Confusing home loan terminology: What is a conventional mortgage, anyway?

If you spend any amount of time reading about mortgages (so much fun!), you’re likely to come across the term “conventional” loan. But what exactly is a conventional mortgage?

Merriam-Webster’s dictionary is not much help. It defines “conventional” the way most us do — as either adhering to “convention,” or “lacking originality or individuality.”

But most of us are not mortgage lenders.

Verify your new rateConventional means “not government-backed”

Many think the term “conventional” just means a “plain vanilla” mortgage without creative or risky bells and whistles.

But while many plain vanilla home loans are conventional, not all of them are. And many conventional loans have features like interest-only payments, very high loan amounts, or adjustable interest rates.

Conventional vs FHA: Which is better for you?

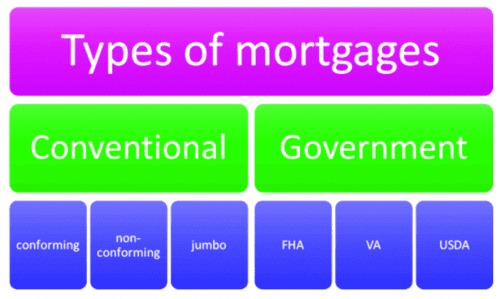

Conventional loans are simply those not guaranteed by the USDA, FHA or VA.

Confusion: conventional versus conforming

One reason for this confusion is the tendency for mortgage articles, even those from seasoned loan professionals, to use the terms “conventional” and “conforming” interchangeably.

Conventional home buying guide for 2017

“Conforming” loans can be considered “plain vanilla,” or even, as the dictionary says, unimaginative, because they must “conform” to guidelines established by Freddie Mac and Fannie Mae, the two entities that back or sell most loans in the US.

What does “conforming” mean?

In order to sell mortgages to investors, Fannie Mae and Freddie Mac buy them from lenders, bundle them into large pools, and then sell shares in those pools. In order to do this, all loans in the pools must carry the same amount of risk and have similar terms.

Conforming loan limits: first increase in 11 years

How do they make a bunch of loans to different people a reliable investment? By standardizing the terms of the loans they will buy from lenders. Because lenders must conform to these guidelines to sell to Fannie or Freddie, the loans are called “conforming.”

So, all conforming loans are conventional, but not all conventional loans are conforming.

Non-conforming conventional home loans

Freddie Mac and Fannie Mae are not the only games in town when it comes to privately-funded home financing.

Lenders can make mortgages that don’t conform as long as they keep them on their own books, because they will be the losers if the loans fail. (These are often called “portfolio” loans.)

Alternatively, lenders can sell these loans to investors who have established their own standards, which can differ from those of Fannie and Freddie.

These loans are not government-backed, so they are still conventional loans. However, their guideline can range from very conservative to quite innovative.

“Non-conforming” conventional loans can have almost any guidelines lenders want to establish. So a lender might offer loans in amounts up to $2 million with 10 percent down — but only to doctors with excellent credit. (Yes, this is an actual program.)

Jumbo non-conforming mortgages

One of the most common reasons a mortgage might not be conforming is its amount. Fannie Mae and Freddie Mac limit the size of mortgages they will buy. So loans that don’t conform because of their size are called “jumbo” or even “super-jumbo.”

How your loan size affects your mortgage rate (and what to do about it)

Conforming loan limits depend on the property location. They range from $ to over a million dollars in certain “high cost” areas.

“Non-prime” non-conforming mortgages

Another subset of non-conforming mortgages is so-called non-prime. These are loans that carry more risk to lenders than most programs. They include mortgages for people with FICO scores as low as 500, but there are also programs for people with great credit and special needs.

Crazy mortgage programs that really exist

Non-prime mortgages include bank statement programs that verify borrower income by analyzing how much money runs through their bank accounts each month. This allows applicants whose tax returns don’t show enough taxable income to prove their cash flow in another way.

(Stated Income, No Income Verification, and No Doc loans are illegal as of this writing. Borrowers must still prove that they can afford the payments on any mortgage granted.)

What this means when you shop for a mortgage

When you shop for a home loan, the type of mortgage counts, for several reasons.

Non-conforming loans can vary widely in rate and terms. So it pays to shop these extensively to get the loan you want at the best rate.

Because their guidelines are non-standard, you may be able to find something better for you than the no-frills conforming products — but you’ll have to look harder.

Jumbo mortgages provide an opportunity to save more by shopping, because their rates vary and their amounts magnify any savings you find.

And non-prime are the trickiest of all, because the market is extremely fragmented, guidelines range from “almost conforming” to completely wackadoodle.

What are today’s mortgage rates?

Current mortgage rates, whether government-backed or conventional, are still incredibly attractive. To find the best deal on the best loan for your situation, contact several lenders and compare offers now.

Time to make a move? Let us find the right mortgage for you