Unlocking the best refinance terms

Refinancing your mortgage is like dating—asking the right questions upfront can save you a world of trouble down the line. Just as you wouldn’t commit to a relationship without knowing the basics, diving into a refinance without the right queries can cost you big time.

Let’s explore how a little curiosity can lead to better terms, big savings, and a much smoother process.

Check your refinance eligibility. Start hereIn this article (Skip to...)

- Good and bad times to refinance

- Why it’s crucial to ask the right questions

- Top questions to ask your refinance lender

- The bottom line

Good and bad times to refinance

There are times — when mortgage rates are falling fast — when refinancing is a no-brainer. Providing your new rate is at least 0.5% lower than your existing one, refinancing is typically beneficial.

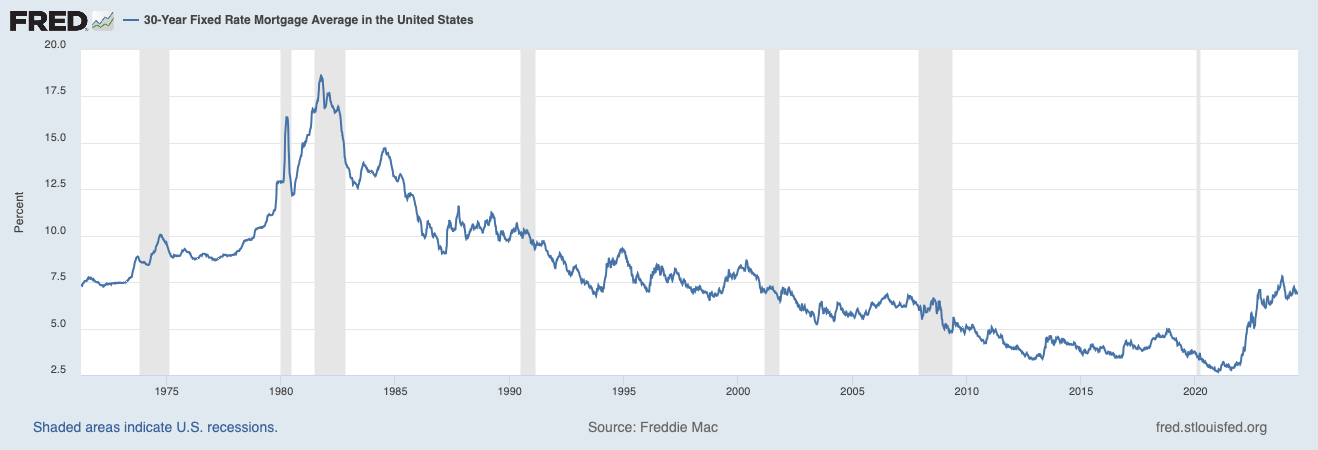

And, from October 1981 until December 2020, mortgage rates were on a clear downward trend, although there were plenty of peaks and troughs along the way. So, most homeowners refinanced from time to time.

Check your refinance eligibility. Start here

But, since the start of 2021, until this article was written, mortgage rates have been on an upward trend. And fewer owners have been refinancing.

Fannie Mae reckons that, during the week ending June 21, 2024, the dollar volume of refinance applications was down 88.6% compared to the “refinance boom” that occurred during the third quarter of 2020.

How come? Because refinancing to a higher mortgage rate would see homeowners typically either:

- Making a higher monthly payment

- Stretching out the time they’re paying for their home, usually adding significantly to the total amount their interest will cost them

Of course, we all hope to see the return of a falling trend in mortgage rates; homeowners could save thousands. But it hadn’t yet arrived when this article was written.

When refinancing is good despite rising rates

Refinancings may be rarer than they once were but they’ve far from disappeared. Some people still get valuable benefits from them. So, what might those be?

Well, occasionally, someone who closely monitors mortgage rates might spot that the current mortgage rate is 0.5% lower than their existing rate. Then, they could do a “rate-and-term” refinance, which can deliver a lower mortgage rate without extending the total loan term.

That happens sometimes, even within a rising trend. It’s about those peaks and troughs.

Check your refinance eligibility. Start hereCash-out refinances can be good

But, more commonly, it’s because someone needs a cash-out refinance. You replace your existing mortgage with a bigger one and walk away with a lump sum of the difference, minus closing costs.

If you’re refinancing to a bigger loan at a higher rate, there are obvious disadvantages. You’re highly likely to get a much higher monthly payment and the total cost of borrowing to buy your home rockets.

That’s not certain. For example, if your credit score is much higher and your debt burden lower than when you applied for your current mortgage, you may be offered a low rate. But your financial circumstances would have had to have transformed to get close to compensating for mortgage rates’ rising trend.

You may be able to moderate the effect on your monthly payment (perhaps even get a lower one) by extending the time you take to pay down your home loan.

For example, suppose your current 30-year mortgage has been going for 20 years. If you get a new 30-year loan, you’ll be spreading your payments over 50 years. That can help with your monthly payments but will send the total amount you pay in interest sky high.

So, why refinance? Because sometimes you need a cash injection so badly that the (mostly deferred) pain is worth it. Imagine you have crippling debts that threaten every aspect of your life, including your home. Or that you’ve started a new cash-hungry business. Or that you’re suddenly faced with an unavoidable and unplanned commitment.

Maybe a cash-out refinance is your only way forward. But, before you decide on that, check out home equity loans and home equity lines of credit (HELOCs). With these second mortgages, your existing mortgage remains in place and you pay a higher rate only on your new borrowing.

Why it’s crucial to ask your refinance lender the right questions

By now, you’ll have recognized that a mortgage refinance is all about the math:

Check your refinance eligibility. Start here- By how much will you benefit through a lower rate and monthly payment or a lump sum cash out?

- What will you pay in closing costs?

- What will a refinancing do to your total cost of borrowing?

- How much will extending your loan term cost you in the end?

- How does this form of borrowing stack up against any alternatives?

Once you know those figures, you’re in a much better position to make an informed decision. Asking comprehensive questions can prevent future surprises, lead to better mortgage terms, and help make the refinance process smoother. Those five are all questions to ask a refinance lender. But we’ve more suggestions coming up.

Refinance quotes

And, nowadays, you may not have to ask out loud. Most of the answers are contained in the refinance quote lenders will send you on request. Get quotes for home equity loans and HELOCs, too, if those look attractive options.

You need to get such quotes from multiple lenders so you can compare them to find your best deal. Today, such quotes (called “loan estimates”) come in a standardized format. And federal regulator the Consumer Financial Protection Bureau has a great guide to how to read them on its website.

But don’t hesitate to ask a lender about anything you don’t understand. You’re not a professional and can’t be expected to know about these things. There’s no such thing as a stupid question in these circumstances.

Top questions to ask your refinance lender

Time to make a move? Let us find the right mortgage for you- What’s the best type of mortgage for me (conventional, FHA, VA or USDA), and do you offer it? Each has its pros and cons and not all lenders offer all sorts of loans

- What new refinance rate can you offer me and how does it compare to my existing one?

- How does that affect my monthly payment?

- What are the closing costs on my refinancing, and are there any other fees?

- What is the break-even point for my refinancing? This applies only to rate-and-term refinancings and shows how long it will take to recover the costs through your savings

- How much can I expect to save (rate-and-term) or lose (cash-out) over the life of the loan?

- How does your refinance deal compare to a home equity loan or line of credit?

- What types of refinancing options are available to me?

- How will refinancing impact my home equity? A rate-and-term should barely affect it, but a cash-out will reduce it by the amount you borrow plus closing costs

- Is that the best you can do? Mortgage estimates aren’t set in stone. Use them to try to negotiate a better deal. Try playing one lender off against another

These may be the most important questions to ask a refinance lender. But you may have others. It’s these professionals’ job to help consumers understand what’s happening and its implications. So, ask away!

Questions to ask a refinance lender: The bottom line

Fingers crossed that by the time you read this mortgage rates will be on a downward trend. If that’s steep enough, millions of Americans could benefit from rate-and-term refinances. And millions more could get more attractive cash-out refinances.

But, until that happy day arrives, most refinances will be a result of homeowners having urgent needs for cash. And their costs could be high in the long term.

Wherever mortgage rates are heading when you’re reading this, you’ll need our list of questions to ask a refinance lender. This may be one of the biggest personal financial transactions of your life. And you’ll need to fully understand all its implications.

That means you may well have more than our 10 questions. So, make your own list. And, when the time comes, feel free to ask anything.