Refinancing still worth it for over 1 million borrowers

The average 30-year fixed-rate mortgage surged through 2022 and just hit 5% for the first time since 2011.

Unsurprisingly, this rapid rate growth will deter many homeowners from refinancing. But the window to save isn’t completely gone.

Over 1.3 million homeowners exist who would currently benefit from a refi — especially if they move quickly before more Fed hikes come.

Find and lock your lowest refinance rate. Start hereRefi savings exist, even at 5%

Despite the average 30-year FRM rising to 5% on April 14, an estimated 1.34 million borrowers could still save $316 per month with a refi, according to mortgage technology and data provider Black Knight.

That translates to a monthly total of $422 million in principal and interest savings nationally.

These borrowers are defined as having a maximum 80% loan-to-value ratio, credit scores of 720 or higher, and who could shave at least 0.75% off their current first lien rate.

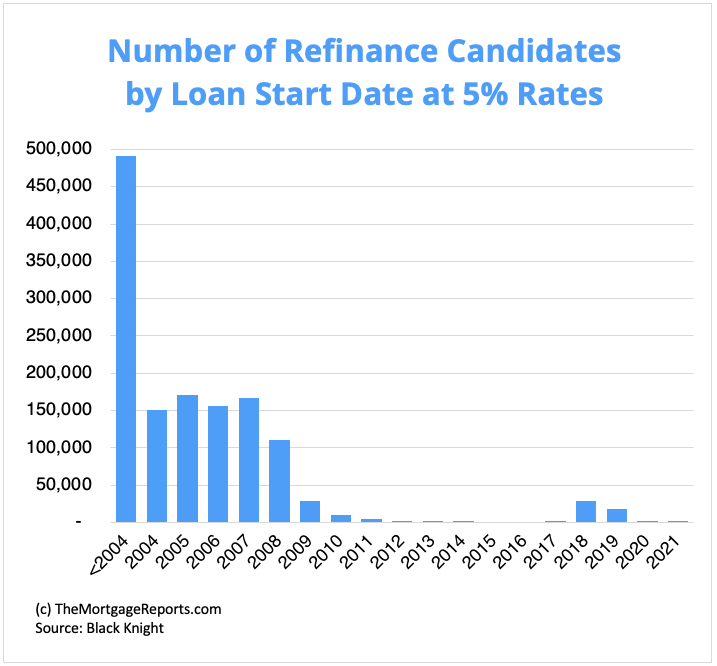

If you fit these parameters, odds are you locked in your rate prior to the housing crash. The chart below shows the total number of refi candidates by the year of their mortgage. The largest group of about 491,000 got their mortgages before 2004.

Should I refinance right now?

The golden rule of refinancing is you should do it if you can cut your current rate by 75 basis points — or 0.75%. This is often the threshold where the savings you’d receive from refinancing outweigh the costs of doing it.

However, every situation is different. Whether a refi is worth it hinges on multiple factors like your loan balance and timeline. Depending on your current mortgage, even a rate reduction of 25 basis points (0.25%) could make sense.

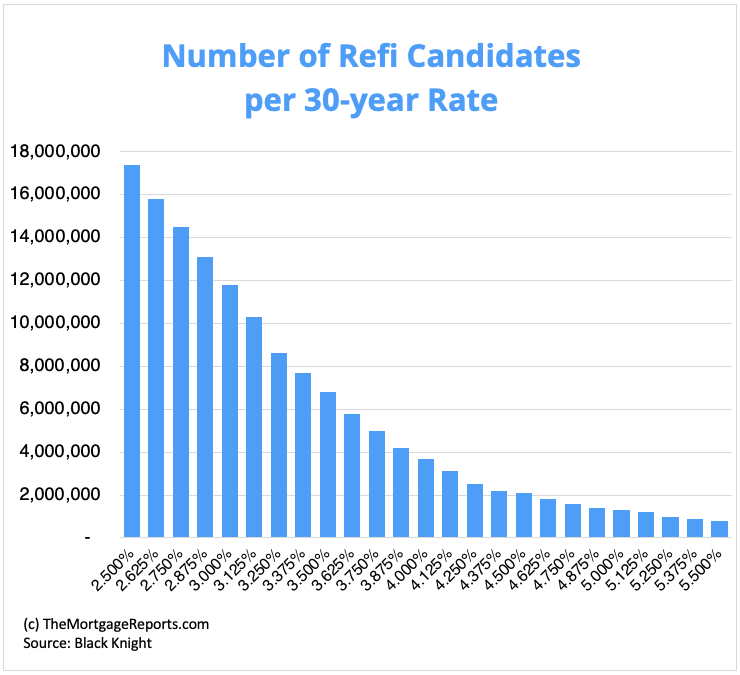

In the chart below, Black Knight estimates how many refi candidates there would be at different mortgage rate intervals.

While the number of homeowners who benefit from a refinance tails off as rates rise, just under 1 million still would if they hit 5.5%. Even with today’s mortgage rates, it’s possible to save hundreds of dollars every month with a refi.

Your next move

If you’ve waited this long to refi in hopes rates would start ticking back down, wait no longer. Both market indicators and experts point to further rate growth this year.

In all likelihood, it would be prudent to start the refi process now before the next Federal Reserve meeting.

If you’d like to see if refinancing your mortgage is right for you and would save you money, get the ball rolling by reaching out to your lender

Time to make a move? Let us find the right mortgage for you