How Much Debt Can You Have And Still Buy A Home?

Concerned that your Mastercard bill and your student loan payments mean you can’t buy a house? Maybe you can. If you wonder what is the debt-to-income ratio for FHA home loans, you may be surprised to learn that the answer is: it depends.

Verify your FHA loan eligibilityThe Relationship Between Debts And Income

When you borrow money to buy a home, your lender reviews your credit score. In addition, a lender compares your monthly payments on your debt with your gross monthly income to generate a debt-to-income ratio, or DTI.

Your DTI includes the minimum payment on each debt listed on your credit report, other debts on your loan application, and the monthly payment for your new mortgage.

First-Time Homebuyer Guide: Buying With Student Loans And Other Debt

The maximum DTI allowed for a qualified mortgage is generally 43 percent. However, in some cases loans purchased by Fannie Mae can go as high as 50 percent. The maximum DTI for FHA home loans ranges between 40 and 50 percent for FHA applicants.

FHA loans, insured by the federal government, generally offer more forgiving qualification guidelines. They are a good option for borrowers with less-than-perfect credit or who want to limit their down payment to 3.5 percent.

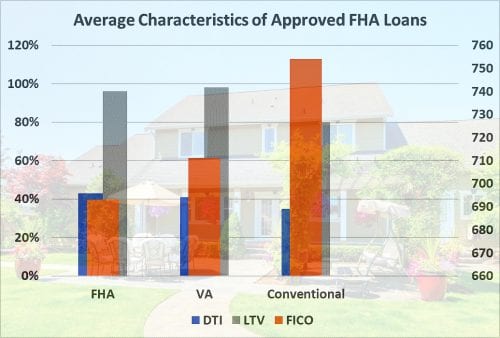

Lenders weigh three characteristics when they underwrite your loan application: DTI, your loan-to-value, or LTV, and your FICO (credit) score. The chart below shows the average characteristics of approved FHA buyers.

The factors balance each other — if you want a loan with a below-average FICO, you’ll probably need to be better-than-average with your down payment or DTI.

What’s Included In Your DTI

On the debt side, your lender includes your monthly housing payment of principal, interest, property taxes, HOA dues (if applicable), homeowner’s insurance and mortgage insurance.

FHA loans require mortgage insurance. Your debts also include minimum payments on your credit card balances, student loans, installment and other accounts. If your student loan payments cannot be documented, FHA loan guidelines assume a monthly payment of one percent of the balance.

Installment loans that will be paid off within 10 months won’t count as part of your DTI. However, your lender must include the amount of that payment that exceeds 5 percent of your monthly income. So if you earn $4,000 a month, and your auto loan has six payments left at $500 a month, you’ll only be hit with $300 a month.

- $4,000 income * .05 = $200

- $500 payment - $200 = $300

If you’re on the edge of being able to qualify, paying down an installment debt to less than ten remaining payments can be a good strategy for loan approval.

Income Counted In DTI

Your income includes all of your gross monthly income, including investment income, interest, rents, and anything that is stable and expected to continue at least three years. Part-time or overtime earnings counts, too, if you can document a two-year history of that income.

How To Buy A Home On $50,000 A Year

If you’re self-employed, however, it’s your taxable income, plus some adjustments like depreciation, that lenders use. So if your business brings in $300,000 a year, and you have $250,000 in write-offs and $20,000 in depreciation, the lender credits you with $70,000 income.

- $300,000 gross - $250,000 write-offs = $50,000

- Add back $20,000 depreciation (because it’s not a cash expense), and you get $70,000

Calculating The DTI

Suppose you have the following situation:

- Gross (before tax) wages of $72,000 a year ($6,000 a month)

- Interest and dividend income of $6,000 a year ($500 a month)

- Total income: $6,500 a month

- New monthly house payment: principal and interest: $1,200, property taxes: $250, and homeowners insurance: $50, totalling $1,500 a month

- Two auto loans: one is $300 a month, and the other is $200, total $500

- Credit card balances with minimum payments of $175 a month.

- Total debt payments: $2,175 a month, including the new housing expense

- DTI = $2,175 / $6,500 = 33.46 percent

Going Bigger: It’s Possible With Compensating Factors

The debt-to-income ratio for FHA home loans can be expanded to a DTI of as much as 50 percent. However, you’ll need “compensating factors,” which offset the risk of your higher debt load. Lenders check many dynamics before approving a mortgage, such as your job history, your credit score and your loan-to-value.

10 Ways To Qualify For A Mortgage (Even If You Think You Can't)

FHA guidelines mention specific factors that can compensate for a high DTI, but borrowers with a credit score below 580 are limited to a DTI of 43 percent regardless of compensating factors.

If your score is 580 or above, you may qualify for a loan with a DTI of 47 percent to 50 percent. However, having one of these additional qualifications may secure you a larger loan than you’d otherwise qualify to get.

- Cash reserves equal to at least three mortgage payments

- FICO score of 680 or higher

- Document future income potential — if you’re a recent college graduate, for instance, in a lucrative field

- Minimal increase in your housing payment after the purchase – no more than $100 or a five percent increase, whichever is lower

- Buying an Energy Star home, which reduces your monthly utility costs

- Significant additional income from bonuses, commissions, part-time work or overtime not reflected in your effective income. This could be because you have less than two years of documentation

- If you’re moving and have a working “training spouse” who has not yet found a job in your new location, assuming your spouse plans to work

- Document a pattern of saving, showing regular deposits to a savings or investment account

- Make a larger down payment, like five percent instead of 3.5 percent

- Use credit conservatively

Note that FHA allows lenders to use compensating factors to expand DTI. It does not require them to do so.

Why You Should Aim For A Lower DTI

If your lender approves you with a high DTI, that doesn’t necessarily mean you should spend up to your limit. Using half of your gross monthly income for required minimum payments leaves you little cash for emergencies. And your lender has not considered expenses like child care that can really hurt your cash flow.

Be sure to budget for basic items such as food and clothing, insurance and child care and to save for emergencies and long-term goals.

Too Much Debt To Buy A Home? Here's Your Plan

In the past, guidelines recommended that homeowners spend a maximum of 28 percent of their income on their housing costs. Lenders recommended a maximum DTI of 36 percent on all debts. If your monthly income is $10,000, there’s a big difference between spending $3,600 on your mandatory expenses and a 50 percent DTI of $5,000.

What Are Today’s Mortgage Rates?

Today’s mortgage rates are still really affordable, and that helps keep your DTI low. You can get your rate even lower by choosing products like hybrid ARMs, fixed for three, five, seven or ten years, and by shopping aggressively for your loan.

That means getting quotes from several competing lenders and choosing the one that costs you the least.

Time to make a move? Let us find the right mortgage for you