Will the lowest-ever mortgage rates last?

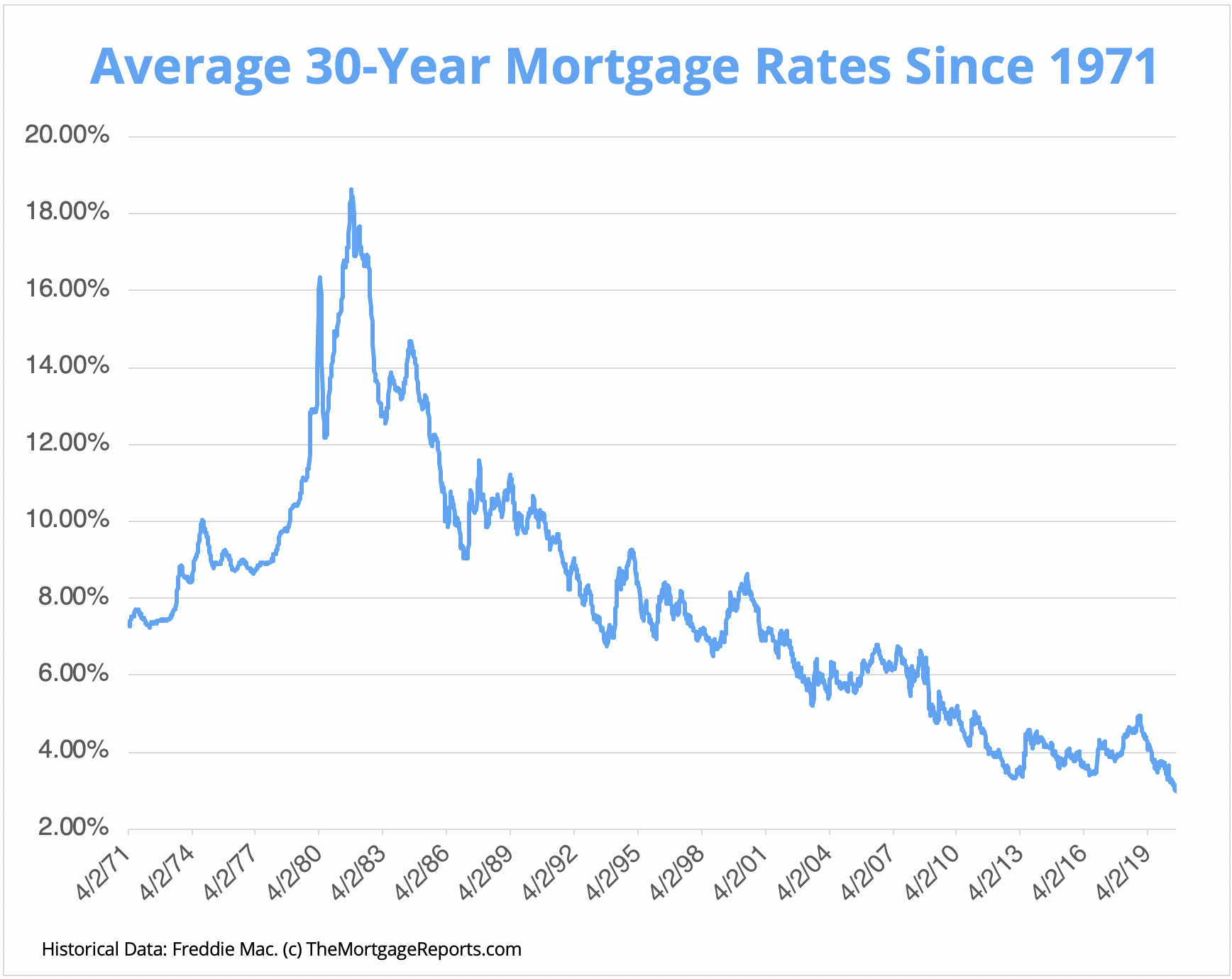

Mortgage rates have collapsed. What else can you say?

The average price for a 30-year fixed-rate mortgage was just 2.98% last week.

It’s another record low — the lowest average rate seen since 1971, the year Freddie Mac first began posting weekly numbers.

Now the big question for home buyers and refinancers is: How long will the lowest-ever mortgage rates last?

Find and lock a low rateToday’s record-low mortgage rates

Mortgage rates are in a ditch. Since 1981, mortgage pricing has gone down and down. Not every week or every month, but the overall trend is clear.

As a borrower, here’s what you should keep in mind when looking at today’s mortgage rates:

- Rates are actually lower than the headlines suggest. The Freddie Mac weekly numbers are a lagging indicator. Mortgages priced at 2.5% were available in May for the strongest borrowers

- Monthly costs are lower. Compared to November 2018, when rates were over 4%, a $200,000 mortgage now costs $225 less per month. Use our mortgage calculator to compare your current rate with new financing

- Homes are more affordable when rates decline. But, this increases the pool of potential buyers and tends to push up prices. Existing home prices in May were up 2.3% from a year earlier, according to the National Association of Realtors (NAR)

- Low rates change locking strategies. If you think rates will go up in the next few weeks or months then the smart move is to lock-in your rate before closing. If you think rates will fall further than it’s best to let rates float until settlement

Of course, “historic mortgage rates” have been in the news for months now.

So it’s easy to be lulled into thinking they aren’t going anywhere — that we’ll sit comfortably at 3% forever. (Or at least, for the foreseeable future.)

But can the streak really last?

Mortgage rates have been on a downward path for nearly 40 years. If there was a top in 1981, then surely there has to be a bottom — a moment in time when mortgage rates begin to generally rise.

Many think that the tipping point is coming soon.

The case for higher mortgage rates to come

There are three main arguments for mortgage rates rising in the near future:

- Increased loan demand — With rates so low lenders are being overwhelmed with applications. In early July the Mortgage Bankers Association reported that refinancing applications were up 111% while purchase loan applications were up 33%. What happens when demand increases? Mortgage rates go up

- An upcoming presidential election — It’s hard to predict what will happen in the November election, much less how it will affect the mortgage economy. The 2016 election was followed by an almost immediate spike in rates. What’s certain is that investors will be watching the situation closely as it evolves in the coming months. If investors predict more economic stability in the future, they’ll begin to exit the mortgage market and rates will rise

- Pending foreclosures due to COVID-19 — Earlier this month, ATTOM Data Solutions reported that foreclosure filings were at 15-year lows. For mortgage investors, such news means little risk and therefore a willingness to lend at low mortgage rates. But there are two problems with those numbers. First: Government protections against foreclosure, which kept filings low during COVID-19, will eventually end. Second, foreclosure numbers are delayed by at least 30 days as it takes time for the filings to go out. So more foreclosures are likely coming in the future — and with them, potential for more risk to lenders and higher rates

These are all very real prospects. We’ve already seen mortgage rates spike once this year, when lenders became overwhelmed by volume and had to stem the tide.

And what will happen in the post-COVID economy, not even experts can say.

Our advice: If you’re about ready to buy a house or refinance, pay attention to these warnings.

Rates are already at their lowest ever. Further drops are likely to be incremental at best, and if you wait, you might miss your window.

Verify your new rateThe case for lower mortgage rates to come

Maybe mortgage rates won’t go up. There’s a huge amount of uncertainty going forward because of the COVID-19 economy.

As the argument goes, interest rates were low and going lower before the virus hit. Why shouldn’t they keep falling?

The supply of capital worldwide grossly outstrips demand. Investors in many countries are investing with negative rates. Not just low rates, but actual negative rates below 0%.

Interest rates were low and going lower before the virus hit. Why shouldn’t they keep falling?

As we wrote last summer:

“The very same factors which led to 3% financing are likely to lead us into the world of 2% mortgages.

“There’s an ongoing imbalance between investors with cash and people who want to borrow. Cash is everywhere and more of it is likely coming to a mortgage lender near you.”

There’s too much supply and too little demand, says the argument for lower rates.

And, looking forward, nothing will change. In this view, rates are still headed down.

Our advice: Like we said above, it may not be worth risking today’s ultra-low rates in the hopes of something marginally lower. If you’re ready to buy or refinance, now might be the time.

But, if your plans to get a loan are a little further down the line, no need to move before you’re ready.

The coronavirus is the main force keeping rates where they are now. And unfortunately, that’s not going away soon. So you have some time.

Your next move

Your next move depends on where you are in your financing process.

For those who are ready to move on a home purchase or refi, it probably makes sense to take advantage of the rates we’re seeing today.

And remember, just because some lenders are offering record-low rates, doesn’t mean they all are. So shop around to find the best deal for you.

Time to make a move? Let us find the right mortgage for you