House payment mistakes can cost you

Far too many buyers make the mistake of calculating their house payments like their rent. That’s because the landlord usually pays all of the costs of ownership. But when you become the owner, you’re responsible for more expenses than you were as a renter. So, it’s essential to calculate house payments correctly.

That way, you won’t end up house poor, struggling to pay your mortgage each month, or worse, in foreclosure. Be confident and get your calculations right by using these tips.

Verify your new rateHouse payments are more than principal and interest

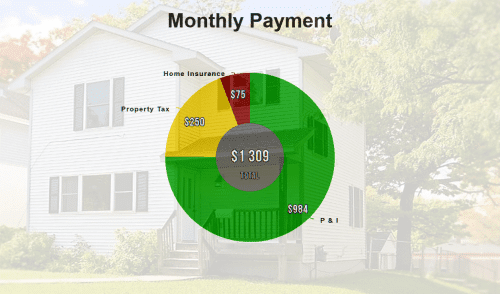

Your mortgage or house payment has four parts. So, as you calculate house payments, keep the acronym, PITI in mind because it represents those four elements. Pronounced “pee-eye-tee-eye,” it stands for “principal, interest, taxes and insurance” and breaks down this way.

- Principal is the part of your payment that reduces your loan balance, aka the principal.

- Interest is the cost of financing. Your interest payment for the month equals your outstanding balance times 1/12th of your interest rate. So the interest on $100,000 at 4.0 percent would be .04/12 * 100,000, or $333.33.

How much cheaper are ARM loans?

- Taxes are included in your mortgage payment under most mortgage programs. They are not a cost related to your mortgage; everyone who owns a home pays property taxes. However, lenders often choose to protect themselves by making sure property taxes are paid. So they “impound” or “escrow” an amount each month so that they can pay property taxes on your behalf when they come due.

- Insurance is the last part of your mortgage payment. This is the homeowner’s insurance most lenders require you to have on your house. Like property taxes, insurance is a cost related to homeownership — not a loan fee. Requiring you to pay for homeowners insurance protects lenders in case of a fire or other covered disaster that could put your home at risk. If you own a condominium, your insurance requirements may be different, because many homeowners associations (HOAs) insure the premises to some extent.

Remain aware of what factors affect these costs and keep track so you won’t have unpleasant surprises. Read your mortgage contract carefully to be certain you’re clear what you’re responsible to pay and when.

Don’t overlook other costs

There are other costs to consider, because they affect how affordable (or unaffordable) a property can be. Those include your HOA fees if you live in a condo or planned community. Expect to pay for flood insurance, too, if lenders require it in your area, or if you just want extra coverage — according to FEMA, all homes in the US carry some risk of flooding.

You may also have to consider the cost of a special assessment. That can either be an extra payment dictated by a homeowners association to cover an extraordinary cost, or required by a local government to pay for an improvement for the area. The seller or HOA should disclose them. And the home appraisal should also note the amount and payment terms.

PMI or private mortgage insurance protects the lender if you don’t put at least 20 percent down. You pay the premiums, which you pay in monthly instalments with your mortgage payment. The insurer calculates your premium each year based on your remaining balance. When you owe 78 percent of the home purchase price, the insurer is supposed to automatically cancel your policy and refund any unused premiums.

PMI is neither "good" nor "bad

Government-backed loans like FHA, VA and USDA have their own rules. VA loans have a funding fee, which can be paid upfront or added to the loan, but no mortgage insurance. FHA and USDA loans have upfront mortgage insurance premiums, which can also be added to the loan, plus monthly mortgage insurance payments. In addition, all government-backed loans require impounding of taxes and insurance.

How do impounds affect your mortgage payment?

If you put at least 20 percent down, or work with a portfolio lender (which creates its own programs and does not sell its loans to investors), your mortgage payment might just include principal and interest (P and I). But you’ll have to pay your property taxes and homeowners insurance yourself, or your lender might foreclose on you and pay these amounts to protect itself.

For most borrowers, lenders require that you pay PITI every month, and it creates a special account for you. Depending on where you live, this name of this account is an “escrow” or “impound.” These accounts are not evil, because while they protect the lender, they also benefit you.

Why do mortgage lenders want so much money at closing?

These accounts allow you to split the substantial annual costs of homeownership into 12 monthly payments. Lenders (or loan servicers) set these payments aside in your impound account and pays your taxes and insurance when they come due.

Even if you make a larger down payment and don’t have to let the lender impound your taxes and insurance, agreeing to set up a mortgage escrow can get you a lower interest rate. And if you don’t agree to escrow, some lenders insist you auto-pay your mortgage.

Federal law protects your impound account

Lenders don’t get to keep the money they have you pay for escrows. The Real Estate Settlement Procedures Act, or RESPA, protects the funds. The Act makes lenders refund money left over in the impound account after annual reconciliation, or when you sell or refinance.

On the other hand, if the lender doesn’t collect enough to cover expenses when they are due, the lender might require you pay the difference. There’s no legal requirement for lenders to set up impound accounts under RESPA, but many require them from some or all of their borrowers.

Costs to fund mortgage escrow at closing

At closing, federal law allows your lender to require you to “front-load” your escrow account with specific prepaid amounts at closing. They can include a year of homeowners insurance, plus one or two months additional, and a few months of property taxes.

But, impounds also can include PMI, flood insurance and special assessments. After that, you’ll pay your mortgage and mortgage interest plus 1/12 of your property taxes and insurance into your escrow account.

Do your research so you know what you’ll have to pay in your state to front-load your mortgage escrow account.

Use online tools to calculate house payment correctly

By using our mortgage calculator, you can calculate what PITI will be by entering various values. They include home price and related variables like interest rate, down payment, property type and use and location.

Try The Mortgage Reports mortgage payment calculator now.

As you change those numbers, the graph the right of the calculator adjusts your numbers. Your county assessor’s Web site can usually tell you what the property taxes are for any address in its jurisdiction.

Don’t forget to use the other calculator features. You’ll learn how much house you can afford, and determine what monthly payment is most comfortable for you. You can do all this without entering personal information or obligating yourself to anything.

Time to make a move? Let us find the right mortgage for you