Why aren’t more people refinancing?

Looking to save some money each month, millions of homeowners have already taken advantage of low rates by refinancing their mortgage.

Even with mortgage rates still at record lows, however, refinance activity took a dive in April.

In fact refinance applications fell 7.3 percent late last month, even after 30-year fixed rates hit their lowest level on record — 3.23%.

So, why aren’t more homeowners refinancing when they could save so much?

Find and lock a low refinance rateMillions have yet to refinance, despite low rates

According to Black Knight, over 13 million homeowners were in the money to refinance in April — meaning they could lower their interest rate by 0.75% or more.

And that was even before interest rates hit a new record low on April 30: just 3.23% for a 30-year fixed-rate loan.

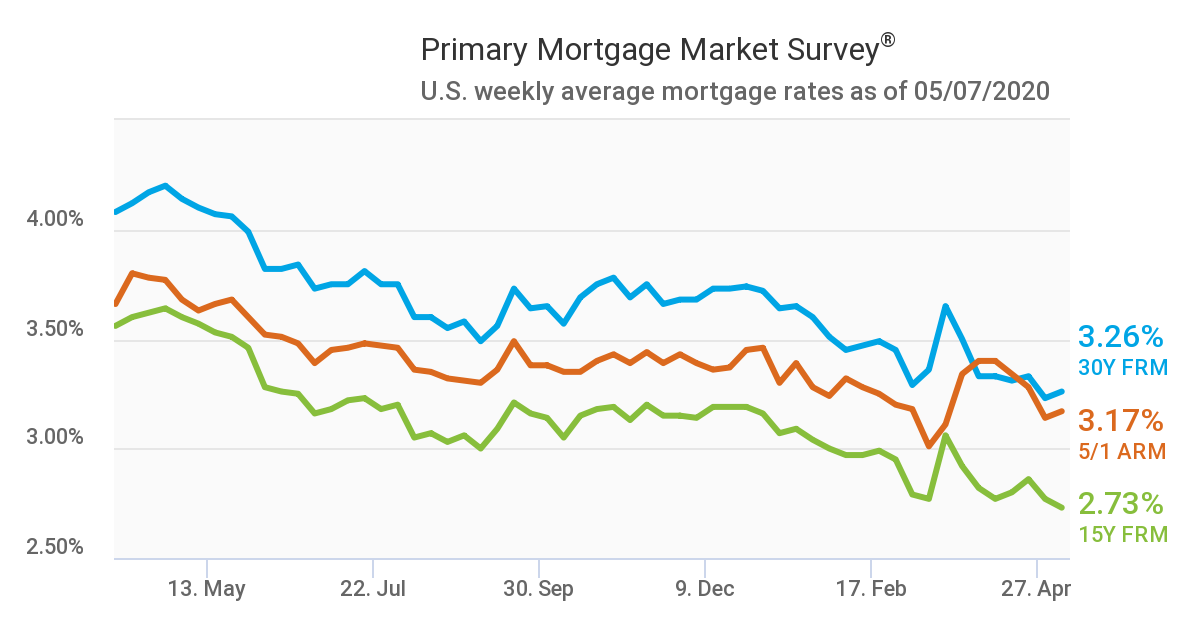

30-year mortgage rates set record lows on March 5 (3.29%) and again on April 30 (3.23%). Source: Freddie Mac

And yet, homeowners don’t seem to be paying as much attention. Refinance rate locks in April were nearly 80% below their early-March peaks.

This could be due to several reasons.

As homeowners rushed to refinance earlier this year, many banks and lenders became inundated with new applications.

In response to unprecedented volume, lenders were forced to bump their rates to control the influx of new loan applications.

Around the same time, many lenders also tightened their standards, making it harder to qualify for a new loan. Some lenders increased minimum credit score requirements as much as 100 points.

From lenders increasing their rates to tamper volume, to credit criteria making it tougher to refinance, many would-be mortgage refinancers weren’t able to take advantage of the record-low rates.

Verify your new rateThe sweet spot for mortgage rates — why you should lock now

Fortunately, lenders are beginning to scale those changes back and show more tolerance in approving mortgage applicants.

Lower credit scores, higher debt-to-income ratios, and smaller down payments are already coming back, according to a new report from the Urban Institute’s Housing Finance Policy Center.

In many cases, lenders are even reaching out and encouraging borrowers who have previously been rejected for a mortgage to try again.

In many cases, lenders are even reaching out and encouraging borrowers who have previously been rejected for a mortgage to try again.

Lenders are also closing loans quicker than they were in March. Average turnaround times for most lenders have dropped back down to near-normal levels.

According to Brett DePriest, Senior Vice President for Acopia Home Loans, “Our turn times are back to normal. We are closing purchase transactions in some cases within 20 days, and refinances in as little as 30 days.”

DePriest adds, “We believe that having our operations staff work from home has actually helped us curtail turn times.”

Timing couldn’t be better for homeowners who may have missed out on refinancing earlier this year.

What’s more, the timing couldn’t be better for homeowners who may have missed out on refinancing earlier this year.

The average U.S. mortgage rate was 3.26% last week for 30-year fixed rate mortgages, according to Freddie Mac

That means current rates are only 0.03% higher than the lowest rates in history set just one week earlier.

Verify your new rateShould you try to time the market?

In an attempt to get the lowest possible rate, some homeowners play the “wait and see” game.

This logic isn’t entirely without merit.

Not only are rates predicted to be at or near 3.32% by the end of 2020, some predictions show mortgage rates in the 2’s come next year.

If you lock in now, there’s always the possibility that rates will drop lower and you’ll have refinancers’ remorse.

But the opposite is also possible.

Rates could unexpectedly creep back up as the economy begins to stabilize after COVID-19.

As the market effects of COVID continue to decrease, there are a number of things that could happen.

Should rates go lower, there may be another spike in mortgage refinance activity. If this happens, lenders may increase rates once again to curb mortgage volume.

Once Americans who’ve been laid off or furloughed are gainfully employed again, and homeowners get caught up after forbearance, there may be another spike in mortgage refinance activity.

In fact, according to Fannie Mae, refinancing volume for the year could total $1.4 trillion. That would be the highest level since 2012.

If this happens, lenders may increase rates once again to curb mortgage volume. And, increased applications could mean longer closing times, again.

So trying to time the market could backfire on you if you’re not careful.

Instead, if you’re in a good financial position with prospects of continued employment, it might make more sense to capitalize on today’s rates — which are at or near all-time lows.

Verify your new rateHow to refinance with no out-of-pocket cost

Refinancing is always a balancing act. Besides trying to time your refi for when mortgage rates are lowest, you also have to make sure the benefit of refinancing will outweigh the upfront cost.

In a time when many homeowners are worried about job stability, agreeing to pay thousands in closing costs is no small decision.

But there are ways to avoid closing costs when you refinance. Specifically, you can:

- Roll closing costs into your new loan — So you accept a higher loan balance, but without any upfront cost

- Look for a "no-closing-cost refinance" — This means you accept a higher interest rate in exchange for the lender absorbing your closing costs

Typically, these strategies only make sense if you can drop your rate a significant amount. If your new rate is low enough, you can accept a larger loan balance or slightly higher rate, and still see savings every month.

As low as rates are right now, it could be a uniquely good time to refinance using one of these two methods.

Lock a refinance rate now or wait?

Regardless, “with rates in the 3’s, and home values being high, we’re seeing plenty of refinance activity,” says DePriest.

It’s almost impossible to say exactly what’s in store for mortgage rates and lender capacity.

“I expect refinances to be around for a while. But that doesn’t mean you should wait,” says DePriest.

“The advantages to refinancing now could far outweigh the nominal benefits that may be had by waiting for rates to drop even further.”

When used strategically, refinancing can help homeowners get access to cash quickly, lower their monthly expenses, or save money in the long term.

Time to make a move? Let us find the right mortgage for you