In this article:

There are several easy rough estimates for how much you can spend on a home.

- Choose a total payment that is close to what you spend now for rent

- Select your maximum home price at three times your annual income

- Choose a total housing payment that does not exceed one-third of your before-tax income

These “quick and dirty” calculations take just minutes to complete. But our home affordability calculator helps you work this out either from a payment or income standpoint and gets you a much more accurate answer.

Verify your home buying eligibilityRules of thumb for home affordability

Rough estimates to know how much house you can afford are fairly easy to determine. But there are lender guidelines that can help you make a pretty accurate guess regarding what’s affordable and what isn’t.

You need to look at your debt-to-income ratio, or DTI. This is a measure that lenders use to get a basic idea of how much home you can afford. It compares your recurring monthly debt payments and your with your gross monthly income.

For instance, if your income is $6,000 per month and you plan to spend $2,000 per month on your future house payment plus all other debts, you would have a 33% debt-to-income ratio.

Rough estimates and the front-end ratio

There are two types of ratios. Front-end ratio and back-end ratio.

We can see your eyes glazing over. But hang with us for one second. This is easy to understand.

Your front ratio compares future housing costs and your gross (before tax) monthly income.

Front-end ratio = housing cost / income

“Housing costs” includes mortgage principal, mortgage interest, property taxes, and property insurance, and HOA dues, if any. The shorthand for housing costs is PITI.

Following is an example of the monthly cost of a $250,000 loan at 4.5%.

| Monthly Expense | Cost |

| Principal & interest | $1,250 |

| Homeowner's insurance | $50 |

| Mortgage insurance | $100 |

| Property tax | $200 |

| Total "PITI" | $1,600 |

Imagine your income is $6,400 per month. You would have a 25% front-end ratio.

The back-end ratio

When lenders think of monthly expenses they also want to know about your other accounts, too. In particular, they’re interested in car loans, student debt, and credit card payments. (Note that ordinary living expenses like food and utilities don’t go into this calculation.)

Your back-end ratio shows how much of your income is used by housing costs plus monthly debt payments.

Back-end ratio = housing cost + debt payments / income

In short, you’re in better shape when your income is higher and/or your monthly payments are lower.

So, what do lenders think I can afford?

Many lenders impose 31/43 ratios. That means a maximum 31 percent of your income can go toward the house and 43 percent can go toward the house plus other debt payments.

If you have $6,000 a month in gross earnings, 43 percent of that amount will be around $2,600. So that’s the maximum you could spend each month on housing plus other monthly debts.

Subtract housing costs – $1,600 in this example – and $1,000 remains for car payments, student loan payments, etc.

If you have two car payments of $500 each, you’re maxed out. Even a small credit card payment of $50 per month will push you over the limit.

That’s why it’s important to look at your monthly debts and figure out ways to eliminate or reduce those payments as you start thinking about buying a house.

Affordability varies by program

From the above example, how far will the $1,600 house payment go in terms of affordability? It depends on your loan program.

With the FHA, you might be allowed 31 percent of your income toward your house. For a conforming mortgage — a loan that meets Fannie Mae and Freddie Mac standards — figure 28 percent.

For VA financing, the news is even better — there is no front ratio maximum, just a back-end one.

Understand, also, that lenders may be more forgiving of high front-end ratios if you have what is called “compensating factors.” For instance, your overall use of credit is low and you don’t have much debt.

Your credit score might be very high. Or you’re in a profession with increasing future earnings (think medical school). In most cases, lenders care more about your credit and total expenses than they di your front-end ratio.

Mortgage rates affect ratios

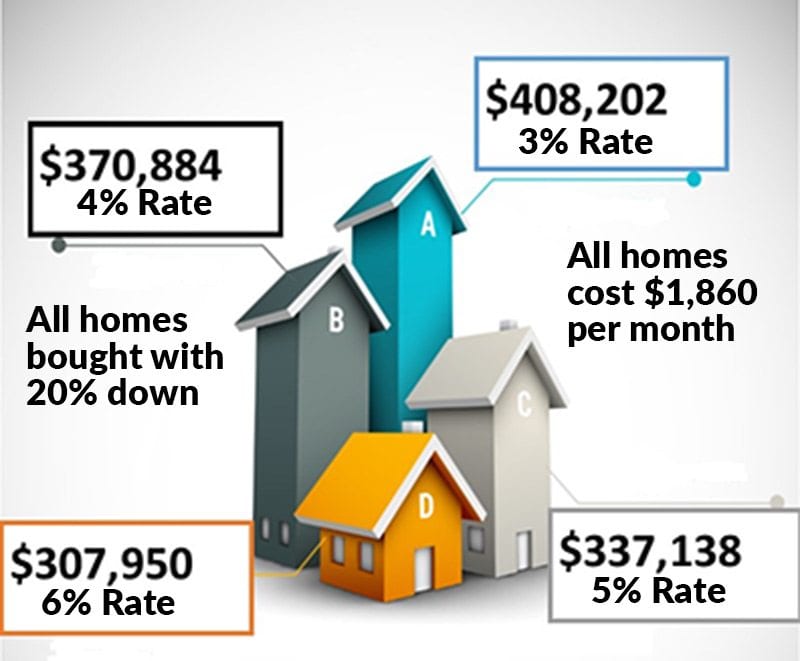

Your ability to buy depends a lot on mortgage rates. The chart below shows how rates affect a family with $6,000 a month income and $300 a month in other payments.

For each 1% reduction in mortgage rate, a home buyer can afford to spend over $30,000 more on their home.

(Calculations performed by The Mortgage Reports Affordability Calculator)

6 ways to increase your home buying power

1. Cut your monthly bills. See how each debt can be reduced or paid off. That leaves you more money for housing and probably improves your credit rating too.

2. Look for loans allowing higher ratios. Some allow up to 50 percent. A caution: These programs may look attractive, but they suggest a lot of monthly debt. That can be a problem if you lose a job or hours are cut.

3. Watch out for overlays. These are extra rules lenders put on the loans. For instance, Lender A might say you can afford a $300,000 home, and Lender B says you can afford $350,000, even though they are offering the same program.

Lender A likely has additional rules barring you from going to your real maximum.

How to buy a home with low income in 2018

4. Consider a VA loan. If you’re VA qualified, there is just one ratio – 41 percent. In other words, there is no front ratio. Your housing can use 41 percent of your gross monthly income if you have no recurring debts.

5. Borrow less. One of the easiest ways to reduce DTI ratios is to buy a less expensive property and borrow less. Or request a down payment gift from family.

6. Use "compensating factors." You can sometimes overcome DTI limits with compensating factors or exceptions. For details speak with loan officers regarding specific programs.

So, what can you afford?

Often, the only way to truly know what you can afford is to get a pre-approval from a lender.

Get a home buying analysis now and be on your way to homeownership.

Time to make a move? Let us find the right mortgage for you