Home equity keeps growing in 2024

Equity is one of homeownership’s major financial advantages over renting.

Home equity is how many people build wealth and, when tapped into, can provide borrowers with money for renovating and remodeling, investing, an emergency fund or even paying off other debt.

Homeowners with mortgages saw a collective annual equity increase of $425 billion in 2024’s third quarter, according to CoreLogic. The average borrower now sits on $311,000 in equity. See which states enjoyed the largest and smallest bumps to their home equity.

Cash out your home equity. Start hereThe latest home equity gains

Home equity grows or shrinks in conjunction with housing prices.

In 2024’s third quarter, the average mortgaged homeowner added about $5,700 in equity year-over-year. This jumped 2.5% annually and amounted to a combined $425 billion gain in home equity for U.S. borrowers.

“As home prices flattened in the third quarter, home equity gains also slowed, even declining in some regions of the country. While home equity closely depends on home price changes, equity losses are also tied to natural disaster events since households can lose a lot of their equity following a catastrophe, particularly if not property insured, said Selma Hepp, chief economist at CoreLogic.

“As a result, following Maui’s 2023 devastating wildfire, Hawaii now tops the list with largest decline in home equity. Nevertheless, Hawaiian homeowners still rank high for homeowner equity, with equity averaging $700,000. Nationally, average homeowner equity remains near a historical peak at over $311,000. Still, recent devastating weather events underscore the importance of maintaining that equity, particularly for households for which this is the only source of wealth.”

Home equity changes by state

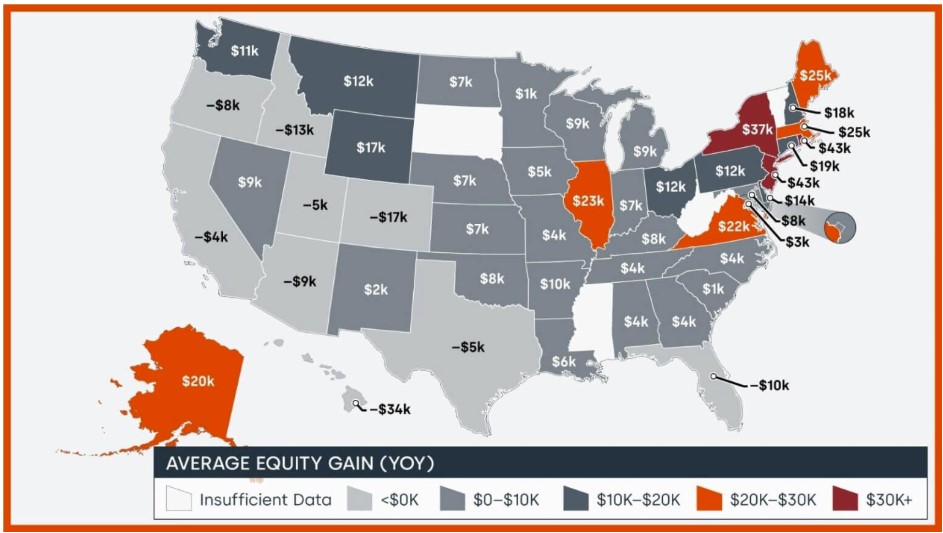

The third quarter’s home equity gains varied across the country. Borrowers in some states had gains more than seven times the national average, while others saw modest increases and even declines.

Rhode Island and New Jersey led all states with an annual spike of about $43,000. New York came next at $37,000; then $25,000 in both Maine and Massachusetts rounded out the top five.

At the other end of the spectrum, borrowers in Hawaii saw their equity decrease by about $34,000 year-over-year. That was followed by annual equity losses of $17,000 in Colorado, $13,000 in Idaho $10,000 in Florida, and $9,000 in Arizona.

The map below shows the third quarter’s estimated annualized home equity changes by state:

How can you use home equity?

Since home equity is tied up in your property, it must be converted to liquid cash in order to be used. There are three main ways to do this: a home equity loan (HEL), a home equity line of credit (HELOC), or a cash-out refinance.

With a home equity loan, you keep your existing mortgage and take out a second loan against your property. These typically have lower closing costs but may come with slightly higher interest rates compared to cash-out refis. Here is a list of everything you need for taking out a home equity loan this year.

HELOCs work similarly to credit cards, with borrowing limits that can be repaid and reused. They usually come with variable rates and low or no closing costs, and you pay interest only on the outstanding loan balance. HELOCs also have set “draw periods” after which you have to repay the remaining balance in full. Here is a full list of HELOC requirements.

With a cash-out refi, you replace your existing home loan with a new primary mortgage. The new loan’s balance will be larger than what you owed, but that difference gets returned to you as cash. Refinance closing costs average around 2-5% of the loan amount and usually get taken out of your cash back total. See if you qualify for a cash-out refi.

Once you’ve cashed out your equity, it can be used for just about anything you want. Many homeowners tap equity to complete home improvements or repairs, consolidate high-interest debt into one cheaper loan payment, or make a down payment on a vacation home or rental property.

Cash out your home equity. Start hereHow do I calculate my home equity?

Home equity is the amount of cash value built up in your property. As you pay down your mortgage and housing values increase, your equity grows.

To figure out your total equity, take your home’s current value and subtract your mortgage balance. If your house is worth $500,000 with a loan balance of $300,000, then you have $200,000 in equity.

Getting an estimated property value requires using an online evaluator, researching recent comparable home sales in your area, or paying for an appraisal. Your lender can assist you in this process and figure out the best way to take advantage of your equity.

How much equity can I take out of my property?

Typically, borrowers can’t cash out all the equity they built up. With exception, lenders normally prefer to keep 20% of your home’s value untouched as default protection. The remaining amount is referred to as “tappable” equity.

Based on the example in the section above, your 20% buffer comes out to $100,000 ($500,000 x 0.2). After subtracting that from your total equity, you end up with $100,000 in tappable equity ($200,000 - $100,000).

Your next steps

If you have a running list of purposes for your home’s equity, start the process of tapping into it.

The best way to figure out how much you can borrow and which loan type to use is to talk with your lender. They can guide you through property valuations, the best ways to tap your equity and which you qualify for.

Leveraging your equity is one of the biggest benefits of owning a home and a way to make your money work for you.

Time to make a move? Let us find the right mortgage for you