Mortgage fraud: You’d never consider it

Mortgage fraud is real. And, amazingly, it’s possible for otherwise-innocent people to become involved.

In general terms, we all know when a crime is a crime. Hold up a bank or steal a car and – no question – those are crimes. Mortgage fraud is more subtle. Real estate financing is complex and easy to be confused. Sometimes professional people and authority figures in our lives are not on the up-and-up.

According to the FBI, mortgage fraud is a “crime characterized by some type of material misstatement, misrepresentation, or omission in relation to a mortgage loan which is then relied upon by a lender. A lie that influences a bank’s decision — about whether, for example, to approve a loan, accept a reduced payoff amount, or agree to certain repayment terms — is mortgage fraud.”

Find mortgage programs for all kinds of homebuyers

Is mortgage fraud common?

Unintentional mortgage fraud may seem impossible, but financial criminals can be cunning. They don’t come out and announce their illegal acts. Instead, they work diligently to confuse and compromise both lenders and borrowers. CoreLogic estimates that 1 in 109 mortgage applications in the second quarter of 2018 had indications of fraud. Given millions of applications each year, fraud is a sizable problem.

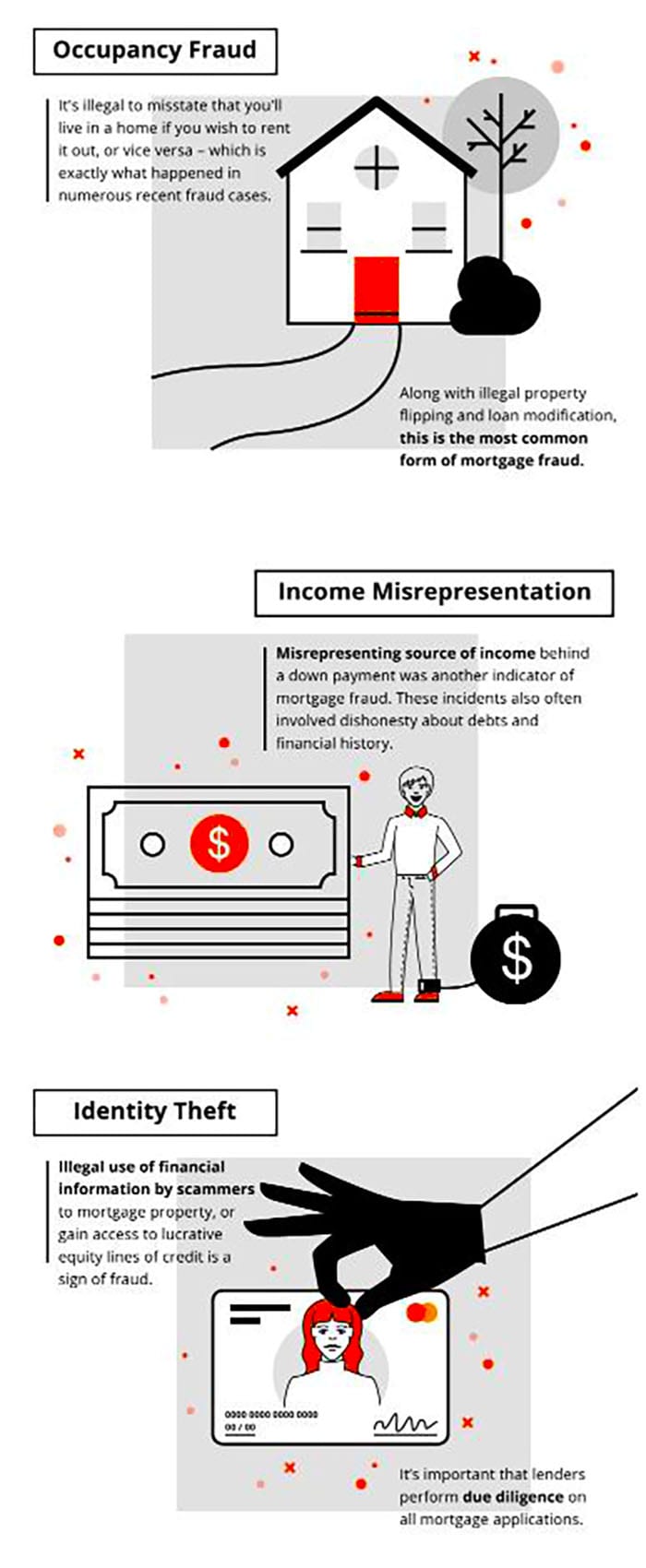

Mortgage fraud takes many forms. The ultimate victim is typically a lender, but along the way, buyers and sellers can also get hurt. Here are the most common forms of mortgage fraud according to the FBI.

Foreclosure rescue schemes

Property owners facing foreclosure can become mortgage fraud victims. So-called “rescuers” can trick desperate homeowners into illegal acts. For instance, transferring deeds to con artists. Or selling to a straw buyer. Or using fake appraisals to boost the sale value.

“Homeowners,” said the FBI, “are sometimes told they can pay rent for at least a year and repurchase the property once their credit has been reestablished. However, the perpetrators fail to make the mortgage payments and usually, the property goes into foreclosure.”

Loan modification schemes

Homeowners facing foreclosure sometimes hear from fraudsters who offer to renegotiate loan terms on their behalf. The scammers, said the FBI “demand large fees up front and often negotiate unfavorable terms for the clients, or do not negotiate at all. Usually, the homeowners ultimately lose their homes.”

Related: Should you lie on your mortgage application?

Illegal property flipping

Here the scammers buy and immediately re-sell property at a higher value. How? With fraudulent appraisals and fake loan documents. Buyer incomes are often inflated and there can be kickbacks to loan officers, appraisers, and escrow officers.

Builder bailout schemes

“Builders,” said the FBI, “facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. Builders find buyers who obtain loans for the properties but who then allow the properties to go into foreclosure.”

Condo conversion schemes

In a condo conversion scheme, straw buyers with high credit scores purchase rental units at inflated prices. The buyers get under-the-table incentives from the sellers. Buyers’ income is often exaggerated on loan applications, sometimes without their knowledge.

The lender ends up financing a much riskier deal than it otherwise would, and the loans fail after the perpetrators have extracted as much rent as they can without paying the mortgage.

Equity skimming or stripping

Equity skimming or stripping became popular during the Great Recession when many homeowners lost income and got behind on their mortgages. Scammers talked them into signing their homes over to investors, who would (supposedly) hold the property for a year, allow them to remain in their homes by paying rent.

In a year, the property owners were told, they could buy their property back. But the investors took the opportunity to refinance the homes, extracting as much cash as they could, and then let the mortgages go. The lender forecloses and evicts the former owners.

Silent second

In this situation the lender is not told that the purchaser is financing with a second loan. This second loan might be used for the down payment. Note that purchase-money second mortgages (also called piggy-backs) are not illegal. Failure to disclose them is.

Reverse mortgage fraud

Reverse mortgage scammers “recruit seniors through local churches, investment seminars, and television, radio, billboard, and mailer advertisements,” according to the FBI. Scammers get a reverse mortgage for the property owner but keep some or all of the money for themselves. Such schemes often involve fraudulent appraisals.

Commercial real estate loans

Commercial property owners sometimes finance and refinance buildings by faking rent rolls, using fraudulent appraisals, and writing fake leases. The lender makes an over-sized, risky loan.

Air loans

According to the FBI, the lender victim funds a “nonexistent property loan where there is usually no collateral. Air loans involve brokers who invent borrowers and properties, establish accounts for payments, and maintain custodial accounts for escrows.

“They may establish an office with a bank of telephones, each one used as the fake employer, appraiser, credit agency, etc., to fraudulently deceive creditors who attempt to verify information on loan applications.”

Beware of wire transfer fraud

A new form of mortgage fraud has emerged: wire transfer fraud. So-called “business e-mail compromise” fraud (BEC) is increasingly common. The way this works is that a buyer receives email instructions to wire money for closing to a particular account. The trick? AThe wire included a substitute account number.

How to protect yourself

There are a number of steps you can take to protect yourself against mortgage fraud.

First, when completing a mortgage application, don’t guess. Get numbers for your income and savings from tax returns and bank statements.

Second, keep records. Retain copies of the statements and records used to complete a mortgage application. Keep a copy of the application. If information needs to be re-checked you will have documentation in hand.

Third, know your closing agent. Never wire money to a closing agent without verifying account information. Call the closing agent to check account numbers. Have the closing agent send email to several email accounts with correct wiring instructions.

Finally, never sign a blank loan application. Complete all spaces yourself. Draw a diagonal line through all blank forms.

Time to make a move? Let us find the right mortgage for you