Knowing how hot your housing market is can help prepare you for the level of home buyer competition you may face.

With more jobs returning to in-person protocols, fewer house hunters are searching in different metro areas, according to Redfin.

Discover which cities are seeing the biggest inflows and outflows of potential home buyers.

Check your home buying options. Start hereMigration patterns

For home buyers, the widespread remote working policies of the Covid-19 pandemic ushered in a tidal wave of movement.

With borrowers untethered from their physical offices and daily commutes, they had the ability to live elsewhere while maintaining their employment.

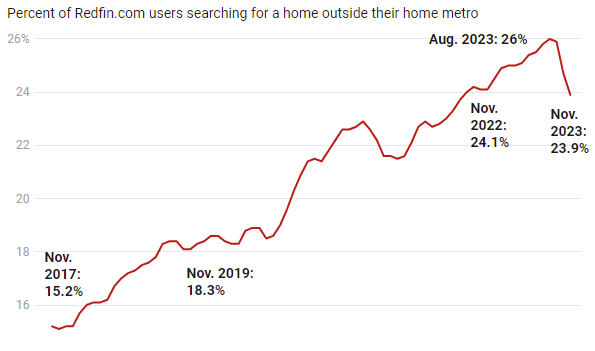

Redfin has tracked the amount of potential home buyers searching in other metropolitan areas in its Migration Report since 2017. That share hit an all-time high of 26% in August 2023, compared to pre-Covid rates in the mid-to-high teens.

However, more jobs are returning to in-office and hybrid models, and popular migratory destinations experienced higher price growth relative to surrounding areas. Because of these factors, the share of migrant home buyers declined for the third straight month. A 23.9% share of borrowers looked to possibly relocate in November 2023, down from October’s 24.7% and November 2022’s 24.1%.

In November, Sacramento, Calif. led all housing markets by net inflow (the amount of Redfin.com users who looked to move into the area over those who looked to leave) of 5,100 borrowers. The largest contingent of house hunters were from San Francisco.

The table below shows November 2023’s top 10 most searched metros by net inflow:

| Metro Area | Nov. 2023 Net Inflow | Nov. 2022 Net Inflow | Top Origin | Top Out-of-State Origin |

| Sacramento, Calif. | 5,100 | 7,000 | San Francisco, Calif. | New York, N.Y. |

| Las Vegas, Nev. | 3,800 | 6,400 | Los Angeles, Calif. | Los Angeles, Calif. |

| North Port-Sarasota, Fla. | 3,700 | 3,700 | New York, N.Y. | New York, N.Y. |

| Cape Coral, Fla. | 3,700 | 4,000 | Miami, Fla. | Chicago, Ill. |

| Salisbury, Md. | 3,600 | 2,000 | Washington, D.C. | Washington, D.C. |

| Myrtle Beach, S.C. | 3,600 | 2,800 | Washington, D.C. | Washington, D.C. |

| Orlando, Fla. | 3,500 | 3,300 | New York, N.Y. | New York, N.Y. |

| Portland, Maine | 3,400 | 2,800 | Boston. Mass. | Boston. Mass. |

| Nashville, Tenn. | 3,000 | 2,800 | Los Angeles, Calif. | Los Angeles, Calif. |

| Spokane, Wash. | 2,500 | 2,300 | Seattle, Wash. | Los Angeles, Calif. |

Redfin analyzed about two million Redfin.com users across more than 100 metro areas, from September 2023 to November 2023. A Redfin.com user counts as a migrant if they viewed 10 or more for-sale homes in the three-month period and at least one of those homes was outside their home metro area.

Check your home buying options. Start hereThe places home buyers are leaving

If borrowers are moving to new places, that means they’re leaving their old metro areas behind.

With budgets and affordability strained for so many, expensive coastal housing markets typically see the largest swaths of people leaving for greener (or in this case, cheaper) pastures. Los Angeles took November’s top spot by net outflow with 26,100 migratory home buyers. Las Vegas was the most sought after destination, as the median sales price is about half that of L.A.’s, according to to Redfin’s report.

The table below shows the top 10 metro areas by highest net outflow:

| Metro Area | Nov. 2023 Net Outflow | Nov. 2022 Net Outflow | Top Destination | Top Out-of-State Destination |

| Los Angeles, Calif. | 26,100 | 30,300 | Las Vegas, Nev. | Las Vegas, Nev. |

| San Francisco, Calif. | 25,400 | 32,000 | Sacramento, Calif. | Seattle, Wash. |

| New York, N.Y. | 24,900 | 20,700 | Miami, Fla. | Miami, Fla. |

| Washington, D.C. | 13,300 | 16,100 | Salisbury, Md. | Salisbury, Md. |

| Seattle, Wash. | 11,900 | 1,300 | Spokane, Wash. | Phoenix, Ariz. |

| Chicago, Ill. | 7,600 | 7,100 | Cape Coral, Fla. | Cape Coral, Fla. |

| Boston, Mass. | 5,000 | 6,100 | Portland, Maine | Portland, Maine |

| Philadelphia, Pa. | 3,000 | 1,300 | Salisbury, Md. | Salisbury, Md. |

| Detroit, Mich. | 2,100 | 3,400 | Washington, D.C. | Washington, D.C. |

| Denver, Colo. | 2,000 | 3,200 | Chicago, Ill. | Chicago, Ill. |

The bottom line

While more jobs return to an in-office model, plenty of prospective home buyers are still remote and free to relocate.

Interest rates have descended and 2024 is anticipated to be a big year for home buying. Knowing whether to expect a big influx of borrower competition in your city can help you get ahead of the curve.

If you’re ready to become a homeowner, reach out to a local lender and get the process started today.

Time to make a move? Let us find the right mortgage for you