The science and art of rent setting

Smart landlords keep a close and constant eye on their local rental market. Optimizing your revenue stream so it's sustainable isn't the same as always maximizing it for short-term gain. These tips for landlords will help you establish a rent in that sweet zone for long-term profitability.

Read on to explore your rent-setting options and discover whether you're a real estate scientist or artist —or maybe a property polymath.

Verify your new rateSmart landlords as scientists

One definition of a scientist is someone who gains knowledge through experimentation and observation. So, when it comes to setting rents for her tenants, just about every landlord is a scientist.

You'll be gaining an intimate knowledge of your local rental market based on observation and you'll doubtless end up doing some experimenting.

Normally, what you charge for rent depends on the property's market value. In typical US markets without rent control, landlords get between .8 percent and 1.1 percent of the home’s value for their monthly rent. A home valued at $100,000 would commonly fetch between $800 and $1,100 per month. You'll need to do a little work to discover which end of that range is in your strike zone.

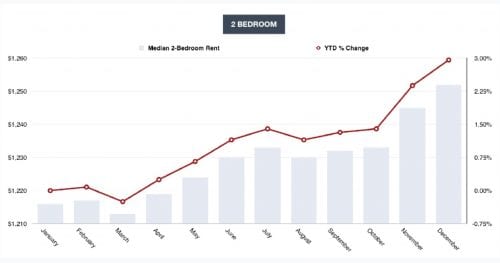

Source: Abodo

Observation

The more successful you become, the more time you're likely to spend observing your marketplace. Only by knowing the going rate for rental units can you be sure you pitch your price correctly.

Charge too much, and you risk not attracting tenants. That means longer periods when your units are empty and costing you money.

But pitch your rents too low and you're giving money away.

Complete guide to buying rental property

Market intelligence

Gaining market intelligence isn't hard but it does take time. The most accurate source of market data is an appraisal with a rental schedule. Most mortgage lenders require this when you purchase a rental property for good reason. The appraiser does all the hard work for you -- valuing the property, providing an estimated rent, and comparing its desirability to other nearby competitors.

Or you can check online home valuation tools, and monitor ads placed by your competitors. You'll benefit from networking with other local landlords so you can pick each other brains. You'll also want to visit plenty of open houses.

Comparisons

All this is to allow you to compare a unit you own with ones locally that others own. When you know a one-bedroom apartment has just been rented for $1,200 a month, that helps you set the rent you want for your one-bedroom apartment.

Not ready to become a homeowner? Buy a rental property now and move in later

You may think that a unit's square footage and the number of rooms it has are the two critical factors when comparing homes. You'd be right as they're often the most critical but they're far from the whole story

Not just number of rooms

There is a whole slew of other factors that can affect rental values, including:

- The neighborhood — Rundown, gentrified or up-and-coming

- The location — Whether the unit is close to major employers and local amenities such as parks, schools, trendy restaurants and so on

- The view — People will pay more to look out over an attractive landscape or cityscape

- The unit's fixtures and fittings — Renters value modern or new appliances, HVAC, and good kitchens and bathrooms. But you need to be sure your tenants will look after them

- Whether or not units are furnished and to what standard — Yours and the ones you're using as comparisons

- Storage and other features — Havings lots of closets is great, as are bay windows and balconies or roof terraces

- Floor — In most buildings with elevators, the higher the unit, the higher the rent. But with walk-ups, values tend to drop above the third floor

Still science?

Over time, you could probably build an algorithm that would score those variables and calculate the best rent to ask for each unit. Indeed, some of the really big rental companies already use computer applications to help them set rents. So, maybe this is still science?

You could certainly learn from experimentation. The mistakes you make when choosing units to buy and deciding on the level of finish when making improvements are likely to remain with you.

Most appraisers know there's an x-factor involved in setting a home's sale or rental value. Being able to identify that comes with an intuition that develops with experience.

Guide to becoming a landlord in 2018

Smart landlords as artists

Whether or not you count that intuition as an "art" is up to you. There's one area of rent setting that feels even more art-like, which is, about optimizing rather than maximizing rental income.

Let's look at an extreme example. You could maximize your rent by catering to tenants who are organized criminals. Many would pay way more than market rates for an incurious landlord who would turn a blind eye to drug dealing, prostitution, people trafficking and so on.

You don't knowingly do that because you don't want to risk jail time and the forfeiture of your property. So you're already optimizing rather than maximizing your rental revenues.

Maximum vs. optimal

However, there are much less dramatic — less "Chicago P.D." — ways in which smart landlords favor the optimal over the maximum on a daily basis. Maximizing rental income over the short term can quickly damage your long-term profitability and optimizing almost always pays off. Optimizing means sacrificing some short-term potential profit in order to make your income more secure and sustainable.

Investment property mortgage rates: How much more will you pay?

The most obvious example is when you have a perfect tenant. You always get your rent on time and you're only aware she exists because you receive her checks. You're also confident she cares as much about your unit as you do.

Valuing what's important

What do you do when it comes to renting reviews? Do you increase the rent to its maximum market value, risking forcing your perfect tenant out?

You may find yourself with expenses for redecorating, replacing carpets and having a fallow period between tenants when you're finding someone new and when your unit is earning you nothing. Worse, that new renter may pay late, complain all the time, damage your asset and cause nuisance.

There's a balance here. An art, if you will. Most smart landlords value their golden tenants and cut them some slack — sometimes quite a lot — over rent rises. They see that as good business.

It is still a business and sentiment is a luxury many landlords simply can't afford. Only you can decide where (standby for art allusion) to draw your lines.

Time to make a move? Let us find the right mortgage for you