- Mortgage insurance is a policy purchased by the borrower for the benefit of the lender.

- Mortgage insurance pays the lender if you, the borrower, default on your home loan and cause the lender to lose money.

- You can avoid paying for mortgage insurance by financing 80 percent or less of the home purchase price.

Mortgage insurance: necessary evil?

For many homebuyers, the phrase “mortgage insurance” is as dreaded as “tax audit.” But, this coverage could make the difference between getting a home or not.

In some cases, it can help you keep your home, too. Here’s a brief primer to help you understand why you might need this protection on your mortgage.

Time to make a move? Let us find the right mortgage for youWhat is mortgage insurance?

Mortgage insurance lowers the lender’s risk of making mortgage loans to homebuyers who don’t make large down payments. If you default on your loan, the lender can foreclose and sell your property. However, the foreclosure sale proceeds might not be enough to cover the amount you owe plus legal costs.

If the foreclosure sale proceeds don’t cover the lender’s losses, mortgage insurance makes up the difference. With this coverage in place, lenders feel more comfortable making loans to buyers with little or no money for a down payment.

Who must get mortgage insurance?

Loans with smaller down payments are riskier for lenders. So almost all home loan programs require mortgage insurance for borrowers with less than 20 percent down.

Avoiding mortgage insurance is costing you $13,000 a year

Some lenders just charge a higher interest rate and buy their own coverage or self-insure. But most simply send your information to a mortgage insurer and purchase the policy, which you pay for.

How much does mortgage insurance cost?

The cost of private mortgage insurance (PMI) for non-government loans depends on your down payment and your credit rating.

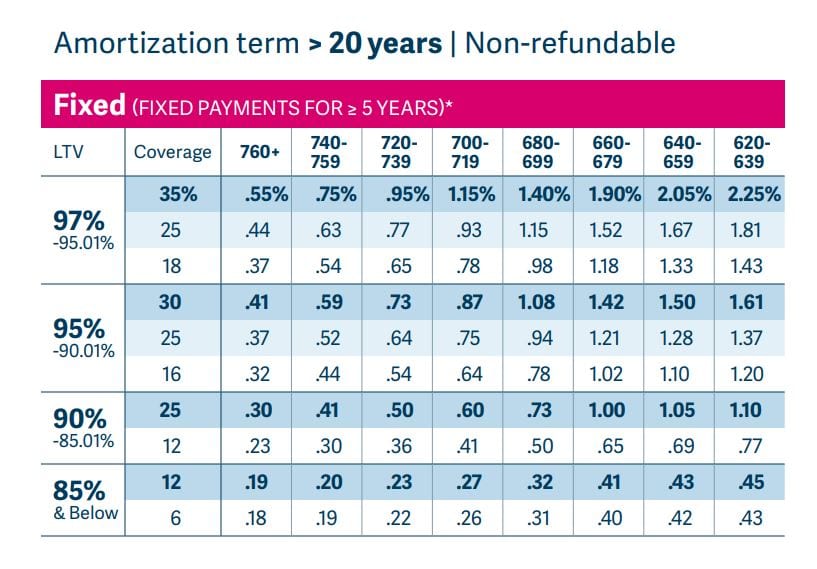

The image below shows premiums for fixed-rate loans from one national mortgage insurer. Note that for a 95 percent loan, the cost for a borrower with a 760 FICO is a full percent less than that of a borrower with a 620 score.

How can you save on mortgage insurance?

How can you save on mortgage insurance?

You can see from the image above that the most obvious way to save is to improve your credit score before applying for a mortgage. Even a few points could potentially help you — improving from 639 to 640, for example, gets you .09 percent off your rate.

And if you can squeeze out a larger down payment now, you could save a lot over the years. A borrower with a 640 FICO could save about half a percent a year by putting 10 percent down instead of 5 percent.

Finally, the lender has some control over the cost of PMI. Lenders choose the provider and the amount of coverage required. There are three lines of coverage for every loan amount and FICO score. A lender requiring only 25 percent coverage on a 97 percent loan (the middle line) will get you a lower MI premium than one requiring 35 percent coverage (the top line).

Shop for your total payment and cost, not just your interest rate.

How can mortgage insurance benefit buyers?

This lender protection allows you to buy a significant asset without saving a 20 percent down payment. That way, you can take advantage of increasing real estate values to build wealth.

It may also help you avoid foreclosure. If you have trouble paying your mortgage, you may be able to get a claim advance.

Behind on your mortgage payment? Ask for a claim advance

Both lenders and mortgage insurers want to avoid the high costs of foreclosure. So, after carefully considering your situation, mortgage insurers may cover your past-due mortgage payments to avoid taking a bigger loss in a foreclosure sale.

They might also get your monthly mortgage payment reduced with a payment to your lender that buys your loan rate down. Some mortgage insurers even pay your mortgage if you lose your job.

The "silent" benefits of private mortgage insurance

Check with your lender or the settlement agent who closed your mortgage to learn if your mortgage insurer offers claim advances.

Several types of mortgage insurance

The mortgage insurance you pay depends on your home loan’s source. The four types of private mortgage insurance (PMI) cover conventional (non-government) loans when borrowers put less than 20 percent down.

- The most common, borrower-paid PMI, results in a higher monthly payment. The annual premium is divided by 12 and added to your monthly payment.

- Lender-paid (LPMI) gets included in the mortgage interest rate, and you pay it for the life of the loan. But your monthly payment may be lower.

4 types of PMI: Which is right for you?

- You pay single premium PMI (BPMI) in a lump sum at closing and avoid paying PMI every month. Like LPMI, it leads to a lower monthly payment qualifying you a bigger mortgage. You can pay it at closing or build it into the loan. Ideally, you get the home seller to pay for it as part of your negotiations.

- Split premium PMI allows buyers to pay PMI in two payments. You pay one lump sum at closing and the rest in smaller monthly installments with the mortgage. By having a lower monthly payment, you may qualify for more home. Again, this may be something to ask the seller to pay.

Coverage for government-backed home loans

With government-backed loans like FHA and USDA, you’ll pay a mortgage insurance premium. It’s unavoidable if you put less than 20 percent down and it’s payable both upfront (this can be added to your loan balance) and monthly.

For VA loans, you’ll never pay mortgage insurance. Instead, you’ll pay the VA Funding Fee, which goes back the VA to cover veteran-owned home defaults.

Unlike private mortgage insurance, government premiums are not dependent on your credit score. So you may be better off with a government-backed loan if your credit is not perfect. Compare to see when you shop for a home loan.

How to avoid mortgage insurance

By putting 20 percent down, you eliminate the need for the coverage since you’re less of a risk to lenders. You also can get piggyback financing, which is two mortgages where the second “piggybacks” the first.

With a piggy-back loan, you put 20 percent down. But you might borrow some or all of that, either from the home seller or from a lender in the form of a second mortgage.

Avoiding PMI with a piggy-back home loan

The standard combinations are 80/10/10 or 80/15/5 for a house or 75/15/10 for condos. The first number is the first or primary mortgage. The second is the purchase-money second mortgage (from a lender or the seller), and the third number is the percentage that you bring in.

So with an 80/10/10, you get a first mortgage for 80 percent of the purchase price, a “purchase money second” mortgage for 10 percent, and you’ll bring in 10 percent down.

Getting mortgage insurance removed

Pay your conventional loan down to 78 percent and PMI falls off automatically. Or if you get it down to 80 percent, and your loan is in good standing, you can ask the lender to terminate your coverage.

You also can refinance your way out of the coverage if real estate values increased and you have 20 percent or more in equity. That automatically eliminates the need for PMI.

How to cancel FHA mortgage insurance

With an FHA or USDA loan, you must refinance into a conventional loan type. Otherwise, you’ll pay MIP for the life of the loan.