3% mortgage rates are now a reality

It wasn’t that long ago that predictions of 3% mortgage rates were considered wishful thinking.

Surprisingly, rates this low are now a reality.

And that’s putting homeowners in a very good position.

A new report shows that more homeowners could benefit from a refinance than at any time since 2001.

Think you might be able to save with a refinance? With rates this low, you’re probably right.

Get started on your refinance here.As rates fall into the 3s, late-2018 mortgages seem downright expensive

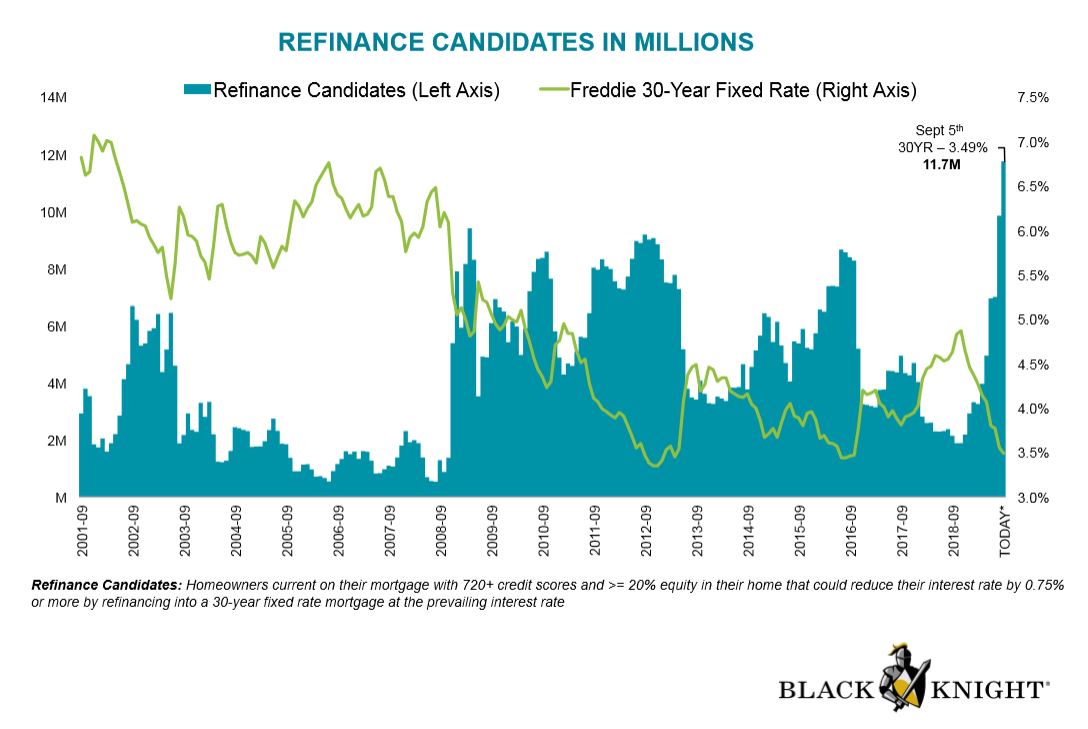

Last week, Freddie Mac reported that the average 30-year fixed mortgage rate hit 3.49%.

That’s as low as rates have been since October 2016, right before the presidential election that sent rates skyward for the following two years.

But there’s been a reversal of fortune for anyone interested in mortgage rates.

Getting a $250,000 mortgage in late-2018 would have cost you $200 more per month than it would today.

Rates have been dropping since December 2018 and are now about 1.5% lower than they were late last year.

Getting a $250,000 mortgage in late-2018 would have cost you $200 more per month than it would today.

Report: 11.7 million homeowners could cut their rate by at least 0.75%

According to a new report by mortgage data firm Black Knight, 11.7 million homeowners could refinance into today’s rates and cut at least 0.75% from their existing mortgage rate.

That’s the most eligible refinance candidates going back to 2001, says the report.

The report considers an eligible refinance candidate as one with adequate credit scores and equity to refinance. But even more homeowners might be eligible than the report suggests.

Thanks to programs like the FHA streamline refinance, as well as VA and USDA loan versions of the program, homeowners can refinance with less-than-perfect credit, no appraisal, and no equity.

Whatever your situation, it could be a great time to check your eligibility, cut housing costs, and ease tension on your budget.

Will mortgage rates remain this low?

Mortgage rates are ridiculously affordable from a historical perspective, creeping up on all-time lows set in 2012.

But rates might not stay this way. Daily, economic news swings rates, sometimes wildly. Rates often rise faster than they fall.

Want to capitalize on today’s low rates? Start below.

Time to make a move? Let us find the right mortgage for you