Not Just For Starters: Small Home Mortgage Loans Help People Downsize

While it once was the dream of many, not every American wants to live in a large home. This is true across generations, according to a recent Trulia study. Small homes and small home mortgage loans are enjoying new popularity.

About 29 percent of those living in a 2,700 square foot home for at least ten years said they’d buy a small home next. And 70 percent of those with houses over 3,200 square feet claimed they’d go smaller next time around.

Verify your mortgage eligibility

When More Is Just....More

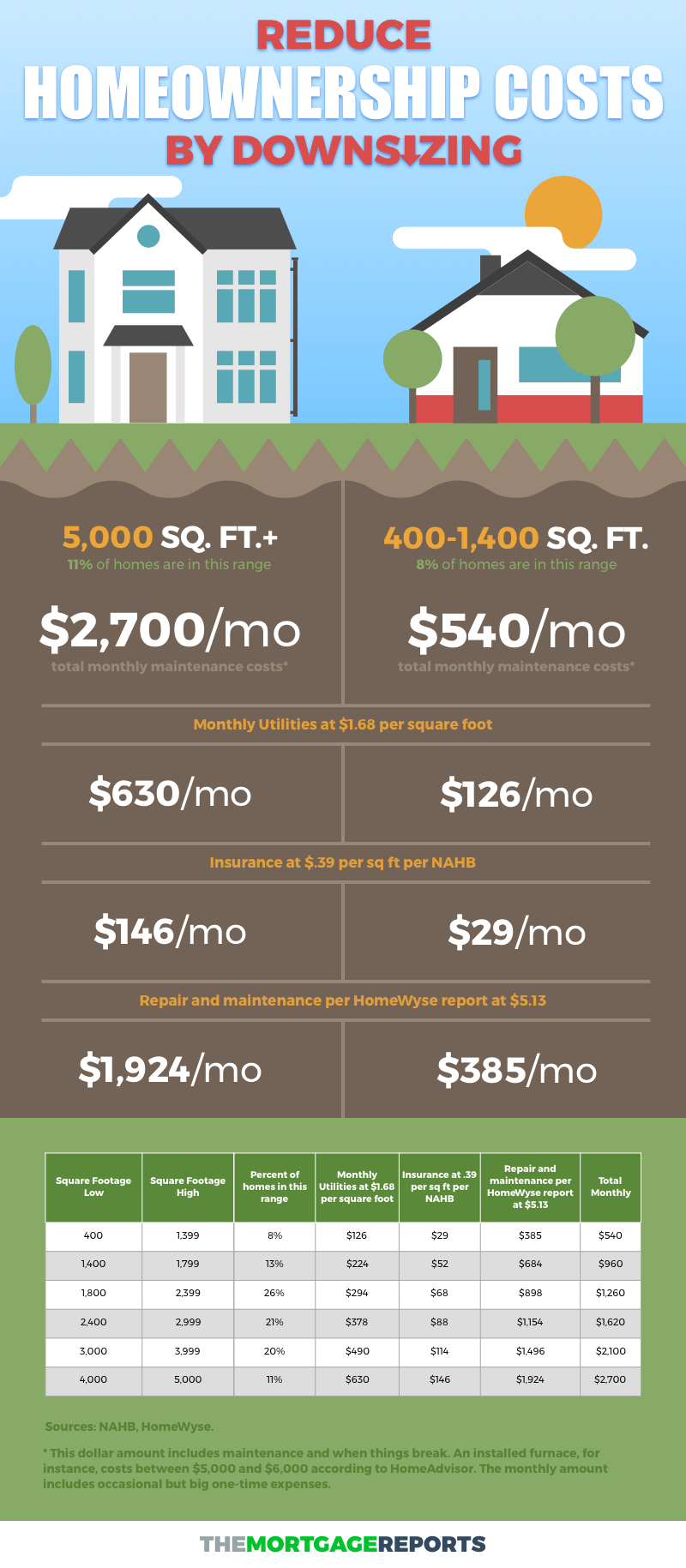

The truth is that larger houses and bigger yards require more heating, cooling, repair and maintenance — either your time, or your money paying for someone else’s time.

And who wants super jumbo loans when they can have small home mortgage loans?

Very few of us aspire to be “gentleman farmers” anymore.

Verify your mortgage eligibilitySize Matters

What about downsizing? Leaving it all behind?

Americans hate to move because we still have to do something with that lifetime’s worth of junk we can’t admit is, well, junk.

Yet, there are ways to make it less overwhelming and it starts with planning early and carefully.

Know Why You’re Downsizing

First, think about the reasons you want to chuck the big house for smaller digs.

Is it to save money, or to live near loved ones where lots are smaller? Has your family composition changed — a divorce or the kids moving out?

Do you or a loved one have health issues you need to address? Have you decided to pursue your own business or hike the Himalayas?

Write down your goals for the move. Only then can you determine how much you’re willing to downsize, what sort of small mortgage loans to consider, and if you even need a mortgage at all.

Decide What You Need In Your New Home

Moving to a smaller home is a major economic and psychological shift.

It’s important to know what you’ll require for comfort in a smaller home. If your move is to pursue a dream, know what your new space must have to make it happen.

Decide what amenities you’ll need in your smaller home. Maybe open space with lots of light. Perhaps a small garden instead of your old huge yard.

Or, maybe you’ll need a home office in while you can meet clients or spend 18 hours a day crunching numbers.

And What You Don’t

Establish what you’re willing to live without. Decide the largest space you’re able to manage and what you’ll need there.

When you reduce your living space, especially after a decade or more, you have to limit what you will take with you. You just can’t teleport the contents of a 3,200 square foot mansion to your new 1,200 square foot cabin.

One well-known television show forces its downsizing participants to pile everything they want to keep into one room. If it doesn’t fit, it doesn’t make the cut.

See how much you really need off-street parking or playground equipment. Or your grandfather clock...

Avoid rushing this part of your decision, because it really determines how you’ll execute the next steps.

The First Cut Is The Deepest

Start by deciding immediately what’s not moving with you. That should be easy — if you haven’t used it in a year or couldn’t even tell someone where it’s stored, you should probably kiss it goodbye and find it a new home.

Then, there are the things you can’t live without — the treasures you’d go back into burning buildings for (but if you’re smart, they’re already in safe deposit boxes somewhere).

Next comes the hard part—deciding what to do with the stuff that’s not on either list. You’ll have to go through it carefully and let go.

Maybe you can’t keep all your kids’ cards and drawings from school so decide which are most precious to you. But you need important paperwork and documents so set it aside so it doesn’t get lost or thrown out.

Now also is the time to part with anything someone gave or left you that you don’t absolutely love but felt guilty letting go. You may have to downsize hobbies or collections that just won’t fit into your new space or life.

Ready To Go?

What affect will rightsizing your life for you have on your financial picture? Whether or not your move is a cost-cutting one, run the numbers. Know your financial picture and how it will shift if you move.

Review your credit reports and score and clear up any issues.

If you’re self-employed, there are special considerations — businesses must be established and portable to qualify for small home mortgage loans in new locations.

Start getting an idea of what’s necessary to sell your house, get your house appraised, and begin working with qualified real estate agent.

If you can find one that specializes in helping clients downsize, you’ll be in better shape during the process. Make sure others on your real estate team know this process well, too.

Consider the tax implications of selling one home and buying another. In fact, talk to a tax professional about this and other tax implications of downsizing.

You may be better off keeping your old house as a rental and buying a new house to live in. Or taking advantage of real estate profits you’re allowed to exclude from taxable income.

Small Mortgages For Smaller Houses

If you lived in your home ten or more years, a lot has changed for buyers in the real estate and mortgage market. If you’re downsizing to a condo, there are special rules.

Learn about the overhaul of laws for lenders and buyers under Know Before You Owe regulations put in place after the last real estate crisis.

In many ways, there are more protections for real estate buyers. There are additional requirements.

Also, you can leverage a variety of down payment and other strategies to get the best mortgage available to you. It’s easier than ever to learn much of what you need to know from home using online tools.

You may not be a first time home buyer. But, if you’ve been out of the market for awhile, get educated on your options before you sell you current home.

Finally, contact some lenders who specialize in small home mortgage loans and make them work for your business.

Time to make a move? Let us find the right mortgage for you