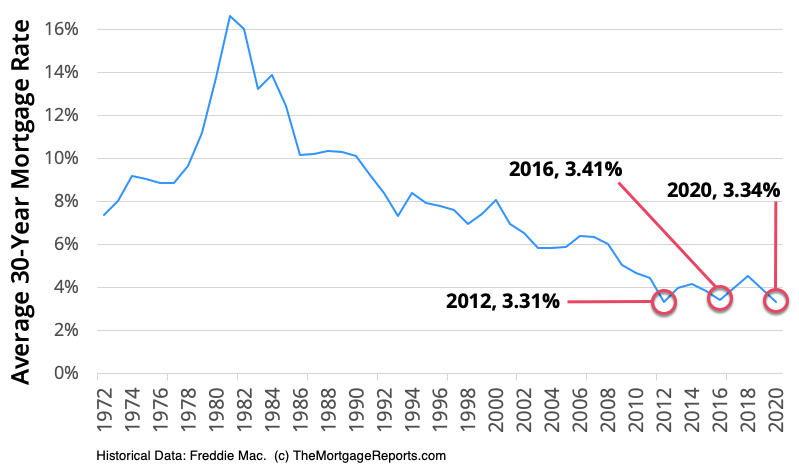

Mortgage rates hit their second-lowest in 48 years

On Monday (February 24, 2020), the average 30-year mortgage rate clocked in at 3.34%.

That’s the second-lowest 30-year rate in history. (Or at least, since Freddie Mac started recording mortgage rates in 1972.)

| Lowest 30-Year Rates on File | Month Recorded |

| 3.31% | November 2012 |

| 3.34% | February 2020 |

| 3.41% | July 2016 |

Source: Freddie Mac

Typically when rates drop like this, they don’t stay so low for long.

If you’re buying or refinancing soon, this week is an excellent time to lock a mortgage rate in.

You could secure a near-record low rate and hold onto it, even if mortgage rates shoot back up in the next few weeks (or sooner).

Find and lock a low rate todayCan mortgage rates go lower?

Mortgage and refinance rates have plummeted in the past few weeks; a reaction to the effect of Wuhan coronavirus on worldwide markets.

Now the question on home buyers’ minds is, can mortgage rates go lower?

We already know 30-year fixed rates will average out lower in February than they did in January, thanks to Freddie Mac’s weekly data:

| January Average | 3.62% |

| Week of February | 3.45% |

| Week of February 13 | 3.47% |

| Week of February 20 | 3.49% |

| Current February Average | 3.47% |

But will the rapid dropoff we’ve seen in the past couple weeks continue?

Some experts think not.

As Matthew Graham, COO of Mortgage News Daily puts it, “At no time in modern economic memory have mortgage rates been able to move significantly or aggressively lower than they are right now.”

“At no time in modern economic memory have mortgage rates been able to move significantly or aggressively lower than they are right now.” —Matthew Graham, COO, Mortgage News Daily

We’ll know more about mortgage rate movements in three weeks.

That’s because the Federal Reserve’s FOMC is scheduled to meet March 17th and 18th to set a target level for the federal funds rate.

Given an economic slowdown and lower interest rates worldwide, the Fed may elect to lower the target level of the federal funds rate.

While this will not impact most mortgage rates directly, a Fed action can influence general rate trends.

And it would have a direct impact on Home Equity Lines of Credit (HELOCs).

But remember, the main force pushing mortgage rates down right now is the Wuhan coronavirus.

Whether rates drop again — or suddenly skyrocket — hinges on news about the virus.

That makes rate movements in the near future largely unpredictable. Perhaps they could nudge down a bit further. But it’s just as likely they could go up.

In all likelihood, this is a short, rare window of sub-3.5% rates that home buyers and refinancers will want to take advantage of.

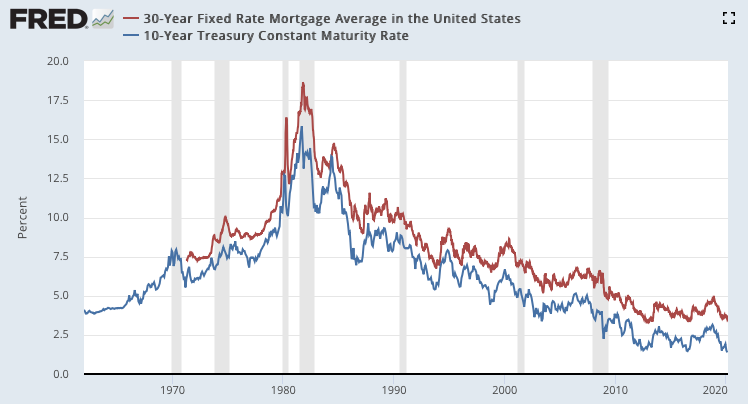

Find and lock a low rate today10-year treasury rates vs mortgage rates

Mortgage rates and the pricing for 10-year treasury notes closely track one another. This happens because for many investors each financial option represents a similar level of risk and reward.

Because 10-year treasury notes and mortgage rates are closely related, it follows that if treasury rates fall the same is likely to happen with real estate financing.

As the virus has spread US financial markets have taken a deep dive.

- On Monday, February 24th, the Dow closed at 27,960.8 – down 1,031.61 from Friday

- On Tuesday, February 25th, the Dow closed at 27,081.36 – down 879.44

- Also on Tuesday, February 25th, 10-year treasury notes fell to 1.309% during the day

- The 1.309% figure is the lowest rate on record

The spread of the Wuhan coronavirus has arisen at the very moment when some of the world’s largest economies are in recession or close to it — including Germany, the UK, and Japan.

The emergence of the virus is a kind of financial piling on, bad news on top of bad news for worldwide economies.

And yet, in a strange turn of events, mortgage borrowers have benefitted greatly from the downturn in markets.

It’s an unlikely kind of silver lining under very poor circumstances.

Should you lock a mortgage rate this week?

Some believe the coronavirus will continue to nudge mortgage rates downward.

If you agree, you might wait to see lower rates before locking one in.

More conservative borrowers might decide that by locking now, they can secure a rate almost unheard of in US mortgage history.

Even if rates edge down a bit more, a mortgage rate on par with what we’ve seen this week puts you in a very good position.

Time to make a move? Let us find the right mortgage for you