing costs. The two go hand-in-hand.

When you’re shopping for mortgage refinance rates, you’re also shopping for the lowest closing costs.

While Lender A might be offering a rate of 6.25% compared to Lender B’s 6.5%, Lender A might charge more in closing costs. There’s a chance Lender B’s rate of 6.5% may be more affordable than the 6.25% offered by Lender A if you’re paying less at closing.

Many lenders also offer “no-closing-cost mortgages,” which can be a bit misleading.

While these loans can eliminate the upfront cash requirement, you typically end up paying those fees in a different way (via a higher interest rate or bigger loan amount.) So if your lender is advertising a no-cost refinance, be sure to ask about the rate and fee structure.

Find out what rate you qualify for. Start here

4. Compare loan estimates to find your best refinance deal

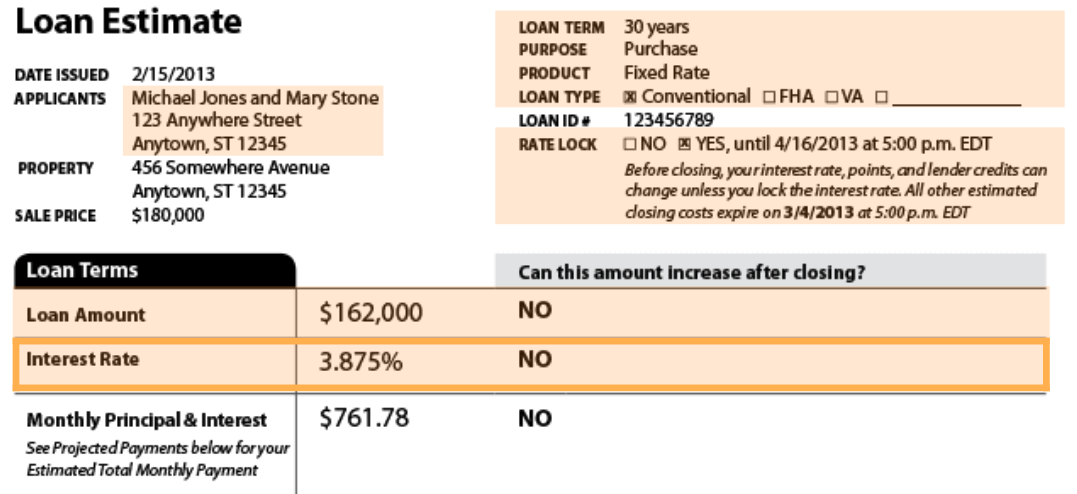

When you start applying with mortgage lenders, you’ll often receive Loan Estimates from each one. The Loan Estimate is a standard document that includes a complete breakdown of the costs associated with your loan.

Some lenders may not provide you with an actual Loan Estimate until you officially begin a loan application. However, you can still ask them for a breakdown of the rate and associated closing costs.

When you receive your Estimate from each lender, you’ll want to do an “apples-to-apples” comparison. That means comparing your refinance offers dollar-by-dollar and line-by-line. Luckily, Loan Estimates are pretty straightforward and easy to read. All lenders use a similar format.

The first page will show your loan details, as well as your quoted interest rate, monthly principal and interest payment, and projected payments over the life of the loan.

Sample Loan Estimate. Image: ConsumerFinance.gov

5. Know which costs you can shop for

Page two of the Loan Estimate breaks down the upfront costs associated with your loan.

Group A shows costs you can shop for, like the lender’s origination fees and discount points. Group B shows the costs you can’t shop for, such as the appraisal fee, credit report fee, flood determination fee, and other related fees.

When you’re comparing closing costs, pay close attention to costs in Group A. These are the fees to look at when doing a side-by-side comparison.

Sample loan estimate. Image: ConsumerFinance.gov

While many of the fees listed in Group B are predetermined, others, such as appraisal fees, are not. So it’s still necessary to compare these fees when you’re reviewing each lender’s Loan Estimate.

The total you pay in closing costs will determine if Lender A’s 6.5% rate is actually less expensive than Lender B’s 6.25% rate.

“If a Loan Estimate is provided, you can get a good grasp of this difference by comparing the APRs,” says Jon Meyer, The Mortgage Reports loan expert. “APR is ‘costs over loan term,’ not just your interest rate.”

If you plan on rolling your closing costs into your loan, you could wind up paying more each month on a loan with lower interest and higher closing costs than you would on a loan with a higher rate with lower closing costs.

Find out what rate you qualify for. Start here

6. Consider discount points to lower your refinance rate

Most lenders let you buy down your interest rate using what are known as “points” or “discount points.” Each point you buy costs 1% of your loan amount. In most cases, buying one point will reduce your interest rate by 0.25%.

For example, if your new loan balance is $300,000, and you decide to buy one point to lower your rate by 0.25%, it will cost you an additional $3,000 at the closing table.

So, how do you know if buying points is the right move?

First, if you can’t afford the higher closing costs, you may want to stick with the quoted rate and forego discount points.

If you can’t make a large upfront payment, you’ll probably want to skip discount points and stick with the quoted rate.

If you can afford a larger upfront payment — and your ultimate goal is to get your best refinance rate — you might consider buying down your quoted interest rate.

Also note that the cost of mortgage points can often be rolled into your loan amount, allowing you to lower your rate without increasing your upfront fees. However, this will increase your mortgage balance and the total interest paid over the life of the loan. So ask your loan officer for a long-term cost breakdown if you’re considering this option.

Refinance example with discount points

Let’s look at a $300,000 loan amount with a quoted rate of 7% and no points. At 7%, your monthly principal and interest payment would be $1,996.

You decide you want a lower rate. But is it worth buying one point to lower your rate to 5.75%?

At 5.75% on the same $300,000 refinance loan, your monthly principal and interest payment would be $1,751 — saving you $245 each month, or $88,200 over a 30-year mortgage loan.

However, you’ll need to bring an additional $3,000 to the closing table to pay for that point.

| Refinance rate | 7% | 5.75% |

| Refinance loan amount | $300,000 | $300,000 |

| Cost of discount points | $0 | $3,000 |

| Total P&I savings | -- | $88,200 |

| Time for savings to break even | -- | 12 months |

Keep in mind that many people don’t keep a 30-year loan for all 30 years. So instead of looking at lifetime savings, look at your break-even point.

If you divide the amount you paid for one point ($3,000) by the amount you’ll save each month ($245), it would take you 12 months to break even on the upfront costs ($3,000/$245=12.25).

The bottom line: It will take you about a year to recoup the $3,000 paid for a lower mortgage rate.

If you plan on staying in your home for longer than twelve months after you refinance (and you can afford an additional $3,000 upfront), you’ll save money over the life of your loan.

This example covers only principal and interest payments. It doesn’t take into consideration any property taxes or homeowners insurance premiums that will likely be included in your monthly payment. Those additional fees aren’t affected by interest rates.

Find your lowest refinance rate. Start here

7. Remember your refinance goals

When you’re trying to decide which refinance offer to choose, think about what you’re trying to accomplish with the new loan.

Meyer says a borrower’s goals are the most important point in the process. “When a client says they are considering refinancing, the first step is to identify their primary goals with a refinance.”

If your only goal is to lower your interest rate and reduce your monthly payment, you can easily look for the lender offering the lowest rate and closing costs.

For someone looking to cash out home equity, on the other hand, finding the lowest rate might not be as important as finding the right loan option. Cash-out refinance loans often have slightly higher interest rates, but you get the added benefit of money back at the closing table.

If paying nothing upfront is your goal, then you may consider asking the lender with the lowest costs to roll them into your loan at a slightly higher rate. If the lender agrees, you may not be required to bring any money to the closing table.

Which mortgage lender has the best refi rates?

If you’ve been shopping for the best mortgage refinance rates, you probably noticed they vary from lender to lender. In some cases, they vary by a lot.

So, why does Lender A offer an interest rate of 6.5% while Lender B offers a 6.25% rate?

There are many reasons, such as current economic conditions, how quickly mortgage rates change each day, how the bond market is faring, and more. So take into consideration the date you received the estimate, as it can change daily.

Lenders don’t offer a “one-size-fits-all” refinance rate. Your rate won’t always match what the company advertises.

Also, lenders don’t offer a “one-size-fits-all” interest rate. No lender will offer low rates to everyone who wants to refinance their mortgage — regardless of what their advertising says.

So, to find your best refinance rates, you should get quotes from several lenders for the same type of loan (supply each mortgage lender with the same information).

A good rule of thumb when shopping for mortgage refinance rates is to know your target number before you start looking. If you know beforehand how much you want to drop your rate and monthly payment, you’ll have a good idea of how much it will cost you (and how much you’ll need to pay upfront) to hit your target number.

You can use an online refinance calculator to model your savings before you apply.

Find your lowest mortgage refinance rate. Start hereWhat to look for in a good refinance lender

A good lender offers more than a competitive interest rate. Look for:

- Low refinance rates and closing costs

- Great customer service

- The right refinance product for you (cash-out refinance, conventional refinance, Streamline Refinance, etc. Let your goals guide your search)

Good customer service, a strong track record, and delivering on any promises are all factors you should consider.

Also, make sure the lender offers the most beneficial refinance for your situation. If you have an FHA loan currently, don’t work with a lender that doesn’t offer the FHA Streamline Refinance, which requires no appraisal, no pay stubs, and no W2s.

However, Meyer points out that the most advantageous refinance option for FHA loan holders may be to refi into another loan program. “Anyone with an FHA loan should have a goal to refinance out of FHA and, hopefully, drop the mortgage insurance,” he says.

Additionally, check the lender’s reputation via online reviews, conversations with friends or neighbors, or with real estate agents who work with more than one lender.

You can always start the search with your current lender. However, don’t sign off without looking at any other offers. You could easily be leaving money on the table.

Mortgage refinance rates FAQ

Find your lowest mortgage refinance rate. Start hereShopping around for refinance rates means checking interest rates from at least three to five lenders. Don’t just look at rates advertised online, because these are only a sample and they’re often based on an ideal borrower profile. Your own rates could be higher or lower depending on your finances and loan type. Fill out loan applications with a few lenders so you know which one can offer the best deal for you. Also, try to get quotes on the same day so you’re comparing apples to apples.

Your current lender likely doesn’t want to lose your business, and some will offer special deals for existing customers who refinance. But you shouldn’t take those deals at face value. Another lender might offer much lower rates, meaning you could actually save more than you would with your current lender. Even if you like your existing mortgage lender, shop around with a few others just to make sure you’re not missing out on a better deal elsewhere.

Refinance rates and purchase mortgage rates are often the same. You typically won’t pay a higher rate just because you’re refinancing. However, market conditions can affect that relationship.

Your mortgage interest rate shows the amount you’ll pay each year for financing. Annual percentage rate (APR) is a little more expansive; it includes the interest rate as well as all your upfront fees, spread over the life of the loan. APR can help you compare the ‘true’ cost of different mortgage loans. However, it’s not incredibly useful because the APR calculation assumes you’ll keep your mortgage all 30 years, which most homeowners don’t. You’re often better off looking at the combination of interest rate and upfront fees than APR alone.

VA loans and USDA loans often have the lowest refinance rates. However, you must be a veteran or rural homeowner to qualify. FHA loans also offer competitive refinance rates, especially if you’re refinancing from one FHA loan to another via the FHA Streamline Refi program. Conventional loan rates are often a little higher than government-backed loans. But, you have the ability to lower your rate with a high credit score and avoid private mortgage insurance (PMI) if you have at least 20% equity when you refi.

Your credit score, home equity, debt-to-income ratio, and loan type (for example, fixed-rate mortgage or adjustable-rate mortgage) are the main factors that affect your refinance rate. Loan term, loan amount, loan-to-value ratio, and loan product are also important. For example, you’ll typically pay a lower interest rate on a 15-year mortgage than you would for a 30-year fixed-rate loan. You’ll also pay a lower rate if you have a good credit score (typically 740 or higher) and a low DTI ratio (typically 36% or lower).

The tried-and-true method for getting the lowest refinance rate is to get quotes from more than one lender — and ask questions. If you talk to a lender directly, ask why its rate or closing costs are different from other quotes you’ve received. Lenders are required to provide formal Loan Estimates before you refinance so you can compare costs. If you have a low debt-to-income ratio, a good credit score, and a reliable source of income, you’re in the driver’s seat. Lenders will fight each other to get your business.

There’s no easy answer to this question. The best refinance lender could be different for everyone; it depends on your application, your loan type, and which lender is offering low rates at the time you apply. The good news is, you have complete control over your choice of lender. Big banks, credit unions, mortgage lenders, and mortgage brokers all offer refinance loans. So you can choose the type of institution you want to work with, then find the company offering the best interest rate and fees for you.

Understanding what’s in your credit report before shopping for the best refinance rates could help you when you speak with loan officers. Even homeowners and home buyers with excellent credit can find errors that could be corrected. Using a service like annualcreditreport.com, you can pull free credit reports once per calendar year from the major credit bureaus: Equifax, TransUnion, and Experian. Dispute any errors, incorrect information, or duplications. Also, pay down as much debt as possible, such as high-interest credit card balances, to help improve your FICO score ahead of the loan refinance process.

Shorter loan terms can get you a lower refinance rate, but it will also more than likely increase your monthly mortgage payments. As an example, refinancing from a 30-year fixed-rate mortgage to a 15-year gives you half the time to repay your home loan. However, you will own your home sooner and save on interest payments over the life of the loan.

Conventional refinances typically require at least 20% in home equity. If you made a small down payment and closed on your home recently, you may not have that much equity yet. But if you have a government-insured loan — such as an FHA, VA, or USDA loan — you could get a Streamline Refinance with little or no equity or even with negative equity. Lenders can also approve a VA cash-out refi with little to no equity.

What are mortgage refinance rates today?

Current mortgage rates are still low enough for some homeowners to lock in a lower rate and mortgage payment by refinancing.

However, rates change daily, and they vary by company and by person. To find your best refinance rate, you need to shop with a few different lenders and compare offers. You can start right here.

Time to make a move? Let us find the right mortgage for you