In this article:

You need credit to get credit, which seems impossible. And yet most people manage to establish a credit score and history eventually. Here’s how to speed up the process and get credit without having a credit score:

- Become an “authorized user” on a family member or friend’s account

- Apply for a secured or “starter” credit card

- Get your landlord to report your rental payment history

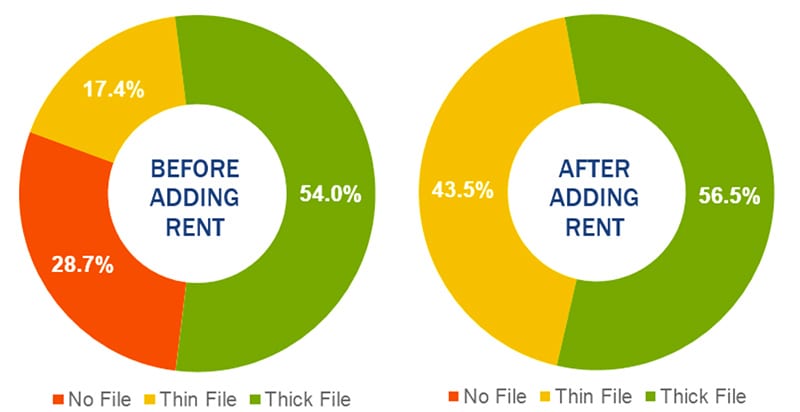

These strategies work best for someone who has what’s called a “thin credit file” with little or no reported credit history.

Verify your new rate“No credit” is not the same as “bad credit”

When you have no accounts reporting your good behavior to credit bureaus, you are very vulnerable. Because anything bad — for example, a small collection reported by a debt collection agency — has nothing good to offset it.

7 mortgages with low minimum credit score requirements

Overcoming past credit missteps is a bit more complex than building new credit, so don’t go there if you can avoid it. If you’re just starting to build a credit history, try these steps. You’ll be surprised how quickly you build strong credit.

Become an authorized user

Becoming an authorized user on a credit card means someone with good to excellent credit adds you to their account. This is a way to piggyback on or inherit that primary accountholder’s good credit history and have it included in your credit reports. But, you’re not legally required to repay the debt and can’t make account changes.

How to raise your credit score fast

If the accountholder is comfortable actually letting you use the account, be respectful of this privilege. Do it responsibly and pay promptly. In most cases, you don’t use the account. You don’t need access to the account to get the good payment history on your own credit report.

In fact, your friend or relative may be a lot more comfortable adding you if you don’t know who the creditor is or what the account number is. Allowing you to be an authorized user is a huge favor and requires a lot of trust.

Authorized user drawbacks

This credit-building strategy only works if the accountholder practices good credit habits. That includes paying the bills on time every month and maintaining a low credit utilization rate.

The best accounts to piggyback on have balances below 30 percent of the available credit limit on the account. And it’s best to get on an account they’ve had a long time to raise the “age” of your credit, because the length of your credit history comprises 15 percent of your score. Bonus points if the card or credit line has a high limit.

Finally, it doesn’t help your credit unless the creditor reports authorized user accounts to the big three credit bureaus: Experian, Equifax and TransUnion.

But, because creditors want to see how you handle credit as the primary account holder, you’ll need to take the next step to building credit, too.

Apply for a secured or “starter” credit card

A secured credit card requires you to make a deposit with the creditor. Although the deposit acts as collateral for the credit card, most issuers still check your credit report. The amount you deposit is usually also your “credit” limit.

The creditor typically holds your deposit in an interest-bearing account until you establish a positive payment history on the card. Eventually, the credit card company might increase your credit limit to a higher level than your deposit. It may even convert your card to an unsecured account with a higher credit limit, and return your deposit to you.

Can you pay your mortgage with a credit card?

Check with the credit card issuer about when you can qualify to have your card converted to an unsecured card since not all offer that option.

If you regularly fail to pay your bill on time or at all, you forfeit the deposit, and your credit score gets severely damaged.

This strategy works best if you charge a small amount on your credit card and pay it off each month by the due date. This could raise your credit score rapidly within a few months. (It’s not time to celebrate and get several more credit cards, though. Too many credit inquiries on your credit report within a short time hurt your credit score, also.)

Another option is a “starter” card like a store or gas credit card. These cards are easier to get than unsecured credit cards for people with thin credit files, but their interest rates can be very high. So, be sure to keep balances low—well under 30 percent of the credit limit—and pay the balance in full each month.

Starter card drawbacks

It’s essential to avoid shady credit card and secured card issuers and practices. The fine print may disclose multiple fees that come right off the top of your deposit, or (worse) show up on your first bill. You may not be allowed to use the card until you have paid off that initial balance.

These fees can include activation, service, annual services, and standard yearly fees as well as credit limit increase fees. The so-called “fee harvester” card activation costs can legally consume up to 25 percent of your credit — that’s $125 for a $500 credit card.

But that’s not enough for some companies —- they do an end run around the 25 percent limit by charging upfront application or processing fees. Avoid those cards.

In addition, the credit card company is not required to report your payment history to credit bureaus. Before signing on with anyone, make sure it reports every month to all three bureaus — not just to one bureau, or only every few months.

Help from your landlord: reporting rent payments

When searching for a rental, ask if the landlord or property manager reports your rent payments to a service like Rent Karma or Rent Reporters. Those agencies report to one or more of the big three credit reporting agencies. That should be a factor when you choose a rental if you’re trying to build credit.

What credit score do you need to rent an apartment?

If you’re already a renter who pays your rent on-time each month, ask your landlord to report your payments. Even if they don’t, keep copies of your own canceled rent checks or receipts to document your on-time payment history. Lenders consider rental history because they believe it predicts how you’ll pay your mortgage.

Because this isn’t traditional credit, in most cases, rent doesn’t automatically or directly get reported to the three major credit reporting agencies. At least not yet.

Drawbacks to rental ratings

If you rent from an individual or small landlord, he or she may object to the hassle and / or cost. In that case, there are companies like RentTrack that you can use (for a price). You pay them, they pay your landlord and report to all three bureaus.

Whichever service you choose, make sure they are an approved Fair Credit Reporting Act (FCRA) data contributor. If they are, they comply with FCRA regulations for reporting your rent payments to credit reporting agencies.

Rental ratings only help if you pay your rent on time, every single month, no matter what. If you get sick, lose your job or withhold rent because your landlord isn’t making repairs, nonpayment could seriously damage your credit. Carefully consider the pros and cons of this option before you use it for credit building.

Non-traditional credit ratings

Even if you don’t have enough traditional credit history to generate a credit score, you can still get approved for a mortgage if you have at least three or four (depending on the program) accounts the lender can use to verify your credit history.

However, the best mortgage rates go to those with high FICO scores, so start building your credit today to save money tomorrow.

Time to make a move? Let us find the right mortgage for you