Increase your credit rating, get a free car

Your mortgage rate depends heavily on your credit score. And because the mortgage is usually your largest debt, improving your credit score could save you more than you think. In fact, the consumer with good credit could save enough while paying their mortgage to buy a car. With cash.

Check out current mortgage rates for all credit levelsHere’s your proof: real-life credit scores, mortgage rates and payments

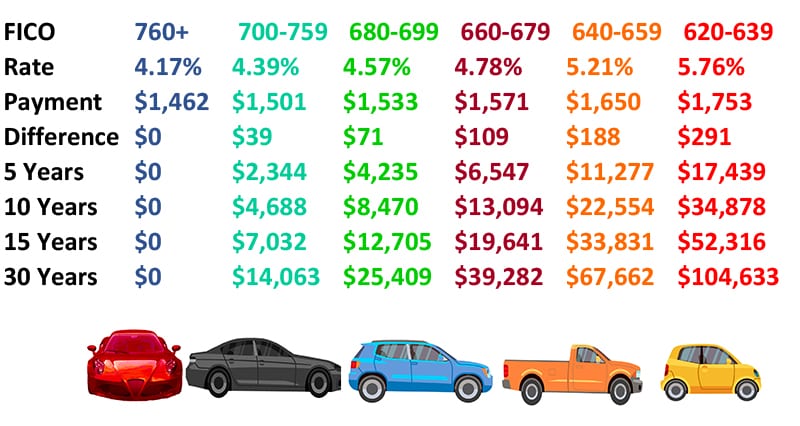

As of this writing, the average mortgage rate for 30-year fixed loans on The Mortgage Reports is 4.708. But actual mortgage quotes depend on your down payment or home equity, and your FICO score. Here is what MyFICO says rates are averaging this same day by credit rating. The chart shows the rate and payment at each level for a $300,000 mortgage.

And the kind of car you could buy with the money you’d save by having better credit. The homeowner with the best credit could save enough for a free, exotic sports car. And those with good scores could still save enough for a sedan, SUV, pickup or compact car.

Looking at this chart, you can see your potential savings. For instance, if your current FICO score is in the 660 - 679 range, you could expect a mortgage taken today to cost you $13,094 more than it would if your score was 760 or higher. If you raised your FICO by a single point to 680, your extra cost drops to $8,470 — saving you $4,624 over ten years.

Improving your credit score — from poor to fair

If you have bad or poor credit, you probably know it. “Poor credit” usually means having a FICO score under 620 — the level at which many mortgage lenders set their minimum acceptable score. And many creditors consider 620 to 679 FICO scores to be “fair.”

According to FICO, the creator of the widely-used FICO credit score, four of the top five reasons for low credit scores relate to delinquency. That means missing payments, paying late or having debts going into collection. The fifth reason is having balances that are too high.

So, you should be able to raise your score over time by simply doing the one thing most people do — pay your bills on time. The fifth factor will go away if you stop using your credit cards and just pay the balance down — preferably making more than the minimum payment.

Need professional help? Try a reputable, non-profit consumer credit agency. Counselors can help you budget and get your bills paid by putting you into a debt management plan (DMP). You pay them once a month, and they distribute the payment among your creditors. You may even get late charges waived and interest rate reductions if you qualify.

Related: How to fix a poor credit score

Improving your credit score — from fair to good

If your credit is “fair,” ranging between 620 and 679, it’s still below average in the US. So if you want even average interest rates and opportunities, you need to improve a little more.

Fortunately, that might not be too difficult. Not all fair credit scores happen because of bad debt management. Your credit history could be minimal. This is called a “thin file” in credit underwriting. Your account history might be ‘too recent,” FICO says, or with “too few accounts.”

Your fair credit score may also be caused by the opposite problem — too many accounts, too many accounts with balances, or your number of accounts with balances is too high. If you don’t have actual derogatory history, you can raise your score quickly by paying down your balances.

Be careful about closing accounts, however. You’ll probably want to pay off, but keep the ones with the longest history or the biggest credit limits. That way, your utilization (your limits versus the amount used) and average age of accounts won’t be damaged.

Related: How to improve a fair credit score

Improving your credit score — from good to great

The average FICO score in this country is about 700, which means it’s in the “good” range. Creditors generally define “good” credit scores like 680 to 739. Anything over that is considered “excellent” in most cases.

So if you have a good credit score, you probably have some good debt habits — paying your bills on time, establishing a long credit history (it takes about 11 years on average to become a credit “superstar”), a good mix of credit — a handful of credit cards, an installment loan (like auto financing) or two, a mortgage....but super-scorers don’t carry credit card debt from month to month. They pay it off.

Credit utilization is also a huge factor. Consumers with good credit scores don’t run up more than 30 percent of their available credit. But to make the jump to “excellent,” you need to keep that down to 10 percent. If you have a $10,000 total credit limit, don’t touch $9,000 of it. Just like the old joke says, banks only want to lend to people who don’t need it. Use your cards for convenience or rewards, not for actual borrowing.

Related: How to make a good credit score even better

Quick and dirty tricks to raise your score fast

If you’re trying to raise your credit score before applying for a mortgage, there are a few ways to increase it quickly. Note that FICO does not guarantee that these will always work, but anecdotal evidence and a few studies suggest that they do.

Authorized user

If you don’t have enough credit history, a too short credit history, or no recent good credit history, you can add some positive history as an authorized user. This means finding friends or relatives willing to trust you to be on their credit card accounts. As an authorized user, you are not responsible for the payment.

You don’t charge anything on the account. In fact, you don’t even need to know the number. But the cardholder’s positive account payment history will appear on your credit report and probably also influence your FICO score. It depends on the version of the scoring system your creditor uses.

Fix errors

If you have any doubts about your credit report or history, pull a report for free using the government’s site, www.annualcreditreport.com. You can get your history from all three bureaus once a year for free (more often if denied credit or victimized by fraud), and purchase your “educational” FICO scores cheaply.

If there are inaccurate late or missing payments, or your balances are showing up higher than they are, contact the creditor and all three bureaus and ask them to correct the record. Be prepared to prove your claim.

Even if the entries are correct, if you have an otherwise good relationship with your creditor, try contacting them and begging to have the late payment removed from your record. If you currently owe past-due amounts, some creditors will be willing to remove the negative history if you agree to pay some portion of the balance now and set up a plan for the rest. Or pay off the balance in exchange for clearing your name.

Remember to get any special agreements like these in writing and signed.

Rapid re-score

Rapid re-scoring is the ability to fix errors on your credit report within a day or two. You have to be able to prove that there is an error. But the service isn’t something that you, a consumer, has access to. Only a mortgage lender.

So if you know that there is a recent payment inaccurately reported as late, get your proof together and ask your lender to help. One recent late payment can drop your FICO by over 100 points if your credit is otherwise great. So there’s a lot at stake.

Each incorrect item costs $30 to $50 to remove but can save you weeks of dealing with credit bureaus and thousands on your mortgage costs.

Related: Raise your FICO 100 points in 2019 and save big on everything

Borrow more

But only to solve specific problems. For example, taking out a personal loan to pay off your credit card balances can skyrocket your FICO if the biggest knock they have on you is that your revolving balance or credit utilization is too high.

Because a personal loan counts as an installment loan (in which you make regular fixed payments until your account is zero), while credit cards are revolving loans (in which you can pay them and then charge them back up over and over). So if you have $9,000 in credit card debt and $10,000 total limit, you’re at 90 percent utilization. But pay them off with a $9,000 personal loan (which may have a lower interest rate), and your utilization drops to zero.

Other ways to reduce your utilization include contacting the creditors with whom you have good, longstanding relationships, and request a higher credit limit. Then don’t go near that limit. More available credit — UNUSED — means lower utilization ratio. So, if you owe $5,000 and have a total limit of $10,000, your ratio is 50 percent. But add another $5,000 in available credit, and your ratio drops to a more respectable 33 percent.

Rent reporters and “second chance’ cards

Often the best way to get lenders and scoring models to ignore your sordid past is to get some recent positive payment history into your report. If you’re a renter, you may be able to sign up for a service that reports your good payment history and gets it incorporated into your credit score.

And for those with no trade lines or poor credit history, a secured credit card can help put some good payment history on your report a score. Make sure that the card offers reasonable fees and that it reports your monthly payments to all three major credit bureaus — Experian, TransUnion and Equifax.

Re-aging your accounts

“Re-aging” means bringing a past-due account current. Your creditor would have to agree to roll your past-due amounts into your account balance. If you have been trying to get current and sending in money, but can’t come up with enough to completely catch up, ask your creditor about re-aging.

You have a better chance of success if you make a couple of on-time payments first, or if you have a non-profit credit counselor contact your creditor. Re-aging can instantly improve your score.

Shop for lenders that use the “right” credit score

A single point on your credit score can make the difference between a “good” mortgage pricing tier and a”fair” one. And as the example above shows, that one point can cost you many thousands over the life of your loan.

Understand that the “educational” score you can purchase when you pull your free credit reports is not the same score that mortgage lenders will see. In fact, there are about 50 different FICO scores geared to various industries, and versions of them updated periodically. So ten different mortgage lenders may get ten difference scores for you.

You’ll likely only know their model is not the best when you get a mortgage quote that’s not as good. The good thing as that multiple mortgage lenders pulling your credit during a short time won’t kill your score (inquiries do affect your FICO but a bunch of mortgage inquiries in a short time will be treated as a single inquiry). So you can safely shop with many competing mortgage lenders to get the best deal available to you.

Whatever your credit rating.

Time to make a move? Let us find the right mortgage for you