Real estate wealth: How to get it

Homeowners in the US have seen their home equity grow by $2.47 trillion since 2016. With the Great Recession finally in the rear view, real estate wealth in the US is on the rise.

And once again, real estate is one of the most reliable ways to generate wealth for everyone — even those homeowners with lower incomes save significantly more than their renting counterparts. You, too, can begin building real estate holdings for your future.

Cheaper mortgages equal higher returns. Check mortgage rates hereReal estate wealth is real and it’s growing

The Federal Reserve says that household real estate was worth $26,052 trillion in 2016. That number reached $29,002 in the third quarter of 2018 — an increase of $2.95 trillion.

Well sure, home prices are generally up, but what about mortgage debt? During the same period, mortgage balances rose from $9,785 trillion to $10,267 trillion. That’s an increase of $482 billion.

What this means is that real estate equity – market value less mortgage debt – went from $16.267 in 2016 to $18.735 trillion at the end of the third quarter. That an increase of $2.468 trillion – almost $2.5 trillion.

Which markets are hot?

None of this is especially surprising. According to the National Association of Realtors (NAR), as of October the typical existing home was priced at $255,400, up 3.8 percent from a year earlier.

“October’s price increase marked the 80th straight month of year-over-year gains,” said NAR.

So far, so good. However, not every market has been favored with growing equity.

The NAR also reported that in the third quarter, 166 out of 178 metropolitan statistical areas saw price increases. That also means 12 metro areas saw declines.

While prices nationwide rose 4.8 in the third quarter compared with a year earlier, some metro areas did far better. According to NAR the big winners included:

- Norwich-New London, CT – 14.9 percent annual price appreciation

- Kennewick-Richland, WA – 14.8 percent

- Las Vegas-Henderson-Paradise, NV – 12.6 percent

- Nashville-Davidson—Murfreesboro—Franklin, TN – 12.1 percent

- Salem, OR – 12.1 percent

- San Jose-Sunnyvale-Santa Clara, CA – 11.6 percent

- Eugene, OR – 11.9 percent

- Baltimore-Columbia-Towson, MD – 11.4 percent

- Yakima, WA – 11.4 percent

- Colorado Springs, CO – 11.2 percent

- Spartanburg, SC – 10.6 percent

- Lakeland-Winter Haven, FL – 10.5 percent

Is now the time to invest?

If you look at the list above the obvious quality is it’s inconsistency. The winning metro areas predictably included San Jose-Sunnyvale-Santa Clara – the Silicon Valley – but that was not the area which saw the most appreciation. Other winners were scattered around the country. As we look toward 2019 there are some thoughts for investors to consider.

Interest rates in 2019 may surprise us

Higher mortgage rates were widely predicted for 2018 but forecast results have been mixed. The annual mortgage rate for 2017 was 3.99 percent according to Freddie Mac and it will be higher when we get the final number for 2018. So yes, rates went up.

However, while many forecasters were talking in terms of 5 percent financing by the end of 2018 that has not happened. According to Freddie Mac they weekly rates went from a peak of 4.94 percent in mid-November to 4.63 percent in mid-December.

Why did rates fall? There are several causes for the late-year interest rate decline. The stock market had a woeful December so investors moved money from equities to bonds. This made more cash available to borrowers and helped reduce mortgage rates. Also, there are worries that a recession looms ahead and that will mean less growth and maybe no growth. The National Association of Realtors’ December forecast predicts that existing home sales in 2019 will decline, as was also the case in 2018.

The good news? Fearsome mortgage rate hikes were avoided in 2018. While rates above 5 percent are forecast for 2019 the prediction business has not proved especially accurate. Softer rate increases – or maybe no rate increases – enhance affordability and that’s good for buyers, sellers, and home values.

Rising interest rates may not slow home sales

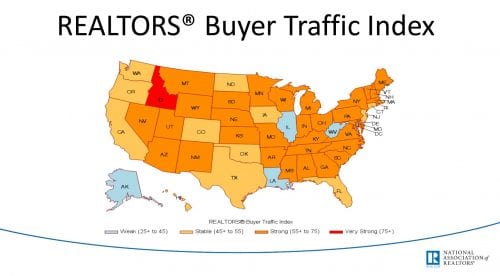

The snapshot below from the NAR shows that demand is stable-to-strong in most of the US.

Most economists predict that higher mortgage rates lie ahead. Higher rates suggest less affordability and that logically translates into stalled prices and fewer sales.

Check today's mortgage ratesBut what if such logic is wrong?

Economist Robert J. Shiller, writing in The New York Times, explains that “the market reaction to interest rates is hardly immediate or predictable. The housing market does not react as directly as you might expect to interest rate movements.

“Over the nearly seven years of the current boom, from February 2012 to the present, all major domestic interest rates have increased, not decreased. So, while interest rates have been low, they have moved the wrong way, yet the boom has continued.”

Is flipping the key to real estate wealth?

Flippers have done really well during the past few years. According to ATTOM Data Solutions, the typical flip yielded $63,000 in the third quarter. While such profits are alluring, flipper activity dropped 12 percent during the past year.

This is likely the result of slowing property appreciation across the country. Also, there is a lot of risk in flipping. Either you finance such projects with cash, or you borrow from private sources. Interest rates for private loans likely will top 8 percent plus 3 to 4 points up front.

Taxes

The latest tax reform legislation will plainly impact the housing market, especially in areas with expensive properties and high property taxes. While mortgage interest will remain deductible, most taxpayers will not use the deduction, opting instead to take the new and larger standard write-off.

Does it make sense to buy real estate?

The reason to own real estate is that people usually want to live indoors. Their choices are generally rent, own, or move in with their parents.

Of those options, renting offers no potential for equity growth. And living with Mom and Dad often means daunting psychological warfare. Ownership offers the possibility of higher values, the very real benefit of mortgage amortization, and intangibles like status and independence.

Perhaps most importantly, the only people who benefited from that nearly $2.5 trillion in equity growth during the past few years were owners.

While appreciation cannot be guaranteed, it’s striking that according to Harvard’s Joint Center For Housing Studies, homeowners age 65 and above had an average net worth of $319,200. And renters in the same age group? Their net worth was just $6,710.