The housing deficit

Between 2012 and 2022, America saw 6.5 million more households formed than single-family homes built. And there was hardly a glut of homes at the start of that decade. Talk about a housing shortage.

The U.S. Government Accountability Office (GAO) summarized the situation in October 2023: “Shortages of affordable housing are a long-standing challenge in the United States. High interest rates and low inventory are contributing to this issue, as is the growing number of millennials, who are looking for larger homes to raise families.”

But don’t despair if you’ve found your route to homeownership blocked. There are signs that some factors are already easing. And, later in this article, we’ll be exploring some strategies that could help you buy a home sooner than you think.

Verify your home buying budget. Start hereIn this article (Skip to…)

- Why is there a housing shortage?

- Strategies for a low-inventory market

- How long with the shortage last?

- The bottom line

- Housing shortage FAQ

Why is there a housing shortage?

The primary reason behind the housing shortage is the insufficient production of new homes by home builders.. But several factors have in recent years compounded the housing crisis problem, making it especially acute right now.

Verify your home buying budget. Start hereSupply and demand

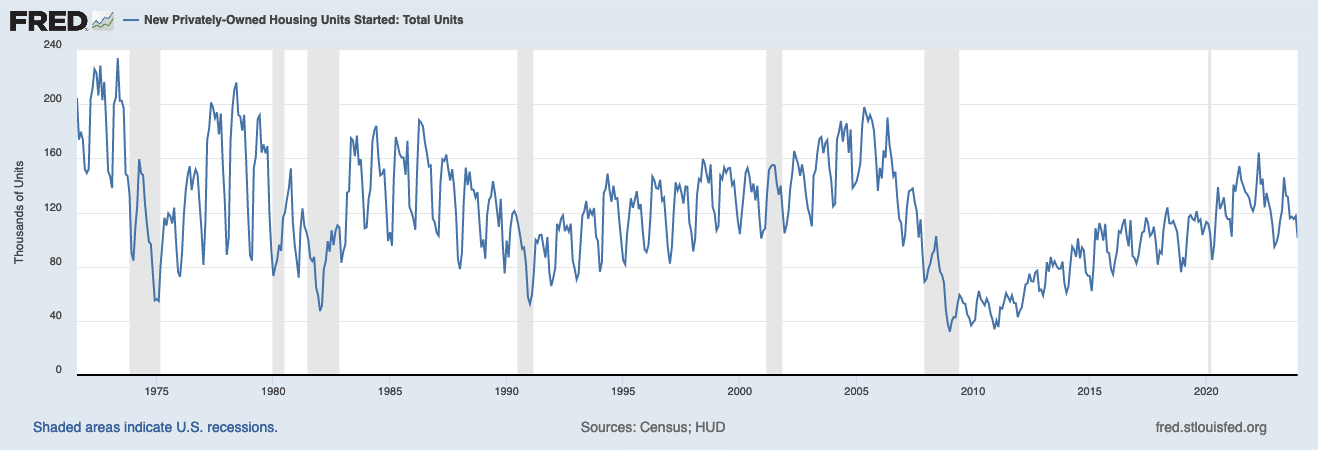

Still, let’s start with the basics. The following chart, from the Federal Reserve Bank of St. Louis, shows the number of new, privately owned homes built since August 1971.

The shaded stripes indicate U.S. recessions, and you can see what a big impact those tend to have on home construction. But the Great Recession, from December 2007 to June 2009, saw a slump in construction to a 35-year low. And we’re still a long way from a recovery to typical pre-recession levels.

Economics 101 often covers housing supply and demand. And the supply of homes falls far short of the demand for them, pushing up prices to unaffordable levels and exacerbating the housing shortage.

Higher mortgage rates and the housing shortage

In 2020, mortgage rates were uberlow, somewhere in the high 2% to low 3% range. But, at the time this was written, they were more than twice as high.

If you bought a home in 2020 or refinanced your existing mortgage to a low rate, your current monthly payments are most likely reasonable. But if you were to move homes now, your mortgage rate and monthly payment would shoot up to much higher levels.

So, you can’t blame homeowners for staying put. Only those who really need to move or refinance would do so. But that means that the usual churn of people upsizing, downsizing and relocating is currently muted, making the homes available to buy even fewer.

Verify your home buying budget. Start hereOther factors

And other factors have conspired to make the housing shortage worse. The COVID-19 pandemic slowed new housing development through labor shortages and disruptions to the supply of materials. Hedge funds and other institutional investors are buying up many of the few homes on the market for investment rental purposes. And, meanwhile, the population growth is creating more demand and putting yet more pressure on affordability.

In November 2023, J.P.Morgan Private Bank summarized the issues thus: “High prices, high mortgage rates and a shortage of homes: Combined, they’ve created today’s crisis of affordability.”

What is a normal amount of inventory?

Inventory is the term economists use for the number of homes available to purchase in the U.S. And it’s currently very low. According to U.S. News, in December 2023, there were 714,176 active listings of homes for sale nationwide, down from 1.03 million in December 2019.

The newspaper went on to quote an industry expert, John Hunt, who’s chief analyst and principal with MarketNsight. “Most cities are around 50-60% of the inventory they had prior to the pandemic,” he said. “We’re still selling houses at about 80% of the clip as last year.”

Verify your home buying budget. Start here

Strategies for a low-inventory market

Many homeowners feel trapped in their homes, unable to sell because they can’t afford the high rates that will come with their new mortgage. But it can be even more frustrating for aspiring buyers, who can spend fruitless months seeking out somewhat affordable homes only to find their offers rejected in favor of a Wall Street investor or a cash buyer.

To a large extent, neither group can avoid a waiting game. They’re stuck until mortgage rates fall sufficiently to allow sellers to sell again and buyers to buy again. However, there are things they can do to position themselves for success when those lower rates finally arrive.

Verify your home buying budget. Start hereBuyers

You won’t be the only ones purchasing when rates become more affordable. We’re currently building huge pent-up demand for homes and you’re going to be competing with very many other aspiring buyers.

So, use the time between now and your entry into the market to get yourself into great financial shape. That can make you more attractive to mortgage lenders as well as sellers. And it should earn you a lower mortgage rate.

In particular, use your waiting period to:

- Check your likely eligibility for down payment assistance and other financial help now. The more you know now, the more decisively you can act when housing costs improve

- Pay down your debts, particularly your credit card balances. That should improve both your credit score and your debt-to-income ratio, improving your chances of getting a low mortgage rate

- Once you’re on top of your existing debts, save as much as you can toward your down payment. The bigger that is, the easier you should find it to get your mortgage application approved, and the lower your mortgage rate might be

- If you’re going to move jobs or open or close existing credit accounts, now might be a good time to do so. Doing those things close to your making an application can make it harder to get approved

- Just before you enter the market, get pre-approved by a lender. That gives you real credibility with sellers and real estate agents

So, don’t see this frustrating period as downtime. Instead, use it to proactively get into as good a financial state as you can manage.

Sellers

Similarly, sellers could use the time when they’re waiting for lower mortgage rates constructively. When the housing shortage ends, it will end. And that means plenty of other homeowners might well be trying to sell their places at the same time.

So, use this time to get your home into great shape. Ideas include:

- Upgrade your interior decor. If you like strong colors, tone those down to more neutral ones that have the widest appeal. Make a plan and timetable to tackle each room in turn

- Give your home curb appeal. Work to make your front yard tidy, colorful and attractive. Tubs and hanging baskets can help. If the exterior of your home needs refreshing, do that, too, with new paint. If sidings or guttering is damaged, replace it

- Don’t forget the backyard. Curb appeal stops buyers from pulling up outside and driving straight on. But they’ll expect a decent backyard, too

- Begin a program of inexpensive, minor improvements. Would your kitchen benefit from new cabinet fronts or replacement handles? Might new faucets and a replacement shower curtain help your bathrooms?

- Close to the time when you’re going to market your home, do a top-to-bottom clean, including steam-cleaning carpets and soft furniture. If your home looks cluttered, store knickknacks and oversized furniture

Real estate agents aren’t too busy right now. If you dangle a future listing, one might well be willing to visit now and help you identify issues that you’ve grown blind to.

How long will the housing shortage last?

It could take decades of above-average construction to build enough homes to satisfy the demand for housing. But things are likely to improve in other ways quickly, perhaps within months.

For instance, many experts expect mortgage rates to fall through 2024. Fannie Mae’s team thinks they’ll be down to 5.8% by the end of 2024 and 5.5% by the end of 2025. Anyone who’s hoping for rates in the late 2%s or low 3%s may have a long wait. But the sorts of falls Fannie is expecting may well be enough to tempt homeowners onto the market.

Verify your home buying budget. Start hereThe J.P. Morgan Private Bank report that we cited earlier explored affordability in the housing market and was published in November 2023. And it asked and answered the question of when that affordability might normalize. It concluded:

“How long might it take to restore average levels of affordability—based on historical ratios of home prices to income, and factoring in mortgage rates—if incomes were to keep growing at their recent pace, mortgage rates didn’t decline and home values stayed at all-time highs? Our answer: About 3.5 years.”

But it continued: “Our analysis of the timing is notably sensitive to mortgage rates. If the market’s pricing of mortgage rates were to fall by just one percentage point, U.S. homes could be affordable again in just two years.” If Fannie’s forecast is correct, we could see that one-percentage-point fall fairly soon.

Of course, buyers and sellers won’t have to wait for normal housing affordability. They just have to pick the moment when it makes financial sense for them personally to enter the market. So, the housing shortage may well begin to ease within months.

The bottom line: America’s housing shortage

The American residential property market is currently in a mess with an acute housing shortage. But we could see improvements very soon and normalization within a couple of years.

In the meantime, many potential buyers and sellers have little choice but to sit out this period. However, they shouldn’t see this as wasted time. Instead, they can get themselves into great shape to take advantage of the recovery when it arrives. And the sooner they’re in that shape, the sooner they can enter the market.

Verify your home buying budget. Start here

Housing shortage FAQ

These shortages arise when the demand for homes far exceeds the supply of them.

Various factors can create a housing shortage. The current one is a result of: too few homes being built over decades; high mortgage rates making moving home unaffordable for homeowners; COVID-19 disruptions; and Wall Street investors buying up too many owner-occupied homes for rental.

It’s almost certain to, and probably quite soon. As mortgage rates fall, existing homeowners are likely to move more, making the pool of available properties much bigger. We could see improvements through much of 2024 and full normalization of affordability within a couple of years.

The housing shortage alone is unlikely to lead to a housing market crash. However, it can contribute to market volatility, price fluctuations, and housing affordability issues. Various factors, including economic conditions, interest rates, and government policies, can influence the stability of the housing market.

You can navigate the housing shortage by being proactive, acting quickly on listings, expanding your search criteria, working with real estate agents familiar with the local market, considering off-market opportunities, and exploring alternative housing options such as co-living arrangements or shared housing.

There’s no magic bullet unless you can relocate to areas where housing is already exceptionally affordable. However, by following our suggestions (above), you may be able to get into the market and move into your own home more quickly than others.