Conventional loan limits rise to $806,500

Home price growth has remained steady, with housing values rising 5.2% last year, according to the Federal Housing Finance Agency (FHFA).

Luckily, loan limits continue to adjust alongside home price trends. On January 1, 2025, new conforming loan limits have increased to $806,500 in most of the U.S.—up from $766,550 in 2024. The limit in high-cost areas rose from $1,149,825 to $1,209,750.

The increase will give borrowers potential access to larger amounts of financing, broadening their homeownership prospects.

Verify your conventional loan eligibility. Start hereIn this article (Skip to...)

Conventional loan limits for 2025

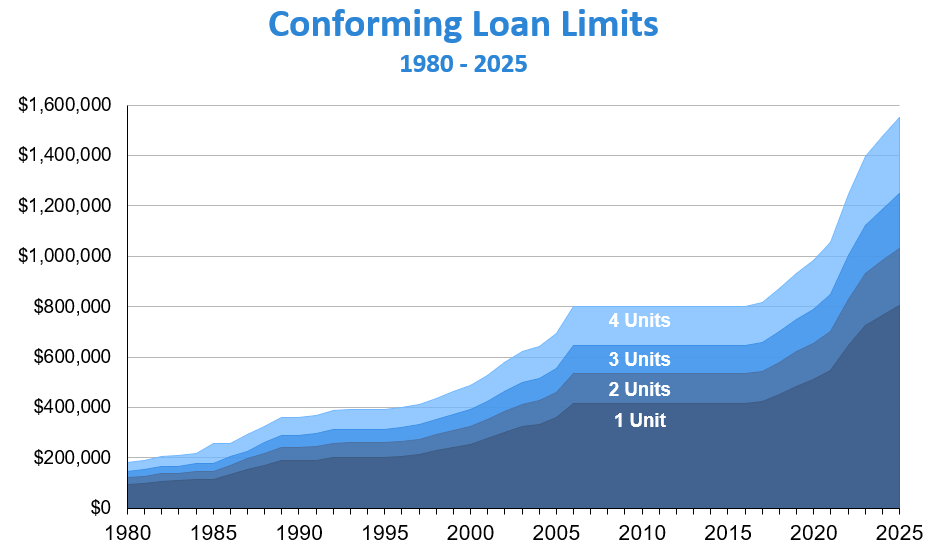

Lending limits for conventional conforming loans got a sizable boost this year.

The Federal Housing Finance Agency (FHFA) determined that home prices rose by 5.21% on average across the nation over the past four quarters. Therefore, it raised conforming loan limits by the same percentage — a jump of $39,950 for the standard one-unit home. Multi-unit properties got similar increases.

| Standard Limit | High-Cost Area | |

| 1 Unit | $806,500 | $1,209,750 |

| 2 Units | $1,032,650 | $1,548,975 |

| 3 Units | $1,248,150 | $1,872,225 |

| 4 Units | $1,551,250 | $2,326,875 |

Baseline conforming loan limits

Standard loan limits for 2025, which apply to the vast majority of the United States, are as follows:

- 1-unit homes: $806,500

- 2-unit homes: $1,032,650

- 3-unit homes: $1,248,150

- 4-unit homes: $1,551,250

Keep in mind that these are only the ‘baseline’ limits. In areas with high-cost real estate, buyers get significantly higher conventional mortgage limits.

Maximum conforming loan limits

High-balance conforming loan limits vary by county. Depending on location and local real estate prices, conforming loan limits can go as high as:

- 1-unit homes: $1,209,750

- 2-unit homes: $1,548,975

- 3-unit homes: $1,872,225

- 4-unit homes: $2,326,875

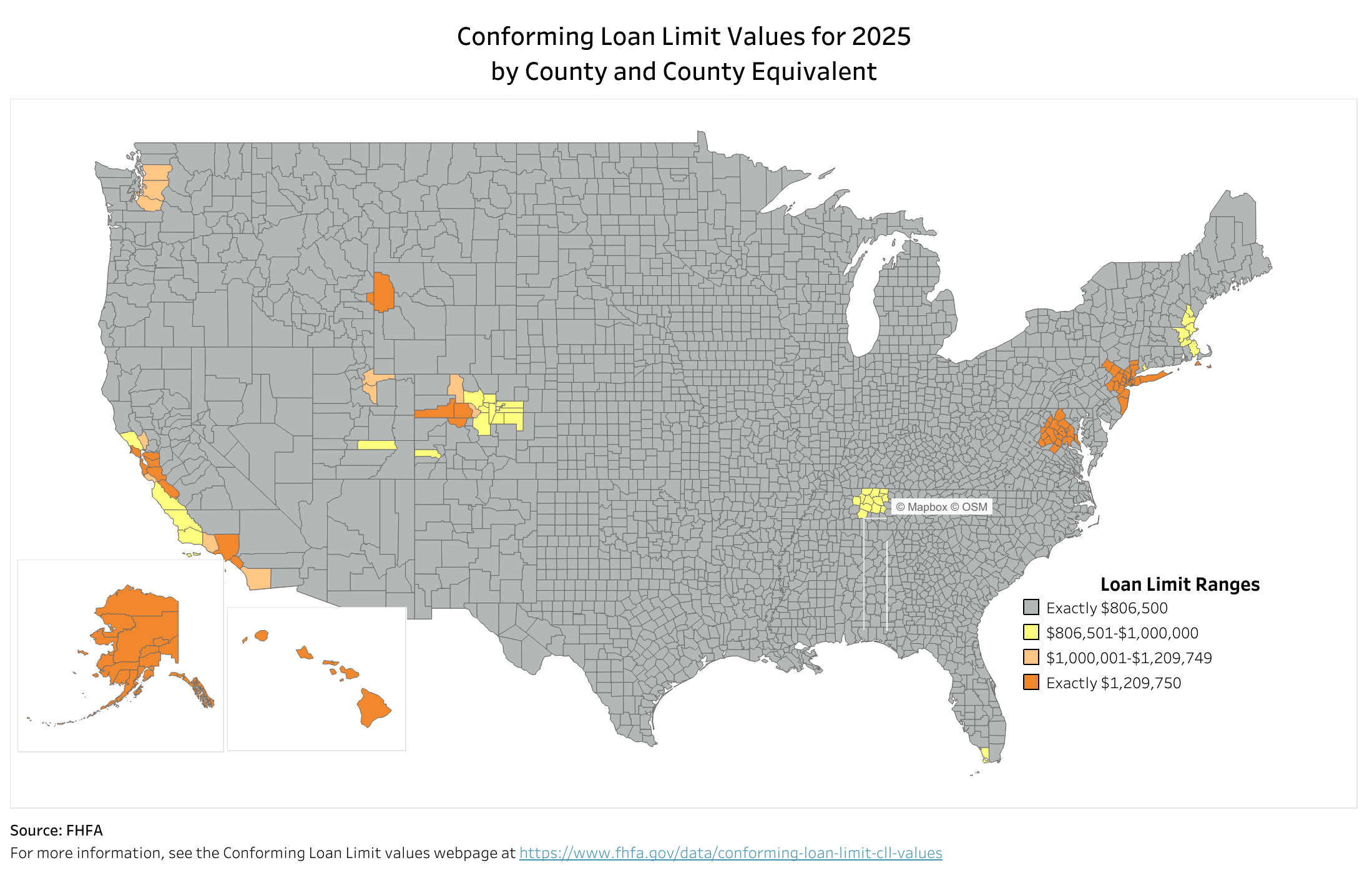

Areas such as San Francisco County, California; Arlington County, Virginia; and Richmond County, New York enjoy the maximum conforming loan limits, while typically expensive cities like Boston, Seattle, and San Diego fall between the standard and ceiling limits.

In Alaska, Hawaii, Guam, and the U.S. Virgin Islands — which follow their own loan limit rules — the baseline loan limit for 2025 is also the maximum $1,209,750 for a one-unit property.

Conforming loan limits by county for 2025

The following map shows conforming loan limits by county. You can access an interactive version of the loan limits map on FHFA’s website.

How do mortgage loan limits work?

Loan limits determine the maximum amount you can borrow under certain mortgage programs. These caps can vary a lot depending on the type of mortgage loan you use and where you live.

Verify your home buying eligibility. Start hereConventional mortgages adhere to one set of loan limits and FHA to another. VA loans essentially did away with limits in 2020.

In the world of conforming loans, Fannie Mae and Freddie Mac limit “borrowable” amounts to keep their nationwide programs available to those who need them.

For instance, Fannie Mae doesn’t want a $10 million loan going through its system. That’s a lot of risk wrapped up in one transaction, and the agency would rather issue many smaller loans to many home buyers.

Fortunately, loan limits are increasing in 2025 to reflect rising home prices across the country.

What is a conforming loan?

A conventional conforming loan is any mortgage that:

- Is not backed by the federal government (meaning it’s not an FHA, VA, or USDA loan)

- Has a loan amount within local conforming loan limits

- Meets lending guidelines set by Fannie Mae and Freddie Mac

Mortgages within conforming loan limits are eligible to be backed by Fannie Mae and Freddie Mac, as long as the borrower meets basic criteria for credit score, income, down payment, and debt levels.

What if my loan is over the conventional limit?

Remember that the conforming loan limit applies to the loan amount, not the home price.

For instance, say a buyer is purchasing a 1-unit home in Boulder, Colorado where the limit is $862,500. The home price is $1 million and the buyer is putting $400,000 down. They would be eligible for a conforming loan. The final loan amount is $600,000 — well within local loan limits for the area.

Still, many applicants will need financing above their local loan limit. This may require a different type of home loan.

Check your home loan options. Start hereJumbo loans

The easiest way to get a mortgage above conventional loan limits is to use a jumbo loan. A “jumbo mortgage” is any home loan that exceeds local conforming limits.

Let’s say a home buyer in Boulder, CO puts down $100,000 on a $1 million home. In this case, their loan amount would be $900,000. That’s above the local conforming loan limit of $862,500. This buyer may need to finance their home purchase with a jumbo loan.

You might think jumbo mortgages would have higher interest rates, but that’s not always the case. Jumbo loan rates are often near or even below conventional mortgage rates.

The catch? It’s harder to qualify for jumbo financing. You’ll likely need a credit score above 700 and a down payment of at least 10-20%.

If you put down less than 20% on a jumbo home purchase, you’ll also have to pay for private mortgage insurance (PMI). This would increase your monthly payments and overall loan cost.

Check your home loan options. Start herePiggyback financing for high-priced homes

Perhaps the most cost-effective method is to choose a piggyback loan. The piggyback or “80/10/10” loan is a type of financing in which a first and second mortgage are opened at the same time.

Typically, this structure is used to avoid private mortgage insurance.

A buyer can get an 80% first mortgage, 10% second mortgage (typically a home equity line of credit), and put 10% down. Here’s how it would work.

- Home price: $1,000,000

- Down payment: $100,000 (10%)

- Financing needed: $900,000

- Local conforming limit: $806,500

The buyer could structure their loan as follows.

- Down payment: $100,000

- 1st mortgage: $806,500

- 2nd mortgage: $93,500

The home is purchased with a bigger conforming loan and a smaller second mortgage. The first mortgage may come with better terms than a jumbo loan, and the second mortgage offers a great rate, too.

What’s the jumbo loan limit for 2025?

Technically there’s no jumbo loan limit for 2025.

Since jumbo mortgages are above the conforming loan limit, they’re considered “non-conforming” and are not eligible for lenders to sell to Fannie Mae or Freddie Mac upon closing.

Check your home loan options. Start hereThat means the lenders offering jumbo loans are free to set their own criteria — including loan limits. For example, one lender might set its jumbo loan limit at $2 million, while another might set no limit at all and be willing to finance homes worth tens of millions.

But the amount you can borrow via a jumbo or non-conforming loan is limited by your finances.

You need enough income to make the monthly mortgage payments on your new home. And your debt-to-income ratio (including your future mortgage payment) can’t exceed the lender’s maximum.

You can use a mortgage calculator to estimate the maximum home price you can likely afford. Or contact a mortgage lender to get a more accurate number.

Verify your new rate

Conventional loan limits FAQ

Time to make a move? Let us find the right mortgage for youConventional loan limits are the maximum loan amounts that Fannie Mae and Freddie Mac will purchase or guarantee. These limits vary by location and are set annually.

Conventional loan limits are set based on the median home prices in a particular area. Higher cost areas have higher loan limits, while lower cost areas have lower limits.

The current conventional loan limit for most of the United States is $806,500. However, this amount can be higher in high-cost areas.

Yes, conventional loan limits are adjusted annually to reflect changes in home prices. The Federal Housing Finance Agency (FHFA) announces the new limits for each year.

You can find out the conventional loan limit in your specific area by using the loan limit lookup tool provided by Fannie Mae and Freddie Mac on their official websites.

You can still get a conventional loan that exceeds the loan limit, but it would be considered a jumbo loan and may have different eligibility requirements and higher interest rates.

Yes, conventional loan limits apply to both home purchases and refinancing. The same limits and criteria apply to both scenarios.