A Mortgage Calculator Should Show More Than Monthly Payment

When looking for a home mortgage, the first step is knowing what you can afford.

Down payments, interest rates, and home prices all are important. But another big factor is your income.

A bigger income means you can afford more house. Is your income adequate to purchase a property in your desired neighborhood?

A good mortgage calculator can give you a general home price range to look in based on your income.

Just about any mortgage calculator can tell you how much it will cost per month to buy a home. But not many can give you a recommended income-based home price.

Verify your new rateUsing The Calculator’s Income Mode

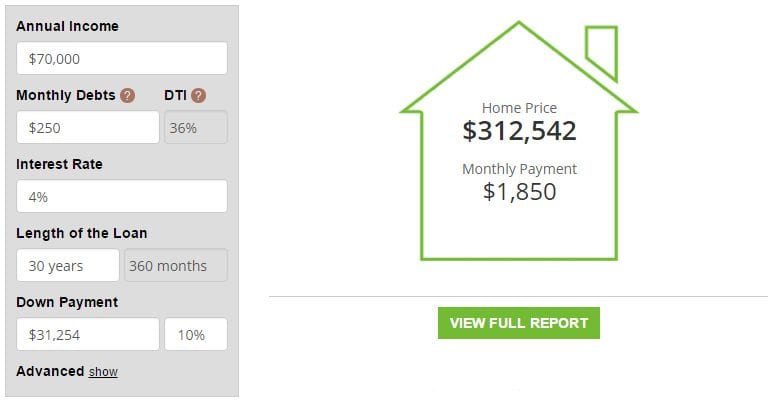

Open a mortgage calculator that has an income mode (you can do that here). In it, you specify your income and regular monthly debt payments.

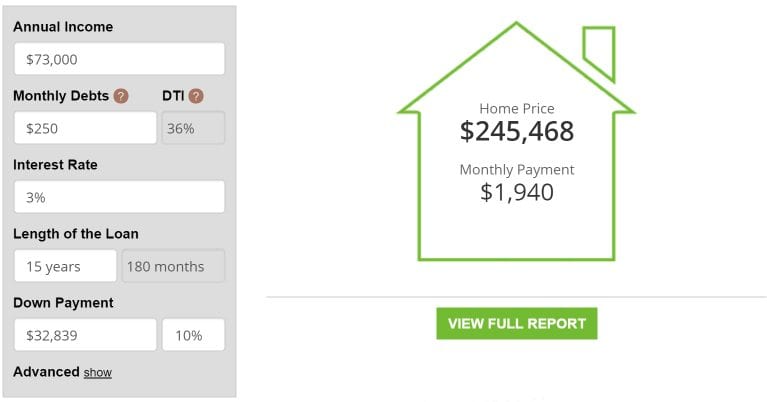

Add a few other factors like estimated interest rate and loan term, and you see the home price and monthly payment you can likely afford. The following is an example of a mortgage calculator running in income mode, assuming a 10% downpayment.

Annual income can be the amount you make alone, or household income if more than one person will help pay the mortgage. Monthly debts are the total of all regular monthly payments you make on such things as car loans, student loans, and credit cards.

“DTI” means debt-to-income ratio, or the percentage of your income that goes out to cover regular debt. It includes the mortgage plus other debt.

Some lenders will consider higher DTIs of 43% or more. Many buyers aim for a DTI of 36% or less to leave room in their budget.

Then you provide the interest rate, length of the loan, and the down payment. You can specify the latter either as a dollar figure or a percentage of the house price.

Plug In All The Numbers

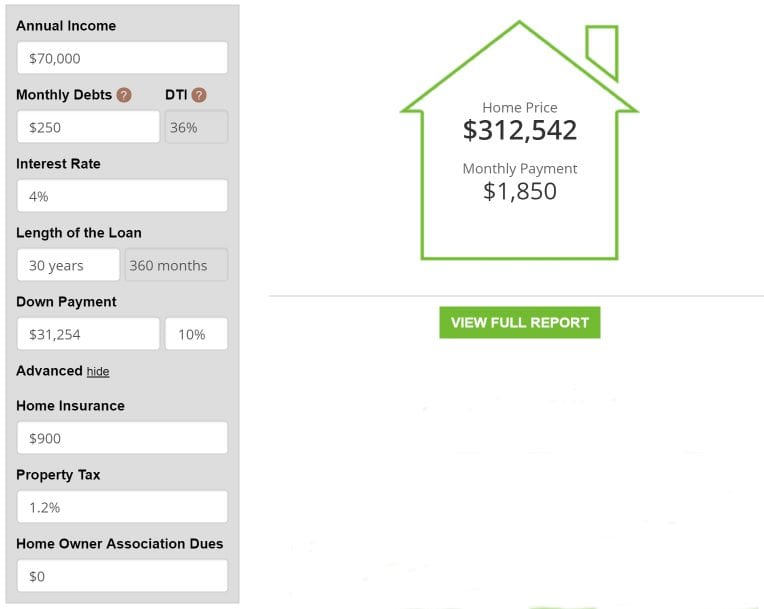

Click the “Advanced” link and you see three other categories:

- Annual house insurance bill

- Property tax

- Homeowner association (HOA) dues

The more complete the information you provide, the more accurate an estimate of monthly payment and maximum house price you see.

Check the real estate listing for any property you want to buy. It should detail the home’s property tax bill, plus the HOA dues if any.

Verify your new ratePerforming What-If Planning

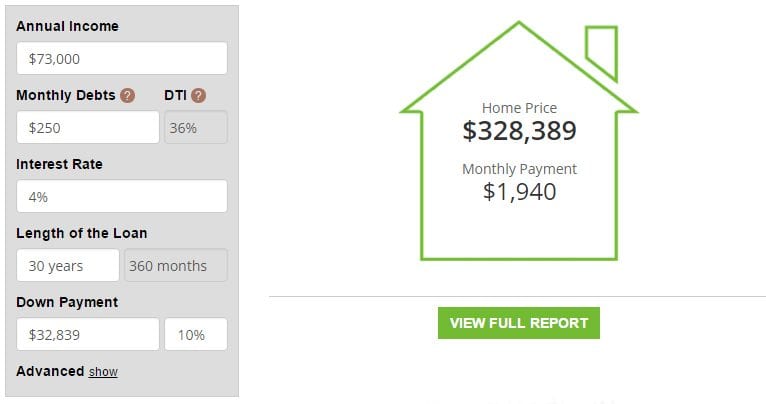

A powerful feature of a mortgage calculator is the ability to consider different scenarios. For example, say that you’re about to get a raise and will make $73,000 a year instead of $70,000. You now see the following:

You now qualify for a home price about $16,000 higher.

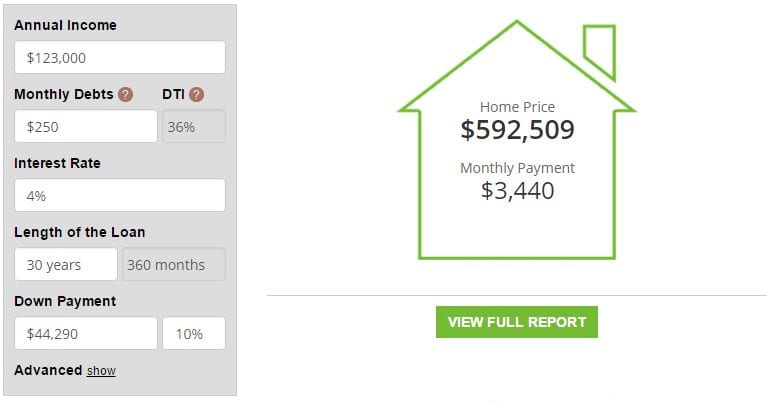

Perhaps this isn’t enough, though. You have considered purchasing a home with a significant other or family member. You want to see how their income might help.

The other person makes $50,000 per year and has no debt. Adding their income makes a big difference in what you can buy.

If you want to buy as much house as possible, consider buying it with a boyfriend, girlfriend, partner, or family member.

Current mortgage guidelines allow you to purchase a home with anyone, even a non-relative or business partner.

Verify your new rateCheck 15-Year Mortgage Affordability

A 15-year mortgage comes with ultra-low rates. And, you own your home free and clear in half the time.

But, the payments are higher. It’s a trade-off between monthly affordability and reducing costs long-term. Still, it’s worth checking what your income will buy, based on a 15-year loan.

Your monthly payment stays the same, but your affordable home price drops by about $80,000. That might not be a bad thing. Buying a more conservative home, and paying it off sooner, could make a lot of long-term sense.

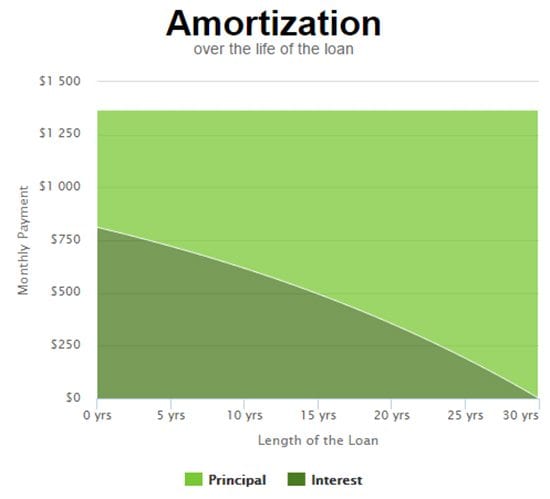

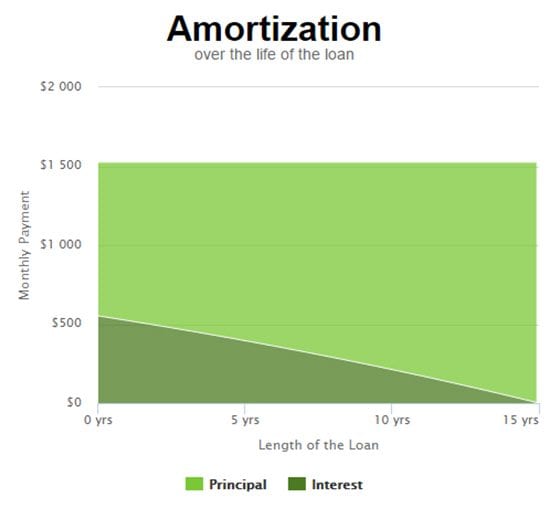

And when you look at the mortgage calculator’s amortization graph, you visually see the drastic difference between a 15- and 30-year loan.

Verify your new rateSee Accelerated Loan Payoff Speed

All modes, including income, on a mortgage calculator should show loan amortization over time. Comparing a 30-year amortization to the 15-year reveals that you pay significantly less interest for the shorter loan length.

First, an amortization graph for the 30-year option.

Compare that to how fast you pay down a mortgage with a 15-year loan.

You start your loan paying drastically more principal, so your loan balance shrinks quickly.

At any time, click the “View Full Report” button to see a summary of the loan information and a month-by-month table that shows how your payments break out over time.

Knowing how much equity you have at any point is good for general credit planning and in case you plan to move before you pay off the loan.

As you make mortgage payments, you pay off more principal each month

What Are Todays Rates?

Rates are low and it’s the perfect time to get a quote for your upcoming purchase. Today’s rates are so low that you can buy more home with the same income, even compared to a few months ago.

Get a rate quote, which can take just minutes. No social security number is required to start, and all quotes come with access to your live credit scores.

Time to make a move? Let us find the right mortgage for you