When you’re a single parent, it can seem as though the stakes are higher in just about every decision you make, or action you take.

You may have all the family responsibility and little help with the most important issues.

This can make a home-buying effort – a huge project by most people’s standards – feel downright Olympic.

The Single Parent Home Buying Guide acknowledges the special difficulties you may face as a single parent, and helps with your particular challenges.

This includes the decision to buy or rent, minimizing your costs, qualifying for your home loan, and how the entire process works, from start to finish.

Our goal is helping you achieve a successful housing experience for you and your family.

Part 1: Should You Buy A Home?

Single Parent Home Buying Involves Your Head And Your Heart

When you’re responsible for your child as well as yourself, your choice of whether to rent or buy a home is not just monetary.

Buying a home as a single parent is also an emotional decision that influences your child’s future.

Before you decide whether it’s time to become a homeowner, make sure you understand the pros and cons of your choice.

Doing The Math

According to one national real estate listing site, it’s 37.7 percent cheaper to buy a home than rent, nationwide.

However, that number varies with local market conditions. Rents have been rising in many cities across the country, and mortgage rates are still very low, which can make buying cheaper.

A mortgage calculator can estimate your monthly payments for a comparison. Or you can get really involved and consider home appreciation, average rental increases, and tax benefits.

The California Department of Veterans Affairs has a pretty nice rent vs buy calculator that’s fairly easy to use, and doesn’t have a bias that one from a real estate firm might.

Advantages Of Buying

Once you’ve got a cost estimate, it’s time to consider the advantages and disadvantages of buying a home as a single parent. Advantages include:

Building home equity (wealth)

According to recent research by the Joint Center for Housing Studies at Harvard University, homeownership continues to be a top method for building wealth — even after the housing crisis.

As you pay down the balance on your home loan, and as (hopefully) your home appreciates in value, you are building equity and heading toward owning your home outright.

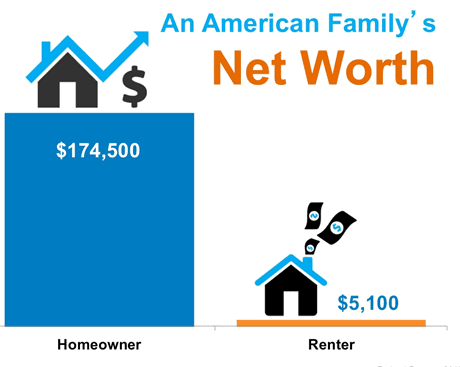

While there’s obviously some risk in investing in property, renting provides zero percent return on your money. According to The New York Times, the median net worth of homeowners in 2013 was $195,400, while that of renters was $5,400.

This 2012 graph from the Federal Reserve backs up the Harvard study with almost identical numbers.

Paying down your mortgage balance and piling up home equity is what the experts call “forced savings,” and is the best way for low- to moderate-income citizens to acquire wealth.

Lowering your tax bill

In addition to the long-term ability to build home equity, an annual benefit of homeownership comes in the form of tax deductions from the federal government and most state governments.

If you itemize your deductions, you also reduce your taxable income by the amount paid for your property taxes, mortgage interest, and often mortgage insurance payments.

If you don’t itemize, or you’re in a low tax bracket, you may still benefit with Mortgage Credit Certificates (MCCs), which return a certain percentage of your mortgage interest back to you. Speak to a tax pro before applying for a home loan in this case.

Freedom to please yourself

One of the most appealing aspects of homeownership is the ability to modify your home to suit your own tastes.

Renters can’t make significant changes to their landlord’s property, and even if they can, a home improvement project benefits the landlord, not the renter.

As a homeowner, you can change everything inside your home from the floors to the ceiling. You can (usually) have the pets you want, too.

Become part of a community

While it’s harder to put a dollar value on the benefits of becoming a long-term resident in a community, putting down roots can provide stability for you and your child.

Of course, some renters stay in one place for years, but you’re more likely to stay seven to ten years or more when you own a home and are building equity.

Pick your school district

When you’re raising a child, the local school is a big deal.

Owning a home provides you and your child with greater certainty about the school district and the chance to build long-term friendships with other children and parents.

Stabilize your housing costs

While some housing costs, like taxes and insurance, can change over time, if you have a fixed-rate mortgage, you’ll know exactly how much your principal and interest will be will be for the entire loan term.

As a renter, you are at the mercy of a landlord who could raise your rent every year, or perhaps make you move when you don’t want to.

In addition, when you have individual electricity, gas and water bills, you control your usage and costs.

Advantages Of Renting

While there are clearly benefits to buying a home, renting has some advantages that you should consider before you make a final decision to become a homeowner as a single parent.

Investment risk

While real estate is generally considered a good investment, there’s no guaranteed profit. The value of your home depends on forces that you can’t control, like the job market, the supply of houses and zoning changes.

You can improve the worth of your home by taking care of it, and can increase your equity by paying down the mortgage balance, but if your home drops in value, you could lose money when you need to sell.

Maintenance

Renters benefit from the fact that the landlord is responsible for maintenance and repairs – both the cost and the hassle of hiring someone to take care of the property.

Buyers sometimes forget to budget for the inevitable cost of home repairs.

Flexibility to relocate

One of the biggest reasons to continue renting is the possibility that you may want to change jobs or transfer to a new location.

Or you may want to escape some awful new neighbors or decide you hate your commute.

Renters can more easily end a lease, while buyers need to sell their home or rent it out and become landlords themselves.

Fewer financial obligations

Of course, renters must pay rent, renter’s insurance and sometimes utility bills.

However, homeowners pay mortgage principal and interest, property taxes, homeowner’s insurance and utilities. There may also be homeowner’s association (HOA) fees and mortgage insurance.

In addition, single parent homeowners should budget about one percent of the property value each year for maintenance and repairs, or purchase a home warranty.

Buying a home comes with two sets of costs – the expenses of the purchase itself, and ongoing outlays you’ll pay every year. The next section covers these costs.

Verify your new ratePart Two: How Much Does It Cost To Buy A Home?

When you buy a home as a single parent, especially if it is your first house, every dollar counts. As a renter, you’re used to paying a security deposit and your first month’s rent upfront.

But when you buy a home, the upfront costs are usually higher. Taking care of the legal and mortgage paperwork can be expensive, and you generally have a down payment and closing costs.

Just remember that you are buying an asset to build your financial future.

Down payment

Most mortgage programs dictate five to 20 percent down payments. However, some require as little as three percent.

VA loans for veterans and USDA loans for eligible buyers in rural areas require no money down.

You can find down payment assistance loans and grants through state and local homeownership programs at www.downpaymentresource.com.

Earnest money deposit

When you make an offer to buy a home, expect to include an “earnest money” check. The check is to show the seller that you’re a serious buyer, “in earnest,” making a serious offer.

The deposit is credited toward your down payment and / or closing costs when you complete the home purchase.

If the seller accepts your offer, the check is put in an escrow account. It cannot be touched until the final documents are signed to transfer ownership.

If you don’t buy the house, your earnest money is almost always refundable to you. The amount of your deposit is up to you, but one-to-five percent of the purchase price is traditional.

If you’re competing with other buyers, you might want to make your deposit larger.

Reserves

In addition to your down payment, it’s smart to have some extra savings to pay your mortgage, even if your income temporarily drops or stops.

These funds are called “reserves”, and they are measured in months.

If your mortgage payment, property taxes and homeowners insurance equals $1,000 a month, and you will have $2,000 in savings after closing on your home purchase, you have two months of reserves.

Prepaid expenses

Some costs of homeownership have to be paid whether you have a mortgage or not. But if you apply for a home loan, these costs have to be paid in advance.

They are called “escrows”, “prepaids”, or “impounds.”

Property taxes

Lenders typically require two or three months of property taxes at the closing for property taxes.

Future property taxes already paid by sellers are returned to them. These amounts will then be added to your closing costs.

The amount needed depends on your closing date and the due date for the taxes. If the sellers owe taxes that haven’t been paid yet, that money comes out of their proceeds from the home sale.

Homeowner’s insurance

Lenders require proof of homeowner’s insurance before approving your mortgage, and most make you pay the first year’s premium at the closing.

This requirement is to cover the lender’s investment if your home is destroyed or damaged, but it also protects you from lawsuits and theft or damage to your personal property.

Mortgage lender charges

Mortgage lender fees can vary depending on the type of loan you choose, and the pricing structure you prefer. In general, the lower the rate, the higher the fees.

A “no-cost” mortgage, for example, has a higher interest rate to cover the lender’s costs and build in a profit.

Origination (or whatever)

Mortgage fees can be called many things — origination, documentation, underwriting... it doesn’t matter.

Charges for flood certification, credit reports, and other expenses (often called “garbage fees” in the lending industry) may be included in the origination, or they may be broken out.

It doesn’t matter.

Lenders can call these fees “hot dogs” and it still doesn’t matter. What matters is the bottom line: the total lender charges for your loan.

Mortgage insurance

Mortgage insurance is paid by borrowers who put less then 20 percent down when they finance a home. It protects the lender if you don’t pay your loan.

Mortgage insurance can be paid as a lump sum upfront, or in monthly installments, which are added to your mortgage payment. Some programs (usually government-backed loans) require both upfront and monthly insurance.

Home appraisal

Your lender will require an appraisal to determine the property value. This may cost $300 to $600 or more, depending on the size of the home and the location.

You’ll typically pay the appraisal fee upfront.

Lender’s title insurance

Lenders want to be sure that your seller has the right to sell you the house — that there are no IRS liens, heirs or other parties with rights to the property.

So they require a report from a title company, and they make borrowers buy title insurance to cover the loan amount if it turns out the property legally belongs to someone else.

Purchasing Costs

Some costs have to be paid even if you don’t finance your home. Property sales are complex and there are many people and companies involved.

Home inspection

You should have a home inspection to look for serious problems with the property, and to see if there are items that you can negotiate to have the seller repair.

An inspection costs $250 to $600 depending on where you live and the size of the home. Inspections are usually paid for in advance.

Other inspections

Depending on local laws, lender guidelines and your preference, you may need to pay for a termite inspection, a radon inspection and a septic inspection.

Each can cost an additional $100 to $300.

Owner’s title insurance

The lender’s title policy protects the mortgage lender’s interest in the property (the loan amount).

It takes an owner’s policy to cover your interest — your down payment and home equity.

Escrow or legal fees

In some locations, properties change hands through title companies with escrow officers to handle the deal.

In other places, it’s done by attorneys in law offices.

Either way, there are fees involved.

Additional closing costs

Closing costs vary by location. Some states have very high costs, while others’ costs are quite low.

There are usually transfer taxes and recording fees to the county, for example.

Seller Concessions

Keep in mind that all home purchases are negotiations, and some costs are traditionally paid by sellers, some are split, and some are covered by the buyer.

However, if you’d prefer to have the seller cover some or all of your closing costs, instead of lowering the asking price, you can ask for that.

Those are called “seller concessions” and allowed by most mortgage programs.

Many single parents have former partners who may be involved in the homebuying process in some way or other. Part 3 addresses these concerns.

Verify your new ratePart Three: Your Ex-Partner And Mortgage Credit Problems

Separating from your partner means the chance to alter your life. If one of the changes you want to make is buying a new home, your credit and income may be a challenge.

For instance, divorce in itself doesn’t hurt your credit score. However, balances can be run up and payments may skipped as people sort out who is responsible for what. In addition, when a two-income household becomes a one-income family, qualifying for a mortgage payment can be an issue.

Protecting Your Post-Divorce Credit

Your first move before a divorce, if possible, should be to protect your good credit. Request a free copy of your credit report from all three credit reporting bureaus at www.annualcreditreport.com.

Close or separate all your joint accounts

If your split is friendly, analyze your joint debts and determine which ex will pay each bill. Contact each creditor and find out how to convert a joint account into an individual account.

If the creditor refuses (they are under no obligation to weaken their position by doing so), you might each open new balance transfer accounts in your own names, and use them to pay off and close the joint accounts.

If the divorce is angry, and you can afford to do so, pay the joint bills now and try to recoup the money from your ex in court.

Remove your ex as an authorized user

If your former partner or spouse is listed as an authorized user on any of your accounts, cancel that access immediately.

Keep paying your bills

Pay all your bills on time, even if you have to make other sacrifices. It’s temporary, and payment history is one of the most important factors in your credit score.

Set up a fraud alert or freeze your credit

If you’re concerned about your ex-spouse damaging your credit, place a fraud alert on your credit report, or completely freeze access to your credit report. You would need to unfreeze your report when you apply for new credit.

Establish independent credit

If most credit has been in your partner’s name, apply for an account or two in your own. Use the credit and pay the bill in full, on time, to boost your score. You may want to open another credit account in six months to expand your credit profile.

Build or rebuild a positive credit history

Your most recent credit activity, particularly on-time payments, should improve your credit profile. Be vigilant about paying your bills.

Single Parent Mortgage: Legal Separation

There’s a big difference between applying for a mortgage in your own name when you’re still legally married, and applying for a home loan when you’ve been legally divorced.

Must be legal

First, your separation has to be documented, spelling out who is responsible for what payments, who gets access to which assets, and so on. It’s very much like a divorce decree, in fact.You may have to file it with the court.

Community property states are different

In California and other community property states, government-backed mortgages like FHA demand that the non-borrowing separated spouse gets a credit check. He or she must sign paperwork acknowledging awareness of the loan and that there is no responsibility for it or ownership in the property.

The difference between a legal separation and a divorce is that a legal separation can be undone, while a divorce is final. That makes the underwriting requirements a bit trickier for mortgage lenders.

Single Parent Mortgage: Using Alimony Or Child Support To Qualify

One obstacle to qualifying for a mortgage as a single parent can be an income reduction after the split. To use court-ordered child support or alimony to qualify, in most cases, you have to show that it’s reliable and will continue for at least three years.

(You’re not required to disclose these payments unless you need the income to qualify for the home loan.)

Requirements when support is higher income percentage

If spousal or child support makes up more than 30 percent of your income, many lenders require that you receive support for a full year before applying. The order must require support payments for at least three years after the loan closes.

Easier when you have substantial independent income

If support is 30 percent or less of your income, you’ll only need to show six months of on-time payments before the support can be counted in your income.

To prove receipt of these payments, you’ll want a copy of the court order showing the payment obligation amount and expected duration.

You should also keep copies of the checks or at least deposit them separately each month so they appear on your account statements — unless you think it will be fun asking your ex for copies of canceled checks in six months when you apply for a loan.

Now that you know what’s involved with being a single parent homebuyer, it’s time to put the whole process together. Part 4 addresses the steps you’ll take to achieve homeownership as a single parent.

Verify your new ratePart Four: Single Parent Homebuyer: Putting It All Together

While a new single parent might be tempted to jump ahead to the fun part and start looking at homes, it’s important to educate and prepare yourself first. You’ll take many steps (and maybe stumble a few times) before achieving homeownership for your single parent household.

Save Your Down Payment

As a single parent relying on one income, your ability to save for a down payment may be constrained by limited resources. It’s easier if you establish a house-buying account and have your bank make regular automatic transfers to it.

Still, you have two things on your side: First, many mortgage programs require down payments under 20 percent. Second, you can look for resources beyond your own savings for a down payment.

Mortgages with zero down payment are available to veterans and active members of the military through the VA loan program. Income-eligible buyers in rural areas may finance 100 percent through the USDA Rural Housing program.

You can also find loans with a down payment of three-to-five percent from conventional lenders and 3.5 percent through the FHA loan program.

You may qualify for homeowner assistance programs that provide down payment funds. You can find these programs at www.downpaymentresource.com.

Determine What You Can Spend For A Home

There are may formulas used by mortgage lenders to calculate what you can afford to spend on a house.

However, your first check should be with your own gut. What are you used to paying for housing now? How much more (or less) would be comfortable for you with your current income and bills?

Include that information when you consult with mortgage lenders, because it matters. If your lender’s numbers say you can afford $800 a month, but you can prove you’ve had no problem paying $1,000 a month to your landlord, that makes a difference.

The flip-side is that just because your lender says you qualify for a $2,000 monthly payment, doesn’t mean you have to take the bigger loan. You’re the one who has to sleep at night — stay in your comfort zone if it makes sense.

Lender Affordability Calculations

Most loan programs allow a maximum debt-to-income ratio of 43 percent. This means that your monthly obligations, including your future house payment and the minimum payment for accounts like credit cards, auto loans and student debt, should be 43 percent or less of your gross (before tax) income.

If you’re relying on one income, you might want to stay well below that maximum, or make sure your emergency savings — at least three-to-six months of expenses — is solid.

Lenders can pre-qualify you for a home purchase, which means they look at your income and assets and estimate what you “should” be able to afford. This is helpful, but it is not a loan pre-approval and should not prompt you to start home shopping.

Go Shopping — For Homes And Loans

Work with an experienced real estate agent who completes many transactions in your area and price range. This person, called a selling or buyer’s agent, is supposed to represent your interests during negotiations. The agent advertising the home is called a listing or seller’s agent.

Understand that there is no way that the selling agent, who is supposed to get you the best deal, can do this without being in conflict with the listing agent, whose job it is to get the most money for the seller.

Get your own agent. And don’t rely on him or her exclusively for everything.

Get Your Own Lender

The Internet makes it easy for you to do some work on your own — look at neighborhood crime statistics and school ratings, for example — that real estate agents are not legally allowed to provide.

The Internet also makes it easier for you to find and compare mortgage offers. The agent might find you the best deal, or he might know little about mortgage rates and just send you to his golf buddy.

Find your own loan.

Mortgage Pre-Approval: The Real Deal

In order for sellers to take your purchase offer seriously, you’ll need to obtain pre-approval for a mortgage.

Mortgage pre-approval requires you to complete an official mortgage application, consent to a credit check, and document your job history, income and assets.

If you pass inspection, you receive a pre-approval letter. That’s a conditional commitment from the lender, stating that as long as your situation doesn’t change for the worse, and the property meets the lender’s guidelines, and the program doesn’t change, you’ll be able to close on your purchase.

It’s the closest thing to a cash offer you can provide.

You Found Your Home! Now Open Escrow

You and your agent should look at multiple homes so you have a full understanding of your local market and your options. Once you identify a home that you like and that you can afford, you and your agent can determine the appropriate offer to make.

You’ll need to include an earnest money check with your offer. Once your offer is accepted, escrow opens and the check is deposited.

Here’s what happens during the escrow process:

Home inspection

Everyone should have at least a basic home inspection before completing a home purchase. For older homes, you may want to go further — electrical, septic tank, roofing, etc. As the buyer, you get to choose the inspector if you want to.

Your contract may require the seller to make minor repairs or give you a credit to have them made. Major problems can take you back to Square One — either you walk away, the seller agrees to fix the problem or lower the price, or the seller walks away and the deal is dead.

Property appraisal

If you’re financing your purchase, your lender will order an appraisal to make sure the sales price is fair. Neither you, nor the seller, nor anyone else benefiting from the transaction gets to pick the appraiser.

Title search

You and your lender will want to be certain that the seller has the right to convey the home to you. Sometimes, unknown heirs, parties in lawsuits and other problems like illegal foreclosures may void your title. To protect you and the lender, a title search is conducted, and title insurance must be purchased. In many states, you, the buyer, get to choose the title company.

Shop for homeowners insurance

Your lender will need proof of your homeowner’s insurance before you can close your purchase, so get it while the inspections and appraisals are going on. Complete the necessary paperwork to purchase your policy. Your proof of insurance is called a “declarations page.”

Lender approves property and issues final approval

Once the home has been appraised, the lender analyzes the property value and completes the final underwriting. Any questions that come up or requests for additional paperwork should be taken care of as soon as possible. Once all conditions are cleared, final documents can be drawn up.

Loan documents are prepared

If you can, ask for copies of your final documents a few days in advance, so you can ask any questions or make any needed corrections. Review all your loan documents before settlement day and contact your lender, your real estate agent or your title company if you have questions.

If your lender can’t get the documents to you early, ask your loan officer to attend your closing or at least be available by phone.

Close on your home

Before your closing appointment, finalize your moving arrangements, including having utilities transferred to your name and hiring a moving van.

You’ll need to sign numerous documents and bring certified funds or arrange for a bank transfer for your down payment and closing costs.

You are responsible for anything you sign at this point, so be very comfortable with the terms of your loan and your property purchase. You’ll get a reconciliation of the last set of disclosures, comparing the estimated costs and terms of your loan and other services, and the actual terms and costs.

If there are significant changes, you should get an explanation, and you may be owed some cash.

Finally, you get your keys. And you can exhale. Congratulations on your home purchase as a single parent!

What Are Today’s Mortgage Rates?

Part of shopping for your home is shopping for mortgage rates. As noted above, it’s easy to do online. The only way to know if you’re getting a good deal is to look at several competing offers.

Time to make a move? Let us find the right mortgage for you