Does refinancing start your loan over?

The short answer is, yes. When you refinance, you’re replacing your original mortgage with a brand new one. That means you effectively start the loan over.

But it is still possible to refinance without restarting your loan term at 30 years.

With a little bit of savvy, you may be able to refinance and shorten the number of years remaining on your loan.

Here are several mortgage refinance options to consider without starting over.

Verify your refinance eligibility. Start hereIn this article (Skip to…)

- Refi without extending your loan

- Shorten your term

- Prepay instead of refinancing

- Refinance-to-prepay your mortgage

- Your mortgage repayment schedule

- Today’s refinance rates

Mortgage refinancing without starting over

As a homeowner, your mortgage loan term is your choice. There’s no rule that says you have to use a 30-year fixed-rate mortgage. If you do choose a 30-year mortgage, you’re not obligated to keep it the full term.

Verify your refinance eligibility. Start hereYou’re free to refinance or use other strategies to shorten your repayment period — and save a lot on interest payments.

That said, mortgage lenders also won’t customize the term to suit the borrower. So you may not find a new mortgage with the same end date as your prior mortgage.

For example, let’s say you locked in a 30-year loan that is now 5 ½ years old, and you’d like to refinance for a lower interest rate. You can’t get a new loan for 24 ½ years to line up with your original 30 year loan. Due to this fact, you’ll either have to extend your loan term or switch to a new, shorter term when you refinance.

Luckily, there are plenty of loan terms available under 30 years, so it’s usually possible to refinance without starting completely over.

Refinance to a shorter loan term

If you want to refinance without “starting over” at 30 years, the most straightforward approach is refinancing your mortgage into a shorter loan term and thus speeding up amortization.

Verify your refinance eligibility. Start hereIf your beginning loan was a 30-year loan, for example, you can refinance into a loan lasting 20 years or 15 years instead.

Reducing the number of years in your mortgage will “accelerate” your amortization, and pay your loan amount off quicker.

Payments on a 10-, 15-, or 20-year mortgage are always higher than payments on a 30-year loan.

However, borrowers who can refinance with a rate that is lower than their original, may find a shorter loan term more affordable than they think.

Prepay your mortgage instead of refinancing

For many homeowners, the higher monthly cost of a shorter loan term isn’t in the budget.

This is why some homeowners skip the refinance and opt to “prepay” their mortgage instead. You don’t get access to new, lower interest rates, but you take better control of your loan.

Verify your refinance eligibility. Start herePrepaying your mortgage means to send higher monthly payments to your current lender, which chips away at the amount you owe faster than your amortization schedule prescribes.

For example:

- If your mortgage payment is $1,750 per month

- And you send $2,000 to your lender each month instead

- You reduce the amount owed on your loan by $250 every month. This will cause your loan to reach its “end date” sooner

The more you prepay, the more money you’ll save.

Refinance-to-prepay on your mortgage

There’s a third way to reduce your mortgage interest and shorten your loan term. It’s called “refinance-to-prepay”.

Refinance-to-prepay is exactly what it sounds like — you refinance your loan to a lower rate, then prepay (make extra payments) on your new loan.

Verify your refinance eligibility. Start hereWith refinance-to-prepay, you get access to current mortgage rates and a quicker amortization schedule.

Here’s how to execute this strategy:

- Refinance to a lower rate on your same mortgage program (e.g. 30-year fixed-rate loan)

- This will result in a lower monthly payment

- Apply your entire monthly savings to your new loan monthly as “extra payment”

- Keep doing this until your loan is paid in full

The refinance-to-prepay system works because, although your mortgage rate is lower, you’re making the same payment to the bank each month.

You’re paying less interest because of your lower rate and you’re sending bonus principal monthly.

When you refinance-to-prepay, your loan will “restart” to 30 years, but you’ll ultimately pay it off faster than if you had never refinanced at all.

In need of funds: Cash-out refinance

It’s no secret that real estate prices have been going up.

If you want to tap into the home equity you’ve accumulated in recent years to fund home improvements or to pay off high-interest credit card debt, then a cash-out refinance mortgage may be a good option to pursue.

A cash-out refinance replaces your current home loan with a larger one, giving you the excess cash to complete your objective.

Depending on how much interest rates have changed since your prior mortgage, a cash-out refinance may not necessarily add to your monthly mortgage payments.

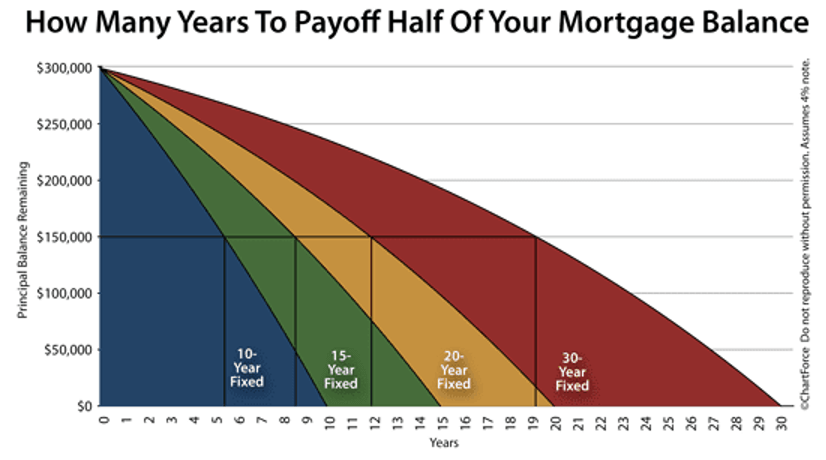

Understanding your mortgage repayment schedule

If you’ve ever looked at your mortgage statement after a few years and thought, “I haven’t paid this thing down a bit!” then you’re witnessing the effects of amortization.

Verify your refinance eligibility. Start hereAmortization is the payment schedule by which your loan balance goes from its starting balance to $0 over time.

The size of your principal and interest portions change each month based on this schedule. And unfortunately, amortization always favors the bank.

That means the early years of a loan require large interest payments, and include very little loan payback.

Only once you’ve held the loan a substantial amount of time do you start paying more toward your balance each month than toward interest.

For example: If you were to borrow $300,000 from the bank at a mortgage rate of 4%, after 10 years, here is how much you would still owe:

- A 15-year mortgage would have $119,000 remaining, or 40% of the original loan

- A 20-year mortgage would have $180,000 remaining, or 60% of the original loan

- A 30-year mortgage would have $235,000 remaining, or 78% of the original loan

With the 15-year home loan, your loan is more than halfway paid. With the 30-year mortgage, you’ve barely made a dent.

This is one of the reasons why homeowners are increasingly favoring 15-year refinances over 30-year ones.

Even if a refinance doesn’t make sense for you, you can take your amortization schedule into your own hands by prepaying on your mortgage. This cuts down on your loan term and can lead to big interest savings in the long run.

“When your principal balance is $300,000, you’re paying 4% of that. This is also why making even smaller additional principal payments helps to pay off the loan amount much quicker,” says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Verify your refinance eligibility. Start hereWhen does a mortgage refinance make sense?

Mortgage refinancing makes sense when you can save money by paying less interest, lower your monthly payment, or change other terms of your loan — like refinancing from a fixed-rate loan to an adjustable-rate mortgage.

- Borrowers who need to tap their home’s value for investment opportunities, debt consolidation, or other financial goals

- Borrowers who want to own their homes sooner can do so by refinancing into a shorter term loan

- Home buyers who financed their new homes with an FHA loan can drop monthly mortgage insurance premiums (MIP) by refinancing into a conventional loan

- Home buyers who financed with a conventional loan and put less than a 20% down payment on a conventional loan can drop mandatory private mortgage insurance

- Homeowners who are paying higher interest rates may qualify for lower rates if their credit scores have improved since purchasing a home

However, a mortgage refinance may not make sense for your financial situation if you’ve been in your original loan for a long time.

Bear in mind that you’ll need to pay another round of closing costs, too. Your lender will charge origination fees, pull your credit report, and, in many cases, order a home appraisal.

A refinance calculator can help you determine if mortgage refinancing will save money in the longer term.

Today’s refinance rates

Although refinance rates are beginning to increase after a historic 30-year low, you may still find rates low enough to justify a refinance. Check today’s rates to see what you could save.

Time to make a move? Let us find the right mortgage for you