How Is PMI Mortgage Insurance Calculated?

PMI, or private mortgage insurance, covers your lender if you have less than 20 percent equity in your property, and you don’t pay your mortgage as agreed. So if your lender has to foreclose and sell the property for less than the mortgage balance, PMI mortgage insurance covers that shortfall.

Your PMI mortgage insurance premium reflects the risk of insuring you. Each PMI provider has its own schedule of premiums.

Verify your new ratePMI Mortgage Insurance Premium Based On Risk

Like any insurer, mortgage insurance companies do a lot of research and crunch a lot of numbers. Insurers calculate how likely you are to cause a claim — whether that’s by getting in an auto accident, having a serious illness, or defaulting on your loan.

Then, they use that information to set your premium.

Read: How To Avoid PMI Mortgage Insurance

For mortgages, PMI companies look at several factors. The most important are your loan-to-value (LTV) and your credit score.

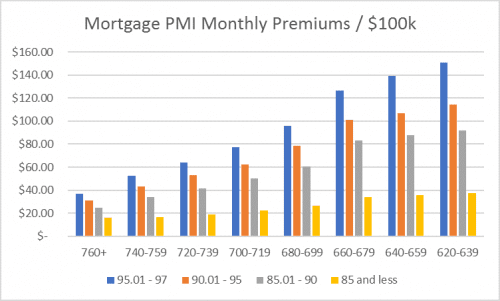

This chart shows PMI monthly premium rates based on FICO scores and LTV. For every LTV, there are several rates, depending on the credit score.

Additional Factors

There are other factors that influence what you pay for mortgage insurance. If your loan has any of these riskier characteristics, you’ll pay a surcharge.

- Cash-out refinancing

- Second home

- Investment property

- Three- to four-unit property

- Manufactured housing

- Relocation loan

- Loan amount > $650k

The above-listed features add between .01 and .60 percent to your mortgage insurance rate. They, too, are affected by your FICO score and LTV.

FICO Score Can Save (Or Cost) You An Extra $100 Per Month

Notice on the chart that for the highest LTV levels, borrowers with the best credit rating pay about $100 a month less for PMI than those with the worst scores. And that’s just for a $100,000 loan.

Borrow $300,000, you’ll pay over $300 more each month if your FICO is 620 than you will if it’s 760.

Read: How To Choose The Right Kind Of PMI

Your FICO when you get your mortgage determines your PMI premium. It won’t rise if your credit gets worse, and it won’t drop if your score improves.

Any improvements you make need to be accomplished before you apply for your mortgage.

Loan Term And PMI

Mortgages with 15-year terms are safer than those with 30-year terms. You might not think so — after all, the 15-year loan has the higher monthly payment. However, homeowners with 15-year loans build equity much faster.

The faster you build home equity, the less likely a lender is to lose money in a foreclosure sale. And that makes the 15-year loan less risky for mortgage lenders, and less costly for you to insure.

PMI for 15-year mortgages costs about .15 less across all FICO scores than the premiums for a 30-year loan.

ARM Vs. Fixed

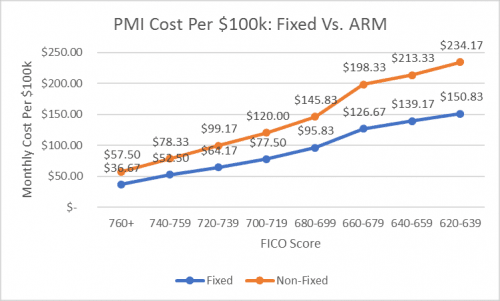

The rate structure of your mortgage also affects your PMI mortgage insurance costs. ARMs are, you guessed it, more likely to end up in foreclosure than fixed loans. That makes them riskier for lenders and more expensive to insure.

Read: Should You Consider An ARM IN 2017?

It’s important to note that for calculating PMI premiums, hybrid ARMs are considered fixed mortgages if their interest rate will be fixed for at least five years. So a 5/1, 7/1 or 10/1 ARM is considered “fixed” in this context.

The chart below compares the cost of insuring an ARM and a fixed loan with an LTV > 95 percent.

You can save a lot on your PMI coverage, especially if your LTV is over 90 percent, by choosing a fixed-rate loan or ARM that’s fixed for at least five years.

Purchasing PMI

If you don’t specify a preference, your lender will simply choose the mortgage insurance provider for you.

Lenders often work with several PMI providers. Your provider might be chosen because it has the lowest costs for borrowers, or because its guidelines are more flexible.

Or because your loan officer is very good friends with the insurer’s rep. You don’t really know. However, consumers can request a specific PMI provider.

Read: Avoiding PMI Is Costing You $13,000 A Year

Not all coverage is equal. For instance, some mortgage insurers include job loss protection in their coverage. This is a potential benefit for you, not just your lender.

If job loss mortgage insurance is important to you, make sure that your lender works with an insurer that offers this benefit.

FHA and USDA mortgage insurance comes from the government, not private insurers. You don’t have any choice there. VA loans have no mortgage insurance. However, borrowers pay a funding fee, which is an upfront charge that pretty much functions as a one-time insurance premium.

Paying For PMI

The monthly addition to your mortgage payment is the most common way of paying for PMI. But it’s not the only way to go.

- You can pay your PMI in one up-front lump sum. Depending on how long you keep your mortgage, this could be a cheaper option. You may also be able to get your home seller to pay it as part of your negotiations.

- You can have the lender pay the premiums. This is usually called LPMI, or lender-paid PMI. Note that you’ll pay a higher interest rate to cover the cost.

- You can choose a “split premium,” which lets you lower your monthly payment by paying an upfront amount.

Read: How To Buy A House With No Money Down In 2017

With PMI, there is a trade-off. The more you pay upfront, the less you pay monthly. This can be a consideration if your debt-to-income (DTI) ratio is high. Reducing monthly MI may make the difference between a 43 percent DTI (approvable) and a 43.1 percent DTI (likely to be declined).

How To Save On PMI

If you are not informed, you may end up paying a lot more for PMI than you need to. For instance, the high cost of PMI for ARMs may prompt you to switch from a 3/1 ARM to a 5/1 ARM, which is considered “fixed” for the purpose of setting PMI rates.

You can save significantly on mortgage insurance by improving your FICO score. Adding 40 - 60 points can halve the cost of insuring your mortgage.

If you have a small down payment, see if you are eligible for Fannie Mae’s HomeReady program or Freddie Mac’s Home Possible loan. Both programs feature reduced mortgage insurance premiums.

Read: HomeReady™ Mortgage: Updated Eligibility, Rates, & Mortgage Guidelines

You can also drop the cost of coverage by increasing your down payment. That might not be difficult. If you can get the seller to pay your closing costs instead of dropping the home price, you could take that money and increase your down payment.

Increasing your down payment from three percent to five percent could reduce your PMI by .07 to over .5 percent.

Finally, consider a piggy-back loan. That’s a combination first and second mortgage. For instance, you might get an 85/15/1 loan, with an 85 percent first mortgage, a 15 percent second mortgage and five percent down. It may be easier to get and less costly than a high-LTV mortgage with PMI.

What Are Today’s Mortgage Rates?

Current mortgage rates include interest charged by the lender. However, if your LTV exceeds 80 percent, your costs also include mortgage insurance. Consider this whenever you compare mortgage quotes between lenders.

Time to make a move? Let us find the right mortgage for you