What will happen to mortgage rates after the election?

If you want to buy a house or refinance within the next few months, you should already be strategizing about how to lock the lowest interest rate.

Which might leave you wondering: How will the presidential election impact mortgage rates?

Rates hit record low after record low in 2020.

But could a surprise election outcome cause mortgage rates to skyrocket, like it did in 2016?

If you’re planning to buy or refinance soon, here’s what you should know.

Find and lock your low rate nowPresidential elections and mortgage rates

Let’s go back to 2016 for a moment, to the last presidential election.

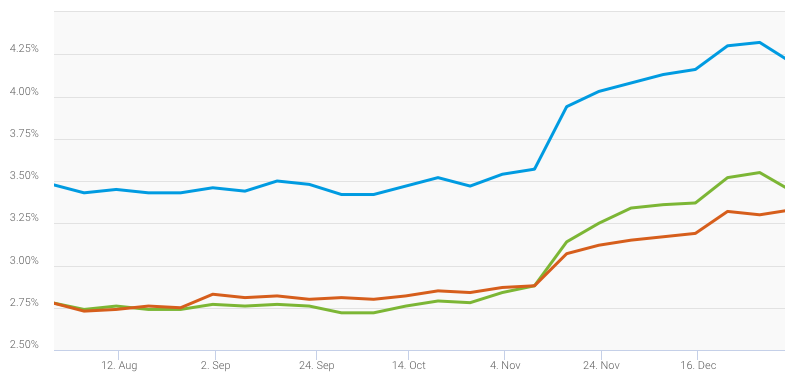

According to Freddie Mac, average mortgage rates went from 3.47% in October to 4.2% in December.

If you were a home buyer, refinancing, or had an adjustable-rate mortgage (ARM) that’s a massive jump.

Mortgage rates from August 2016 to December 2016. Image: Freddie Mac

The catch is that relating mortgage rates to presidential elections is hardly an apples-to-apples proposition.

- In 2012 rates essentially stood still. They were at 3.38% in October and 3.35% in December

- For 2008 the news was good. Rates went from 6.2% in October to 5.29% in December, a substantial drop

- In 2004 rates were largely unchanged. They stood at 5.72% in October and 5.75% in December

So, how can we predict what will happen after the next election?

Is there some reason to think that whoever wins the 2020 election can directly change mortgage rates one way or the other?

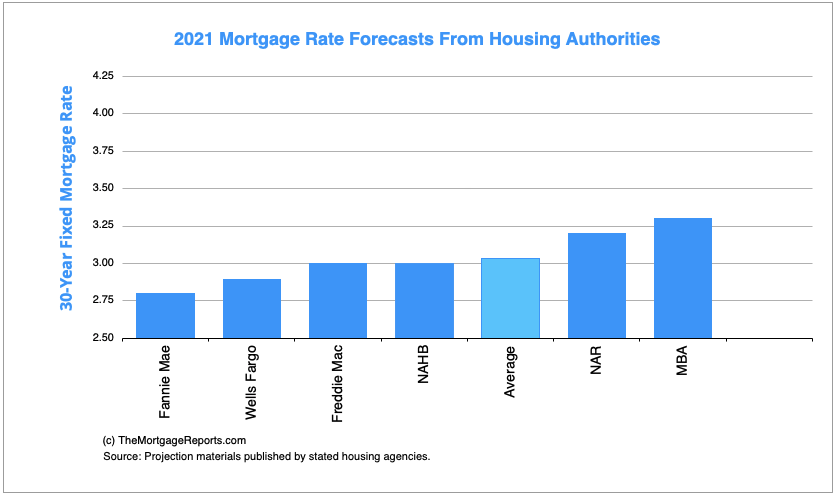

Interest rate predictions for 2021

Last year the typical 2019 mortgage rate forecast said interest rates would soar, going well above 5.5%.

What actually happened was the reverse: Weekly rates at the start of December were at 3.68%, down from 4.75% a year ago.

The predictions today say that 2021 mortgage rates will be around 3%.

However, the 2020 election winners can substantially impact mortgage rates, depending on what actions they take.

- Markets could expect a Biden win, but get Trump. This would mirror the 2016 election, when Clinton was a sure-win. Trump was considered the more business-friendly candidate, and mortgage rates jumped on high hopes of a stronger economy

- But the opposite could happen: a Biden win could spur new optimism, making mortgage rates climb in hopes new leadership will usher in positive change

- Each candidate’s position on COVID-19 response could affect markets. If a candidate is expected to issue shutdowns to curb the disease’s spread, rates could fall on fears of economic fallout

In short, it’s hard to say exactly how a new president will move the needle on interest rates.

So those that can take advantage of low rates now, should.

Find and lock your low rate nowWho — or what — sets mortgage rates?

No one — not the President, the Congress, or the Federal Reserve — sets mortgage rates.

Rates rise and fall with the push and pull of the financial markets. Not just markets within our borders but markets worldwide.

That’s because money moves with electronic speed to the places and investments that money managers hope will produce the best combination of risk and reward.

>> Related: How Fannie Mae, Freddie Mac, and the mortgage market work

Leading up to the 2020 election cycle, interest rates are remarkably low.

The Visual Capitalist has looked at interest levels during the past seven centuries — really, seven centuries! — and found that today’s rates are “at 670-year lows.”

Image: VisualCapitalist

That might sound great for borrowers, but ultra-low interest rates can be a worrisome sign.

Borrowers are simply not competing for cash the way they once did. There’s not much pressure to push up rates.

Worldwide, says Bloomberg News, $15 trillion is invested with negative interest rates — rates below zero.

Not many people or companies want cash to create new factories, technologies, or jobs. Worse, big investors are actually paying banks and other institutions to hold their cash.

In other words: The signs of economic improvement that many are hoping for, would actually push interest rates in the wrong direction (up).

What to pay attention to after the election

Federal debt and mortgage rates

The president doesn’t control mortgage rates. But the 2020 election could still impact interest rates.

The federal government’s public debt now exceeds $23 trillion — and is rising. So much debt creates big interest payments.

In fiscal year 2019, the government paid $575 billion in interest, up from $523 billion the year before.

And when the government borrows, it’s competing with the private sector for cash.

Increased demand on a massive scale should force up interest rates, including mortgage rates. And yet that hasn’t been happening. There’s just too much cash and too little demand.

Thus, the 2020 election winner will face tough choices.

- Do the next election victors cut federal spending to reduce the deficit? If so, what programs will be cut?

- Will they increase the deficit with greater federal spending?

- Will more federal spending set off a difficult round of inflation?

- Do the 2020 election winners raise taxes to cut the debt? Which taxes?

Each choice will have far-reaching implications.

Meanwhile, if rates go up just a little, federal interest costs will soar.

A 1% rate increase can mean hundreds of billions of dollars in higher federal interest payments.

FHA insurance costs and the 2020 election

The FHA mortgage program is a huge success. It’s collecting big money from insurance premiums at a time when there are few foreclosures. The result is a massive surplus.

So, where does money generated from FHA loans come from — and where does it go?

In short, the FHA insures mortgage loans. This insurance allows borrowers to purchase with as little as 3.5% down. Borrowers pay insurance premiums to get FHA backing. And the insurance premiums collected by the FHA go into a reserve account.

The FHA is supposed to have a 2% reserve. In fact, the reserve is now greater than that.

So, what will the next election winners do about the FHA surplus? Keep collecting the money, or reduce FHA insurance premiums?

The current administration says it won’t change FHA mortgage insurance rates. But under a different president, that could change.

Lower premiums would allow more people to buy homes, something that can spark increased real estate sales nationwide.

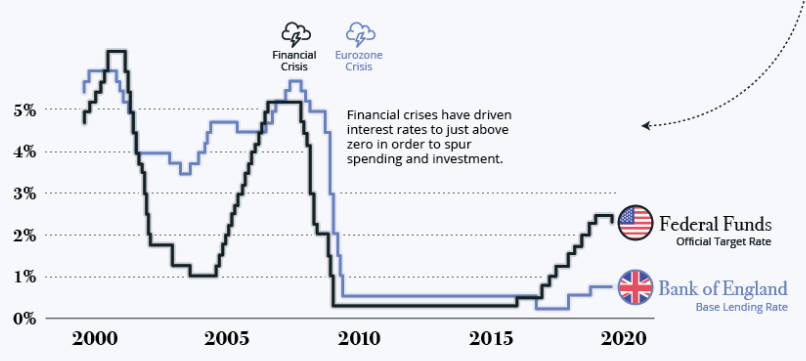

The Federal Reserve and mortgage rates

The Federal Reserve is an independent institution charged with guiding the nation’s economy.

So far in 2020, the Federal Reserve has cut the federal funds rate — the money banks pay for overnight borrowing — to near-zero levels.

Mortgage rates are not controlled by the Federal Funds Rate. But a low-rate environment has certainly contributed to keeping mortgage rates low.

No matter who is elected, no one expects the Fed to raise rates any time soon. The coronavirus presents too big a risk to the economy to do that.

What it all means for you

Predicting what will happen to mortgage rates in 2021 involves a whole lot of “ifs” and “maybes.”

And as history has shown, presidential elections can impact mortgage rates positively, negatively — or not at all.

So what should you do if you want to buy a house or refinance in the coming months?

Stay on top of the market. Mortgage rates change on a daily basis. So when you’re close to closing, keep your eyes on daily rates — and be ready to lock when they’re in your favor.

Time to make a move? Let us find the right mortgage for you