Three in five people think they wouldn’t qualify for a mortgage

If you think getting a mortgage seems hard, you’re apparently not alone. According to a new survey from the National Association of Realtors, the majority of Americans agree with you.

NAR’s recent Home Survey shows a whopping 60 percent of prospective homeowners believe getting a mortgage would be either “very difficult” or “somewhat difficult.” And for those who earn under $50,000 per year? The share jumps to 74 percent.

Fortunately, a lot of these worries are unfounded. In fact, many of the people most worried about qualifying actually have a better shot than they think.

Are you interested in buying a home but unsure about the mortgage process? Think you might have a hard time qualifying? Let’s look at why that’s probably not true.

See what rates you qualify for today. Start hereHow to qualify for a mortgage (you have a better shot than you think)

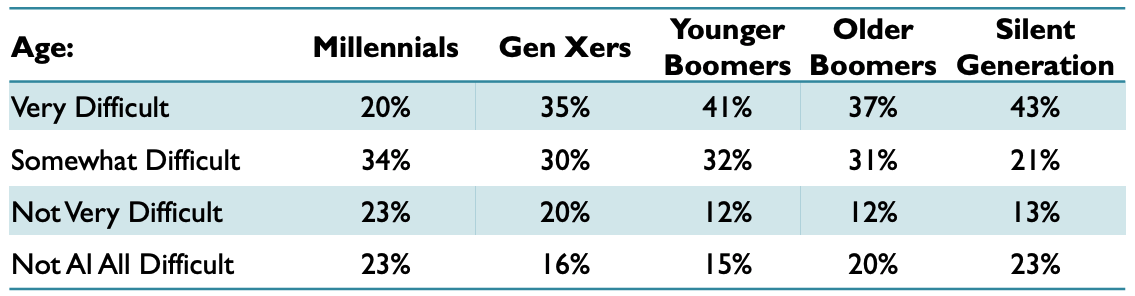

If you look at the results of NAR’s survey by generation, older Americans are most worried about qualifying for a mortgage.

But statistically, Boomers and the Silent Generation have a better shot at getting a loan than most.

Image: NAR

That’s because these cohorts see marked improvements in both their credit score and their debt levels as they age.

Millennials, who appear to be most confident in their mortgage prospects, have an average FICO score in the mid- to high-600s. Boomers and those in the Silent Generation? They average well above 700.

They also have significantly less debt than younger Americans, and with debt-to-income ratios playing a major role in the mortgage process, this automatically gives older cohorts a leg up on their loan applications.

Verify your mortgage eligibility todayHow can I qualify for a mortgage with debt or a low credit score?

If you’re not in this older cohort with decent credit or low levels of debt, you’re not out for the count just yet.

Thanks to a number of first-time home buyer mortgage programs, down payment assistance offerings, and alternative loan options, you still have plenty of ways to buy a home (and do so affordably).

Let’s look at your options for a variety of scenarios:

- Low credit score - Don’t have a great credit score? You’ve got options. In fact, FHA loans allow for scores as low as 500, as long as you can make a 10 percent down payment. You can also add a co-signer to your loan to help your chances of qualifying

- No down payment savings - Despite the rumors, you don’t need a 20 percent down payment to buy a house. On conventional loans, you can pay as little as 3 percent, and if you’re willing to buy in a rural area or you’re a military member/veteran, you can actually skip the down payment altogether

- No cash for closing costs - There are a number of closing cost and down payment assistance programs that can help you cover the up-front expenses of buying a home. These vary by location and are usually offered through your state housing agency

- Non-traditional job or inconsistent income - If you’re a gig worker, freelancer or self-employed pro, you may be worried about proving your income without W-2s, paystubs and other must-haves. Fortunately, many lenders are now offering loans that cater to workers just like you. They’re often called “bank statement loans,” as they allow you to qualify based on your bank statements and cash flow alone

Thanks to these flexible options, it’s possible to qualify for a mortgage with almost any financial background. You just need to know where to look.

Learn more with our complete first-time home buyer’s guide

Affording your new home month-to-month

If you’re worried about making your monthly payments, it’s important to keep two things in mind.

First, rents are rising. Unless you’re in a rent-controlled area, you’ll likely see rent increases in the years to come. Throw in that renting doesn’t build equity, and you lose out two-fold.

On top of this, mortgage payments are actually down. The average mortgage payment dropped 6 percent in the last year thanks to extremely low mortgage rates.

To help you gauge just how much this could impact your prospects, let’s look at a quick scenario.

Let’s say you’re buying a house for $200,000 with 5 percent down. Last September, with rates at 4.63%, you would have paid $1,085 per month. In September 2019, at a rate of 3.61%, payments drop to $973 — $112 less per month and $1,344 less per year.

To find out how much you could afford based on your monthly budget, try using our Mortgage Payment Calculator.

Think qualifying for a mortgage is impossible?

The bottom line is simple: getting a mortgage can seem daunting, but it doesn’t have to.

Be informed about the options you have, and leverage any low-cost mortgage, down payment, and closing cost assistance programs you might be eligible for.

Finally, keep today’s low rates in mind. Mortgage rates are at three-year lows, and home price growth has slowed. It’s the perfect time to get in on the ground floor and start building equity.

Want to see what mortgage rates you qualify for? Start shopping around today.

Time to make a move? Let us find the right mortgage for you