Do you have to completely freeze your finances?

Mortgage professionals often advise that you stay away from anything that affects your debts, income or credit during the weeks or even months you’re in escrow. But that can be wildly impractical. Will buying a new or used car really change your mortgage application that much?

Verify your new rateStop borrowing (briefly)

It’s not just auto loans that can be an issue. Opening any new credit account in the months leading up to your application can make you pay more for your new mortgage.

Too much debt to buy or refinance? Here's your plan

You’re in a mall and see some cushions that would look great in your new home. If you sign up for a new store card, you’ll get a whopping discount on that day’s purchases. But do that and those cushions could be among the most expensive in history.

How does that work?

That’s because applications for new credit ding your credit score in two ways. And even a tiny change in your score could make a significant difference to the mortgage rate for which you qualify.

When you’re borrowing big sums over many years, even a tiny increase in your mortgage rate can add many thousands to your total cost of borrowing.

The two knocks your score takes when you open a new account are:

1. New credit

Every time a lender checks your credit report to decide whether to lend to you (makes a “hard inquiry”), your credit score takes a small hit. The impact is relatively small and recedes in importance quite quickly. But it’s real.

Luckily, there are exceptions. When you rate shop for a mortgage or auto loan, all your applications count as one, provided you make them within a focused period. And you can check your own score and report as often as you want without penalty.

5 ways to raise your FICO score today

2. Length of credit history

The length of your credit history determines 15 percent of your FICO credit score. And part of that is based on the average age of all your open accounts.

When you open a new account, you lower that average age. Closing an old one has a similar effect.

So avoid applying for credit or opening or closing accounts in the months leading up to your mortgage application.

Why a small difference can mean a lot

Many lenders decide on the mortgage rate you qualify for using credit score tiers. FICO suggests these ranges, but lenders can set their own:

- 760-850

- 700-759

- 680-699

- 660-679

- 640-659

- 620-639

Now, suppose you’re on the cusp between two ranges. For example, imagine your score is 640. Just dropping a single point on your score could take you into the 620-639 range.

5 ways to shave .25 percent off your mortgage rates

And that could cost you. On the day this was written, FICO reckoned your higher mortgage rate would increase your monthly payment to $824 from $774 on a $150,000, 30-year, fixed-rate mortgage. That would add $17,950 to the amount you would pay in interest over the life of that loan. For one, single credit score point!

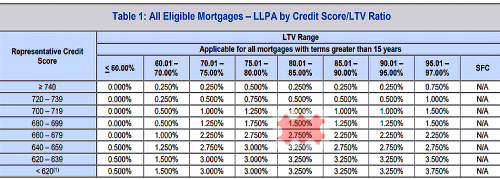

You can see how the additions stack up by looking at Fannie Mae’s Loan Level Pricing Adjustment matrix below.

Notice the highlighted portion showing the difference how dropping your FICO from 680 t0 679 adds 1.25 points to your loan fees (the difference between 1.50% and 2.75%) — $2,500 for a $200,000 mortgage.

Now you know how expensive those cushions could be.

Can you safely shop at all?

By now, you’re asking how long before making a mortgage application you should hold off applying for new credit. Unfortunately, nobody knows.

Credit scores are calculated using fiendishly complicated algorithms. These assign a numerical value to almost every entry on your credit report. And the variables are so numerous that predicting the impact of any one entry is impossible.

What makes your FICO score change each month?

VantageScore, one of FICO’s rivals, reckons for its algorithms the effect of most new applications will fade away within three months. But that may not apply universally. Some suggest holding off for six months or more before you apply for a mortgage.

Wait until the check clears

You may be tempted to sigh with relief and relax as soon as you have your mortgage approval documents in hand. But that’s not the time to start borrowing again.

Here's how to re-approve an "un-approved" mortgage

That’s because many lenders audit your file in the days leading up to closing. And if your score has dropped owing to new credit applications or other issues, you could find the mortgage rate you assumed was safe being hiked. In fact, your lender could even withdraw its offer completely.

So hold off on new borrowing until after closing. A minute after should do it.

But wait, there’s more

Your credit score is only one factor your lender takes into account when deciding the mortgage rate it should offer you. Or, indeed, whether it will approve your application at all.

Qualifying for a mortgage: what mortgage lenders don't consider

It will also look closely at your household accounts to see whether you can comfortably afford the payments on your new loan. And at the heart of its calculation will be your debt-to-income ratio.

Your debt-to-income ratio

Your debt-to-income (DTI) ratio is the proportion of your monthly income that goes back out on keeping up with your existing debts, plus the monthly payments on your new mortgage.

Those existing debts generally include:

- Minimum card payments

- All sorts of loans (auto, student, personal...)

- Child support and alimony

Regular living expenses like utilities and food don’t count.

New auto loan and DTI

Your new auto loan will be part of the new DTI calculation when lenders analyse your mortgage application. If your new payment is lower than the payment on your trade-in, your new car could even help your loan application.

Simple Mortgage Definitions: Debt-To-Income

But if your new loan means you’ll have higher monthly payments, your ratio will rise, all other things remaining equal.

You can see how the new payment is likely to impact your application with our Home Affordability Calculator.

What a higher DTI can do to your application

In extreme cases, increasing your DTI could undermine your eligibility for your mortgage. Many programs have hard-and-fast DTI limits, like 43 percent. Even increasing to 43.1 percent could force you to start over with a new program.

No loan approval is safe if your profile changes for the worse before closing.

How to apply for a mortgage the right way

Obviously, there may be times when you can’t help spending during your loan application process. And you’ll have to deal with the repercussions. But don’t open that can of worms unless you have to.

What are today’s mortgage rates?

Today’s mortgage rates are as low as they’ve been in months. But if you throw a monkey wrench into your application during escrow, your lender could increase that rate.

Avoid that if possible, shop for the best rate and choose the most appropriate program to maximize your savings.

Time to make a move? Let us find the right mortgage for you