Mortgage requirements are loosening

There’s good news for home buyers: It’s finally getting easier to get a mortgage loan.

After tightening their lending standards during the pandemic, it seems mortgage lenders are starting to loosen the reins a bit.

In fact, according to the Mortgage Bankers Association, mortgages were about 2.2% easier to come by in April than in March. And on some types of loans? Mortgage availability was up as much as 12.6%.

Here’s what the change means for home buyers (and refinancers).

Verify your mortgage eligibility todayWhy did mortgage requirements get tougher during COVID?

Last year was a risky time for lenders to loan out money. Unemployment hit record-breaking levels, many people lost jobs and wages, and entire sections of the economy were shut down for months.

To protect themselves from these added risks, many mortgage lenders raised loan requirements. Some even stopped offering certain loan programs altogether (namely FHA loans, HELOCs, and non-QM loans).

For the most part, lenders required higher credit scores and larger down payments over the last year.

For example, at one point Chase raised its credit score requirement to a whopping 700 and asked for 20% down payments on all purchase loans. (Normally, it’s possible to get a conventional mortgage with a credit score of 620 and only 3% down.)

Other mortgage lenders added a second employment verification — one just before the closing date — as an extra layer of protection as well.

Mortgage requirements are now loosening again

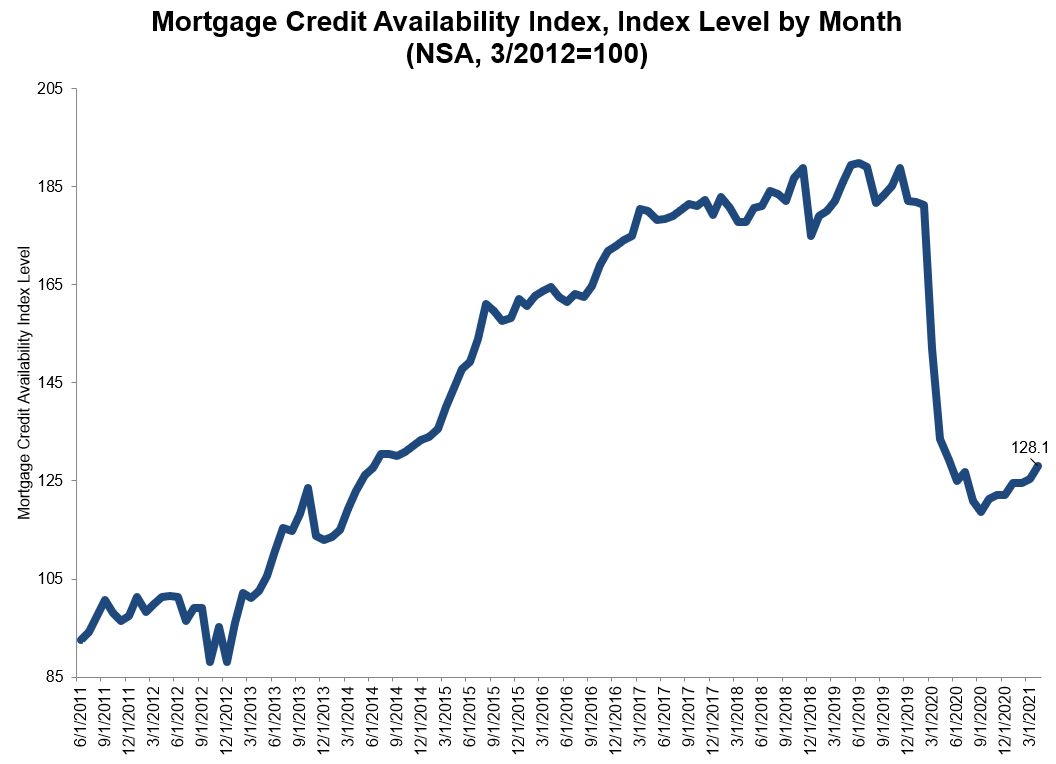

According to the Mortgage Credit Availability Index from MBA, those high standards are finally starting to ease up.

The MCAI increased by 2.2% overall in April, which indicates standards are getting less strict.

Conforming loan requirements

Standards for credit score, down payment, and other criteria loosened the most on conforming loans, with a 12.6% jump over the month.

Conforming loans are those that meet standards set by Freddie Mac and Fannie Mae. The agencies allow credit scores starting at 620 and down payments of 3-5% or higher.

However, lenders are allowed to set their own, stricter requirements on top of Fannie and Freddie’s (called ‘overlays’). These overlays are the reason mortgage requirements vary so much from one lender to the next — and the reason some lenders are re-opening to lower-credit borrowers faster than others.

If you think you should qualify but get turned down by one lender, it’s worth applying with a few others to see if their different guidelines can work in your favor.

Compare mortgage options. Start hereRequirements for other loan types

Jumbo loans — which are reserved for higher-priced property purchases — also saw a big availability increase of nearly 7%.

Government loans, which include FHA, USDA, and VA mortgages, aren’t seeing the same trend, according to MBA’s data.

The MCAI for these programs increased a mere 0.1% from March to April, indicating lending standards are largely holding steady.

Credit availability still not back to 2020 highs

Overall, mortgage credit availability is improving. This is making it easier for many Americans to buy a house or refinance.

Still, mortgage requirements haven’t recovered to pre-pandemic levels — or even near them, really.

Previously, the mortgage credit index was well into the 170s and 180s. Today, it’s just 128.1.

As the economy picks up more post-pandemic steam — and once fewer mortgage loans are in forbearance — credit availability should continue to improve.

So if you don’t qualify for a home loan today, don’t lose hope. Standards should continue to ease up as the year goes on.

If you’re not sure whether you’d qualify now or in the near future, see:

How to qualify in today’s market

Despite the uptick, it’s still harder to get a mortgage than it was a few years ago.

If you’re worried you may not qualify for a loan, make sure you work on your credit before applying for a mortgage.

You should also save up a solid down payment, and shop around with at least three to five different lenders. Every mortgage lender has different qualifying standards, so shopping around can help you find the best option for your unique situation and budget.

According to Freddie Mac, comparing mortgage offers can also save you serious cash (about $3,000 if you get at least five quotes!)

Time to make a move? Let us find the right mortgage for you