A new path to homeownership

It turns out Zoomers aren’t just dreaming about homeownership—they’re teaming up to make it happen. Co-buying is one of the clever ways they’re getting a foot in the door.

Stanford’s Center for Advanced Study in the Behavioral Sciences says, "Gen Z are typically self-driven, collaborative, and diverse-minded. They value flexibility, authenticity, and a pragmatic approach to addressing problems." What could be more collaborative, flexible, and pragmatic than co-buying—when two or more people, often unmarried partners, relatives, or close friends, purchase a home together?

Older generations may find this puzzling, having viewed homeownership as a milestone for individuals or committed couples. But the reality is, they faced fewer and lower hurdles than today’s first-time buyers—regardless of how challenging they remember it being.

Even Millennials, who aren’t too far removed from the struggle themselves, don’t see things quite the same way. According to the 2025 NextGen Homebuyer Report, Zoomers are 78% more likely to consider co-buying than Millennials—highlighting just how dramatically attitudes are shifting.

Verify your home buying eligibility. Start hereIn this article (Skip to...)

- Why co-buying is popular among Gen Z

- Pros and cons of co-buying

- How to successfully navigate co-buying

- The bottom line

Why co-buying is gaining popularity among Gen Z

Affordability challenges

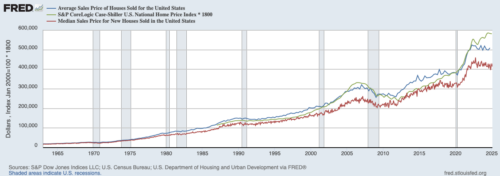

As a national average, home prices have shot up since the COVID-19 pandemic. Don't believe us? Check out this graph from the Federal Reserve Bank of St. Louis:

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Average Sales Price of Houses Sold for the United States [ASPUS], retrieved from FRED, Federal Reserve Bank of St. Louis

Meanwhile, average mortgage rates have rocketed, too. According to Freddie Mac's archive, the average rate for a 30-year, fixed-rate mortgage hit an all-time low of 2.66% on Christmas Eve 2020. Best. Present. Ever.

By Apr. 10, 2025, that same average had soared to 6.62%. Meanwhile, at that time, mortgage rates were impossibly difficult to predict. However, some expected them to dip below 6% during 2025 and 2026.

Yes, average wages also increased over the first half of the 2020s. But at nothing like the pace needed to compensate for higher home prices and mortgage rates.

So, spiraling home prices and mortgage rates delivered a double whammy to first-time and wannabe home buyers. Affordability had become a significant issue for them, a group that included many Zoomers. Small wonder they began exploring new ways to buy a home and hit upon co-buying.

Changing social norms

The Stanford study revealed that many Zoomers are open to new, pragmatic ways of thinking. So, it is no surprise that lots are turning to co-buying. They don't fear communal living in the way previous generations did.

That’s not to say they’ve let go of the American dream—spouse, kids, dog, and the classic picket fence. But many now see co-buying as a smart, strategic step toward achieving that vision on their own terms.

Co-buying with a compatible friend or relation can get them on the first rung of the housing ladder sooner than if they tried to go it alone. And, once there, they'd be able to take advantage of rising home prices to build a down payment with which to buy their own home later, perhaps with a spouse or romantic partner. That's pragmatism in action.

Yes, home prices can fall, too. But look at the graph above. Decreases tend — at least historically — to be shallow and short, while the overall trend is relentlessly and powerfully upward.

Remote work and flexibility

Remote work has completely reshaped how many Zoomers experience shared living—unlocking the freedom to live wherever they choose.

No longer must young people sharing a cramped, city-center apartment endure up close the bad habits of roommates. For just a little more money than their rent and property taxes, they could co-buy a spacious suburban or rural house, with a bedroom, en suite and home office each, plus enough communal space that they're not constantly tripping over each other.

Better yet, they could move to a state with low income and property taxes, freeing up yet more of their earnings for homeownership expenses.

The cherry on top? Many rural and suburban homes are eligible for USDA loans, which are available to those with moderate and low incomes. And those loans, backed by the U.S. Department of Agriculture, have a zero-down-payment requirement and competitive mortgage rates.

Verify your home buying eligibility. Start hereCo-buying vs. traditional homeownership models

One of the interesting things from the NextGen Homebuyers report was how much more open Zoomers are to co-buying than Millennials. Very nearly one in three Gen Zers were up for it, making them 78% more likely than the slightly older cohort.

Here are some other differences in the two generations' approaches to homeownership:

- Millennials’ Approach:

- More likely to pursue homeownership alone or as a couple.

- Preference for fixer-uppers and lower-cost areas instead of co-buying.

- Gen Z’s Strategy:

- Prioritizing co-buying over waiting to afford a home alone.

- Willingness to share financial responsibilities with friends or family.

- Looking at alternative financing methods (e.g., joint mortgages, co-living arrangements).

Pros and cons of co-buying a home

Co-owning a home can be a practical path to homeownership, offering financial advantages and access to competitive markets, but it also comes with important legal, relational, and logistical considerations.

Verify your home buying eligibility. Start here- Pros:

- Easier entry into the housing market.

- Homeownership and its wealth-building opportunities may come sooner.

- Shared mortgage and maintenance costs.

- Ability to purchase in desirable areas.

- Cons:

- Legal and financial complexities.

- Potential conflicts between co-owners.

- Challenges in exiting a co-ownership agreement.

How to successfully navigate co-buying

Legal considerations

No matter how much you like, love, or trust the friend or family member you’re buying with, it’s important to approach the purchase with a clear understanding that it’s a legal and financial commitment.

Being proactive and treating it with the seriousness it deserves can help avoid misunderstandings and protect both your investment and your relationship in the long run.

Verify your home buying eligibility. Start hereWriting down the details of your arrangement within a legally binding agreement can resolve most disputes before they begin. You may be able to find a standard, downloadable co-ownership agreement online.

But make sure you get it from a credible source, and take care when filling in the blanks to fit your needs. You should think carefully about having an attorney review the document before signing.

What if one of you has more money than the other(s)? If you're putting up more of the down payment and paying a bigger share of mortgage, property taxes and maintenance costs, you should probably have a larger share of the ownership. Get that in writing.

And plan for the future. What happens if one of you meets the love of your life and wants to move out — or to move the new partner in? Must the home be sold? Does the remaining co-owner have to buy out the one leaving? If so, over what timeframe? Should you set a minimum period before a co-owner can walk away?

You need an exit strategy in place. Remember, the co-buyers will both be on the mortgage agreement, and they'll retain legal responsibility for that loan unless and until their names are formally removed. Lenders will only do that in certain circumstances, which include the remaining borrower proving that she has the resources to keep the mortgage current by herself.

The idea of a co-ownership agreement isn't to entrap anyone. It's to minimize the risk of life-changing disruption for all parties.

Financial planning

All the parties to a mortgage application must clear the hurdles lenders set for qualification. Your application may be declined, or your mortgage rate may be set at a higher level if one of you has a low credit score or a lot of existing debts.

So, start thinking about these things well before you apply. Indeed, checking credit scores and calculating your debt-to-income ratios (DTIs) should be one of your first steps when you decide to choose co-buying. That way, you can work to boost your scores and perhaps pay down some debt before you make your application.

Also, consider how affordable homeownership will be for each of you. Will you have enough each month to cover your share of the mortgage, property taxes, homeownership association fees (if any), plus occasional maintenance and repairs?

If you have any doubts, talk it through with your prospective co-owner(s). Might they let you pay less if you accept a smaller share of the home's ownership?

Communication and conflict resolution

While you don’t need a formal contract, having an open conversation upfront about how you’ll share the space is a smart way to prevent future misunderstandings—especially if the co-buyers haven’t lived together before. Putting a few key agreements in writing can also help clarify expectations and serve as a helpful reference later on.

Think about things like cleaning communal areas, putting out the garbage, stacking and unstacking the dishwasher, and setting limits on the latest time music or the TV can be loud before headphones must be used. Decide on what food and booze will be bought jointly and what counts as personal property and can't be consumed by the other unless swiftly replaced.

These things might seem minor at first, but they can lead to bigger disagreements down the line—especially if it starts to feel like the arrangement isn’t balanced.

Time to make a move? Let us find the right mortgage for youThe future of homeownership: Will co-buying become the norm?

We couldn't find evidence that co-buying is likely to become the norm. We suspect that too many Americans are wedded to the ideal of a single-family home. However, the trend toward co-buying, sometimes in multi-generational environments, as a stepping stone to that ideal seems likely to strengthen.

When CBS News looked at this trend in 2024, it suggested, "As housing prices rise, these paths—co-ownership and multi-generational living—are becoming more popular solutions for people looking to own homes."

Strong Towns reached a similar conclusion that same year: "Time will tell how sustainable co-purchasing turns out to be. It also remains to be seen if developers and city leaders will recognize the urgent need for housing types that actually align with reality and that provide people with not just a chance to own a house, but with the chance to build a home."

Will those groups permit and build the sorts of homes that co-buyers need? And will mortgage lenders ease the path of those who are attracted to co-ownership? As Strong Towns says, only time will tell.

The bottom line

You can see why co-buying is becoming increasingly popular among Gen Zers. As a route to purchasing a place, it's much easier and faster than saving a down payment and shouldering homeownership costs yourself.

Buying a home is always a major commitment—and doing so with another person can bring unique challenges if expectations aren’t clearly aligned from the start.

So, take your time and observe the formalities. Write a co-ownership agreement so there's no doubt about each party's responsibilities and benefits. And consider a less formal roommate agreement to make sharing space with your co-buyer a more pleasant experience.

We don't yet know whether co-buying is a trend or a long-term shift in the homeownership model. But, done right, it can be collaborative, flexible and pragmatic. And that fits Zoomers to a tee.