Will mortgage rates keep rising?

Mortgage interest rates spiked to start 2022, rising more than two percentage points between January and May.

If you’re considering a home purchase or refinance, you likely want a better idea of where rates will land in the coming weeks and months. To find out, we reached out to eight mortgage industry experts for their mid- to late-2022 mortgage rate predictions.

The pros vary widely on just how high mortgage rates could go in 2022. But they almost universally agree that rates will rise. So if you have a chance to lock sooner rather than later, it’s likely wise to do so.

Find your lowest mortgage rate. Start hereIn this article (Skip to...)

How high will mortgage rates go in 2022?

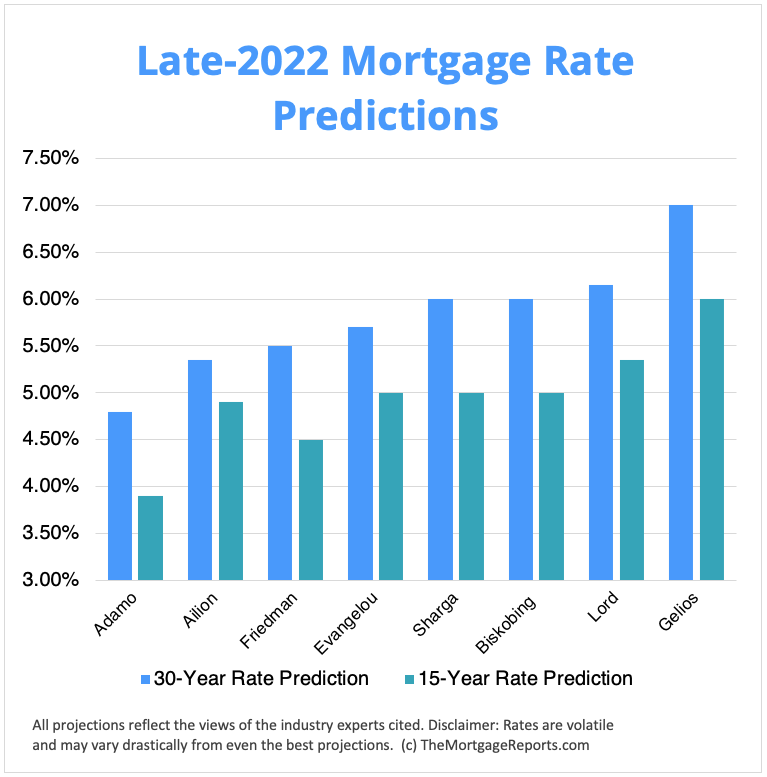

By the end of 2022, experts anticipate that the 30-year fixed mortgage rate could land between 4.8% and 7.0 percent. For the 15-year fixed mortgage rate, their predictions fall between 3.9% and 6.0 percent.

Averaged together, interest rate predictions put 30-year fixed rates at 5.81% and 15-year fixed rates at 4.96% by the close of this year.

What's causing mortgage rates to rise?

Several factors have continued to push mortgage rates upward in 2022:

- The continued high rate of inflation, which is currently around 8.3%

- Increases in the Federal Reserve’s fed funds rate, with more rate hikes expected throughout this year

- Global unpredictability related to the war in Ukraine and stock markets

“Data indicates that inflation will remain elevated for the next several months, which means the Federal Reserve will need to make multiple rate hikes,” says Nadia Evangelou, senior economist and director of forecasting for the National Association of Realtors.

“Two other things causing mortgage rates to increase are the war in Ukraine and the unpredictable stock market,” notes Jason Gelios, a Realtor in Southeast Michigan.

Consider, too, that the pandemic, supply chain disruptions, and labor shortages have persisted, further affecting mortgage rates, according to real estate attorney and Realtor Bruce Ailion.

Find your lowest mortgage rate. Start here

Expert mortgage rate predictions for mid- to late-2022

When trying to gauge where mortgage rates are headed, it’s best to gather a larger sample size of experts. So we consulted with eight different real estate gurus who study the market closely. Here’s what they had to say about mortgage rates, including specific rate predictions for mid- to late-year 2022.

Nadia Evangelou, director of forecasting, National Association of Realtors

Mid-2022 mortgage rate forecast: 5.5% (30-year), 4.8% (15-year)

Late-2022 mortgage rate forecast: 5.7% (30-year), 5.0% (15-year)

Factors that may influence rates in 2022

“Apart from raising interest rates, the Federal Reserve will start reducing the size of its balance sheet in June,” says Evangelou. “This means that the Fed will lower its bonds holding, thereby increasing the supply of US Treasuries on the market. This strategy is expected to move up further Treasury yields and mortgage rates in the second half of 2022. The Fed will raise interest rates at least five more times this year to drop inflation to the 2% target. These rate hikes will continue to push up mortgage rates.”

When will rates stop rising?

“The outlook is for mortgage rates to rise even further in the next couple of years. However, as inflation will start slowing down, mortgage rates won’t rise as fast as they have been rising.”

Advice to home buyers and homeowners

“Keep in mind that, even though mortgage rates are higher now than last year, on a historical level rates aren’t as high as they used to be. For example, in 2002, the average rate on a 30-year fixed mortgage was about 7 percent.”

Rick Sharga, executive vice president, ATTOM Data Solutions

Mid-2022 mortgage rate forecast: 5.75% (30-year), 4.75% (15-year)

Late-2022 mortgage rate forecast: 6.0% (30-year), 5.0% (15-year)

Factors that may influence rates in 2022

“A lot depends on the Fed’s ability to get inflation under control and how rapidly it unwinds its position in the bond markets,” says Sharga. “The more drastic the Fed’s actions, the more likely rates will continue moving up. On the other hand, if the economy cools and inflation starts to move back toward the Fed’s 2% target, we may see less dramatic increases in the federal funds rates, and mortgage rates could plateau.”

When will rates stop rising?

“Unless something unexpected happens, it seems likely that mortgage rates will continue to go up — although a bit more slowly — through the rest of the year. Assuming that the Fed’s actions get inflation under control, we could see rates begin to moderate and even move back down. A lot also depends on the market for US Treasuries: If the yields hit or surpassed 3% on 10-year bonds, it’s hard to see mortgage rates falling.”

Advice to home buyers and homeowners

“Both interest rates and home prices are very likely to go up for the foreseeable future. Buying a home today instead of a year ago requires a mortgage payment between 25% and 30% higher than it would have been in 2021. For buyers ready for the financial responsibility of homeownership, waiting is much more likely to increase their costs rather than save them money.”

“Unless something unexpected happens, it seems likely that mortgage rates will continue to go up — although a bit more slowly — through the rest of the year.”

–Rick Sharga, executive vice president, ATTOM

Albert Lord, founder, Lexerd Capital Management

Mid-2022 mortgage rate forecast: 5.75% (30-year), 4.85% (15-year)

Late-2022 mortgage rate forecast: 6.15% (30-year), 5.35% (15-year)

Factors that may influence rates in 2022

“Two events will make mortgages move abruptly higher: If the Fed continues rate hikes, as expected, to combat inflation; and if households continue to purchase homes at a rate like that observed in 2021, in which case demand for mortgage products will continue to be strong even at higher mortgage rates,” Lord explains.

When will rates stop rising?

“The turning point that will make mortgage rates stop rising is when the interest rates have increased enough to the point that inflation is curtailed. When prices of goods and services are steady and inflation is under control, assuming no extraordinary demand for house purchases, mortgage rates will stabilize and potentially decline. Looking at historic trends, the 10-year Treasury yield should reach 6% for mortgage rates to stop increasing.”

Advice to home buyers and homeowners

“While buyers’ behavior is idiosyncratic, on average two factors motivate buyers to purchase a house: an affordable price and modest mortgage rates. Current trends point to increasing housing prices due to low inventory and limited new construction as well as increasing mortgage rates in the near term. Therefore, the recommendation is to purchase a house now instead of waiting, if you can.”

David Friedman, CEO, Knox Financial

Mid-2022 mortgage rate forecast: 6.5% (30-year), 5.5% (15-year)

Late-2022 mortgage rate forecast: 5.5% (30-year), 4.5% (15-year)

Factors that may influence rates in 2022

“A recession and softening housing prices are two factors that could significantly influence mortgage rates over the rest of 2022,” predicts Friedman. “Also, the high mortgage rates we are currently seeing could cause the demand for mortgages to fall. If this happens, you could see banks lowering their interest rates to drive demand.”

When will rates stop rising?

“Toward the end of the third quarter of this year, we could see mortgage interest rates flatten out or possibly decrease. If the economy enters a recession after the second quarter, I expect the Fed to act by either keeping interest rates flat or decreasing them.”

Advice to home buyers and homeowners

“There is no bad time to buy. You can always refinance a mortgage in a year if rates come down.”

“There is no bad time to buy. You can always refinance a mortgage in a year if rates come down.”

–David Friedman, CEO, Knox Financial

Stephen Adamo, president of National Retail Production, Embrace Home Loans

Mid-2022 mortgage rate forecast: 5.6% (30-year), 4.7% (15-year)

Late-2022 mortgage rate forecast: 4.8% (30-year), 3.9% (15-year)

Factors that may influence rates in 2022

“The Fed is working to curb inflation by raising the federal funds rate,” says Adamo. “The question is, will these rate increases actually have the desired impact?”

“There is some sentiment that the inflation rate will come down — though not quickly — and, therefore, possibly bring rates back down for a period of time. There is also the fact that there are fewer buyers of mortgage-backed bonds today, which is helping to keep rates at the higher end. Also, many macro-economic factors can impact rates and drive them up, such as the current war in Ukraine and the cost of oil. Closer to home, I believe that the cost of goods or inflation will have a lot to do with interest rate moves.”

When will rates stop rising?

“I think we are currently on the higher end of mortgage rates, and we will range within 0.25% from here. It appears that the market has baked in current and future Fed increases.”

Advice to home buyers and homeowners

“Current data suggest more normalized housing appreciation this year, in the neighborhood of 6% to 8%, so purchasing a home still makes sense. Also, as mortgage rates have increased, so have household incomes. This will allow buyers to invest in housing appreciation.”

Bruce Ailion, real estate attorney and Realtor

Mid-2022 mortgage rate forecast: 5.70% (30-year), 4.20% (15-year)

Late-2022 mortgage rate forecast: 5.35% (30-year), 4.9% (15-year)

Factors that may influence rates in 2022

“The inability to control inflation is the primary factor that will drive increases in interest rates. It’s fair to say that interest rates were too low for too long, and the Fed was slow to act. Right now, we are in a catch-up period,” explains Ailion.

When will rates stop rising?

“At some point, the housing market will stall and prices will flatten or fall, which will prompt a decline in mortgage rates. I feel like we are near the high point for interest rates.”

Advice to home buyers and homeowners

“Rates will likely come down before long, but home prices probably will not. If mortgage rates drop back to last year’s level, a homebuyer can always refinance. We have a significantly short supply of homes that will not be resolved in the next two to three years.”

Chuck Biskobing, senior attorney at Cook & James

Mid-2022 mortgage rate forecast: 6.25% (30-year), 5.25% (15-year)

Late-2022 mortgage rate forecast: 6.0% (30-year), 5.0% (15-year)

Factors that may influence rates in 2022

“I believe the Fed will cause a recession in their efforts to stop inflation. But a recession alone is not enough to stop the mortgage rate pain,” says Biskobing. “Rates could continue to push higher despite negative growth. High inflation demands that the Fed continues to raise rates, and I think inflation will continue at an elevated pace for the next few months. But if we see inflation abating, I think mortgage rates will stabilize pretty quickly.”

When will rates stop rising?

“Once inflation shows signs of peaking, rates will stabilize. I think the Fed will cease its rate hikes after monthly inflation numbers start to come down. The hikes will be aggressive until this condition is met, after which time the market will begin to push rates lower. The Fed will probably follow suit since we will almost certainly be in a recession at that point.”

Advice to home buyers and homeowners

“My gut says to wait. There are signs that home prices are coming down in some markets already. If you can wait for further price reductions, then do so. Even if you have to take a slightly higher mortgage rate to purchase later this year, you should be able to refinance when the next rate-cutting cycle gets going.”

“It will probably take about three to four years before we really see mortgage rates decrease enough to be noticed. Considering that we’ve had two to three years of mortgage rates at very attractive offerings, it’s time that they increased.”

–Jason Gelios, Realtor, Community Choice Realty

Jason Gelios, Realtor at Community Choice Realty

Mid-2022 mortgage rate forecast: 6.5% (30-year), 5.5% (15-year)

Late-2022 mortgage rate forecast: 7.0% (30-year), 6.0% (15-year)

Factors that may influence rates in 2022

“We will continue to see mortgage rates increase slightly throughout 2022, with a slight increase in available housing inventory,” predicts Gelios. “Mortgage rates are rising because of inflation and the fact that they were due to jump since they were at record lows for so long.”

When will rates stop rising?

“It will probably take about three to four years before we really see mortgage rates decrease enough to be noticed. Considering that we’ve had two to three years of mortgage rates at very attractive offerings, it’s time that they increased. To see a dramatic decrease in mortgage rates, we need to observe a sizable increase in the number of homes available for buyers. This would certainly cause rates to slow their increase and possibly decrease. Unfortunately, I don’t see this happening anytime soon.”

Advice to home buyers and homeowners

“The best time to buy real estate is when it’s right for you. Those who are financially ready to purchase a home in 2022 should consider it a good time to buy because housing values are slated to stabilize by the end of this year. Home buyers who purchase in 2022 will see a healthy equity gain in the upcoming years. If a potential buyer is considering waiting for a change in the market, they will face a higher mortgage rate and possibly a higher-priced home.”

Should you lock a mortgage rate?

If you’re one of the lucky homeowners who can still benefit from a refinance, it’s likely best to lock a rate as soon as possible. Most experts expect mortgage rates to continue rising throughout 2022, so the window to lock in a lower rate could be closing.

If you’re looking to buy a home, you might also want to lock a rate sooner rather than later. However, your timing will depend more on the local housing market and when you can get an offer accepted than on where rates are sitting.

As most mortgage professionals will tell home buyers: don’t try to time the market. It’s always a good time to buy if you’re financially ready. And, despite rising rates, 2022 is no exception to that rule.

Time to make a move? Let us find the right mortgage for you