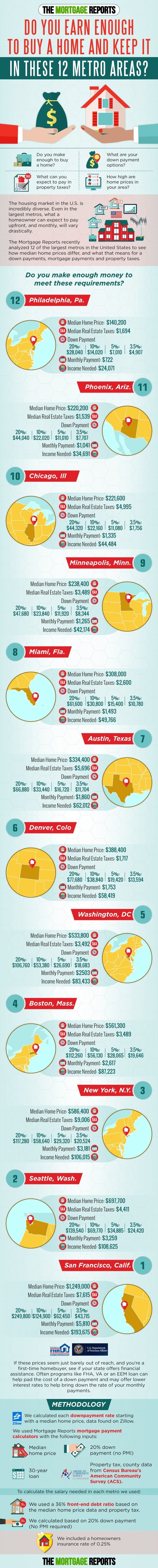

Home affordability varies drastically depending on location

One thing new home buyers wonder is “How much income do I need to buy a home?”

The answer, as with everything in real estate is “it depends.”

Buying a home is quite affordable in some areas, requiring an income of less than $30,000 annually, assuming 20% down.

But in other places — like Seattle and San Francisco — you’ll need a six-figure income to afford the typical home.

The Mortgage Reports recently analyzed 12 large metros in the United States to see how median home prices differ, and what that means for down payments, mortgage payments and property taxes.

Do you make enough to buy a home in these cities?

Data and methodology text:

12. Philadelphia, Pa.

Median home price: $140,200Median real estate taxes: $1,694Down payment:

- 20%: $28,040

- 10%: $14,020

- 5%: $7,010

- 3.5%: $4,907

With 20% down, a homeowner could expect to pay about $722 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $24,071.

11. Phoenix, Ariz.

Median home price: $220,200

Median real estate taxes: $1,539

Down payment:

- 20%: $44,040

- 10%: $22,020

- 5%: $11,010

- 3.5%: $7,707

With 20% down, a homeowner could expect to pay about $1,041 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $34,691.

10. Chicago, Ill.

Median home price: $221,600

Median real estate taxes: $4,995

Down payment

- 20%: $44,320

- 10%: $22,160

- 5%: $11,080

- 3.5%: $7,756

With 20% down, a homeowner could expect to pay about $1,335 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $44,484.

9. Minneapolis, Minn.

Median home price: $238,400

Median real estate taxes: $3,328

Down payment

- 20%: $47,680

- 10%: $23,840

- 5%: $11,920

- 3.5%: $8,344

With 20% down, a homeowner could expect to pay about $1,265 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $42,174.

8. Miami, Fla.

Median home price: $308,000

Median real estate taxes: $2,600

Down payment

- 20%: $61,600

- 10%: $30,800

- 5%: $15,400

- 3.5%: $10,780

With 20% down, a homeowner could expect to pay about $1,493 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $49,766.

7. Austin, Texas

Median home price: $334,400

Median real estate taxes: $5,696

Down payment

- 20%: $66,880

- 10%:$33,440

- 5%: $16,720

- 3.5%: $11,704

With 20% down, a homeowner could expect to pay about $1,860 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $62,012.

6. Denver, Colo.

Median home price: $388,400

Median real estate taxes: $1,717

Down payment

- 20%: $77,680

- 10%: $38,840

- 5%: $19,420

- 3.5%: $13,594

With 20% down, a homeowner could expect to pay about $1,753 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $58,419.

5. Washington, DC

Median home price: $533,800

Median real estate taxes: $3,492

Down payment

- 20%: $106,760

- 10%: $53,380

- 5%: $26,690

- 3.5%: $18,683

With 20% down, a homeowner could expect to pay about $2,503 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $83,433.

4. Boston, Mass.

Median home price: $561,300

Median real estate taxes: $3,489

Down payment

- 20%: $112,260

- 10%: $56,130

- 5%: $28,065

- 3.5%: $19,646

With 20% down, a homeowner could expect to pay about $2,617 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $87,223.

3. New York, N.Y.

Median home price: $586,400

Median real estate taxes: $9,006

Down payment

- 20%: $117,280

- 10%: $58,640

- 5%: $29,320

- 3.5%: $20,524

With 20% down, a homeowner could expect to pay about $3,181 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $106,015.

2. Seattle, Wash.

Median home price: $697,700

Median real estate taxes: $4,411

Down payment

- 20%: $139,540

- 10%: $69,770

- 5%:$34,885

- 3.5%: $24,420

With 20% down, a homeowner could expect to pay about $3,259 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $108,625.

1. San Francisco, Calif.

Median home price: $1,249,000

Median real estate taxes: $7,615

Down payment rate

- 20%: $249,800

- 10%: $124,900

- 5%: $62,450

- 3.5%: $43,715

With 20% down, a homeowner could expect to pay about $5,810 per month including principal, interest, home insurance and property tax. A minimum qualifying income, using the 36% front-end ratio, is $193,675.