The Mortgage Forgiveness and Debt Relief Act: What was that again?

The Mortgage Relief and Debt Act is not in the news, and that’s a crime.

It probably seems odd that after more than a decade, we’re still picking and pulling over the mortgage meltdown. The reality is that fallout from that event continues to impact our real estate markets. In fact, there’s a very good chance that the value of your home has not fully recovered from the crash.

Verify your new rateHousing recovery still incomplete in many locations

The Joint Center for Housing Studies of Harvard University looked at our 100 largest metro areas and asked how they’ve been doing since home prices crashed. With prices up so much in recent years, it may surprise you to learn that “home prices in only 41 of these metros now exceed previous highs, while prices in 32 metros are still down 15 percent or more.

Markets, where prices are well below peak, include not only metros at the epicenter of the housing boom and bust, such as Las Vegas and Tampa, but also Midwestern markets where the cycle in home prices was comparatively mild, such as Chicago and Detroit.”

2007 brought relief to mortgage borrowers

To deal with the personal fall-out from the housing crisis Congress did a humane thing. In 2007 it passed the Mortgage Forgiveness and Debt Relief Act. The idea of this legislation was to protect people who had lost their homes against claims of unpaid income taxes.

To understand what’s going on you have to look into the exciting innards of tax theory — not the world’s most compelling subject. But you might find it more interesting when you see how bland accounting ideas are used to clobber taxpayers who can’t afford lobbyists and PAC contributions.

If you borrow $200,000, you owe the lender $200,000. Seems like clear and straight-forward thinking. As long as you pay back the money, the government doesn’t care. However, if the debt is not fully repaid, then there’s a problem. The government thinks you’ve made out like a bandit, that you’ve gotten income that’s not being properly taxed.

Huh? How is that possible?

Go back to that $200,000 mortgage. Let’s say that after a few years of steady payments you lose your job, your employer closes, you’re hit by a bus, or you contract a dread disease. Whatever the case, you can’t make your monthly mortgage payments and default on your loan. Your home is foreclosed and sold at auction or there’s a short sale. As a result, the lender recovers $150,000.

Imputed Income

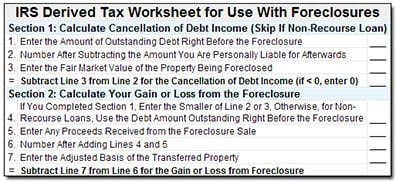

The IRS looks at it this way: There was a $200,000 mortgage, but only $150,000 was paid back. Then it says as a result there’s $50,000 missing. That money is “imputed income,” and the borrowers should now be taxed at regular rates for the missing money.

It’s an interesting theory, but in practice, here’s what it means. Maybe a family encountered tough economic times. They weren’t stealing from anyone. The government will try to collect taxes from individuals unable to repay mortgage debt.

Is it a good use of government resources to chase people who cannot pay the taxes on money they did not get in the form of a payroll check or dividend payment? Most of all, is it a waste of time?

The Mortgage Forgiveness and Debt Relief Act of 2007 neatly solved the problem. Homeowners could protect up to $2 million in foreclosure debt from income tax.

The problem is that the legislation was only good for five years. It was designed to expire in 2012. Consequently, it was extended several times. It last expired at the end of 2016. As of this writing, the only way to avoid the imputed income trap is to discharge your mortgage debt through bankruptcy. However, non-recourse loans (loans in which the lender is not allowed to pursue borrowers for the difference between the foreclosure sale proceeds and the loan balance) are not subject to imputed income.

What will happen next?

The proposed Tax Extender Act of 2017 is supposed to deal with the problem. If passed, this legislation will extend mortgage debt forgiveness through 2019.

It does not appear that Congress has yet come up with a permanent solution to this problem. And even the temporary extension is in limbo in the Senate Committee on Finance, and no action has been taken since December 20, 2017.

Time to make a move? Let us find the right mortgage for you