Foreclosure crisis is not over for renters

Nationally, real estate markets have rebounded, but foreclosures on rental properties are still commonplace, putting tenants at risk of housing loss. Foreclosure proceedings often conclude with the property sale, and the process leading to it can move fast in some states.

Should I buy a house or keep renting?

If you’ve learned your landlord is in foreclosure or about to be, you’ll want to act quickly. Protecting yourself in this situation is time-consuming and stressful, but don’t panic.

Here’s how to preserve any claims you may have if your landlord is in foreclosure.

Verify your new rateLook for foreclosure clues

Sometimes, you’ll get a letter directly from your landlord or a lender stating the home you’re renting is in foreclosure. But that’s not always the case, so you’ll need to be aware of the signs:

- Letters or notices addressed to your landlord, if you live in a private home or condo, from a court, bank or lawyer’s office that you haven’t seen before.

- Attempts to serve legal documents on your landlord at your address.

- Notices posted publicly in or around the property, if you live in an apartment building,

- Utility shut-offs, if the landlord is responsible for them.

- Repairs going undone after you’ve contacted your landlord, perhaps to get you to move out.

- A change in the owner’s behavior to erratic, aggressive or unresponsive.

- Notices of default, violation or eviction proceedings from your landlord.

If you get legal notices or letters in your mailbox addressed to the owner, search the Internet to see who the sender is. Foreclosure attorneys and foreclosure courts are easily identifiable.

Renting can cost more upfront than buying

Contact utility companies if yours go out, and learn what happened. If you get a violation, default or court summons, don’t ignore them, even if you didn’t do anything wrong. Contact a lawyer or local landlord-tenant advocacy program on how to respond, and show up on time for court dates.

Get legal notices to your landlord

Owners facing foreclosure may hide from lenders. Avoid any more involvement than necessary in foreclosure proceedings, but forward notices if you get them. While you’re not legally responsible for this, it may save you grief.

It best if you do this in some trackable way. Write a letter enclosing the unopened mail, and ask if they’re facing foreclosure. But don’t be surprised if you get no response, or a lie.

Rent-to-own homes: Move in now, buy later

Whenever possible, contact your the landlord in writing about issues. Document every interaction, no matter how seemingly trivial, especially phone calls. Don’t make or accept verbal agreements.

Once you have forwarded a set of notices to your landlord, return any additional ones to the sender, and provide the landlord's address. Copy whatever you send and store it for future reference. Keep returning notices until they stop coming.

Just don’t set the notices aside. If your landlord is in foreclosure, that won’t delay the action.

Confirm that your landlord is in foreclosure

Don’t wait for your landlord or the bank to send you formal notice of impending foreclosure. Perform public records searches in your jurisdiction on the property address. State, county or city records include deeds and mortgage documents on all real estate.

Housing and mortgage trends: Buying a home won't get easier

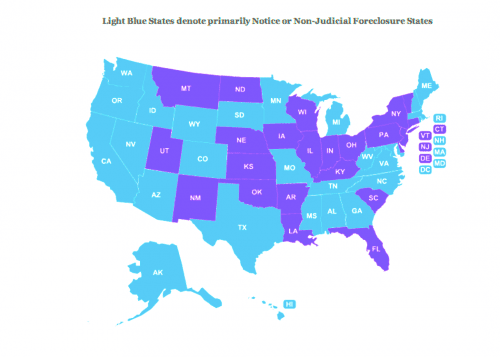

The most common names describing real estate records databases include “land recorder,” “auditor,” “assessor” or “recorder.” What you’ll find depends on whether your state has a judicial or non-judicial foreclosure process.

A judicial foreclosure requires a court process, which can take longer. Non-judicial foreclosure, depending on your location, can happen very quickly. Either way, if your rental is in formal foreclosure, you’ll find a “notice of default” (NOD) or a lis pendens filed by the lender.

Lis pendens is Latin for “lawsuit pending,” which means the property is in a judicial foreclosure. A NOD shows it’s in a non-judicial foreclosure.

If you don’t find either, keep checking back, because your landlord may be in going through the pre-foreclosure process, in a trial mortgage modification, or trying to pull a short sale together. If unsuccessful, the lender may still foreclose.

Your landlord may have redemption rights or the ability to get the property back even after a foreclosure sale, but do you really want to rely on that?

90-day move out no longer guaranteed

While some jurisdictions give you time to move, others don’t, meaning new owners can evict you immediately after a foreclosure sale. That’s because there’s no longer federal protection against immediate eviction.

The 2009 Protecting Tenants at Foreclosure Act expired at the end of 2014. While many jurisdictions adopted the 90-day move-out period, some haven’t. That means state laws may not automatically protect you.

Once you’re sure your landlord is in foreclosure, immediately contact the lender and let them know you’re the tenant in the property. If you haven’t provided it already, make sure the bank knows your landlord’s address. Insist they directly contact the landlord about the foreclosure going forward.

Learn your rights in your state

When you find a lis pendens during your public records search, check the court database identified on it to know how far along the foreclosure suit is. If you find a NOD, you’ll want to look further into the records to see if there’s a notice of sale (NOS) recorded. If you see an NOS, contact an attorney immediately.

“In most states, renters have some rights even after their rental unit goes into foreclosure,” says Shaina Hagen, Esq. A staff attorney for Neighborhood Legal Services Program in Washington, DC, Hagen helps low-income tenants facing landlord problems.

“Your rights vary widely depending on where you live,” she explains. “So, act fast to know and protect them once you know your rental is in foreclosure.” Start by checking your state laws on for your tenant rights in this situation.

“In Washington, DC, tenants whose landlords go through foreclosure retain the same rights as tenants whose landlords don’t,” explains Hagen. “That means they only can be evicted for good cause and there are only ten of those here,” she continues. Your state also may have good cause statutes.

What can change in DC are the terms of the tenant’s lease which might be terminated in foreclosure. That means a tenant’s rent might get raised to market rate, which is determined by fair rental value in DC. “What that rental value is can be subjective in DC, however,” cautions Hagen.

Get legal help

It’s easy to misinterpret landlord-tenant and foreclosure laws, especially since they change frequently. Contact a lawyer to be sure you understand know your rights, especially related to moving out. If you intend to stay in your rental, an attorney can help you, including to determine a fair rent if yours may change.

Make sure the court in your area considers the rental’s condition. “Units in foreclosure aren’t always maintained by landlords so judges should factor that into determining rent,” Hagen adds.

No down payment for a home? Loftium can help

Moreover, nationwide, rent-control, Section 8 or other subsidized tenants like the disabled have different protections. Since those can depend on jurisdiction, too, contact your local legal aid attorney or housing authority.

If you’re in the military or a veteran, there are special laws for you in these situations so research those.

Keep tabs on the foreclosure timeline

Even with legal help, you need to keep checking to make sure your rental is not in nearing its foreclosure sale date. Ask the lender if the bank scheduled the property for a foreclosure sale and, if not, ask when it might be.

Request the lender to send you a notice of your rental’s impending sale but don’t count on that, especially if it’s not a legal right in your state.

Instead keep checking the public database where you found the lis pendens or NOD. Also, regularly search newspaper classified listings for foreclosure sale notices or the Multiple Listing Service.

Plan your move but don’t stop paying rent

Just because your landlord is in foreclosure doesn’t mean you stop paying rent since you can get evicted for that. Instead, contact the lender and find out if you continue to pay rent to the landlord or them.

Then keep paying rent and abiding by the terms of your lease. Do this until you move out or learn from the new owner what’s expected of you if you can stay. Make sure new owners prove they’re the new owners before negotiating anything with them.

But, if you plan to stay, you may not be able to expect repairs once the bank starts collecting rent or ends up owning your rental.

Why homebuying in 2017 is still a smart move

If you learn your state allows new owners to force you out, you should start looking for a new place right away. In states where you have time to move, try negotiating “cash for keys” with the new owners to get move out funds. Just know you might be unable to get your security deposit back from a landlord in foreclosure.

What are today's mortgage rates?

If you're sick of duking it out with your landlord or dealing with rent increases, consider buying your next home. There are plenty of workarounds for most hurdles, including down payment and income issues.

A seasoned real estate pro and a good loan officer can help you take the next step toward homeownership, if that's what you want to do.

Time to make a move? Let us find the right mortgage for you