Chances are, your mortgage interest probably makes up a large proportion of your monthly expenses.

So, how can you secure the best mortgage rate possible? The potential savings you unlock can have a substantial and lasting impact on your lifestyle and disposable income for many years to come.

Read on as we delve into the world of mortgage interest rates, where we’ll explore their implications, and reveal the keys to securing the most favorable terms.

Verify your home buying eligibility. Start hereIn this article (Skip to...)

- What is interest?

- How costly is mortgage interest?

- What factors determine mortgage interest?

- Fixed vs. adjustable-rate mortgage

- The bottom line

What is interest?

Merriam-Webster defines interest as “a charge for borrowed money, generally a percentage of the amount borrowed.” You can think of it as the rent you pay to lenders for giving you access to their money.

That makes it different from the money you access. The money you borrow is called the “principal,” and the interest you pay is almost always a percentage of that.

Verify your home buying eligibility. Start hereYou pay the interest monthly, but it’s calculated annually. So, if you borrow $100,000 at a 5% interest rate, you’ll pay $5,000 a year in interest, which is $600 a month.

With an installment loan, such as a mortgage, you have to pay the principal back over the life of the loan plus the interest that accumulates.

Nearly all mortgages are “fully amortized.” That means, for a fixed-rate loan, all the monthly payments are the same. But your mortgage lender works them out so you zero your balance (including interest and the principal sum borrowed) when you make the final monthly payment at the end of your home loan’s term, often 30 years.

Amortization and mortgage interest

When you make your first monthly payment on a new mortgage, you owe a huge amount of money. So, almost all that payment goes on interest and your principal debt reduces only a little.

Gradually, over the years, your principal decreases and the interest you owe each month does, too. As each payment is made, the percentage allocated to interest shrinks while the portion allocated to reducing the debt grows larger and larger.

By the time you make your last payment, only a tiny bit is interest and nearly all of it reduces your principal — to zero.

This stuff isn’t easy. So, to discover more, read How mortgage amortization works, and why it matters.

How costly is mortgage interest?

When this was written, in October 2023, mortgage rates had just reached a 20-year high. So, it may feel as if mortgage interest is expensive.

But, of course, mortgages are actually one of the least costly ways of borrowing. The problem isn’t the mortgage interest itself but the large sums home buyers borrow over long periods.

Even a low interest rate can result in high monthly mortgage payments when you’re borrowing big. And your mortgage is likely to be by far your largest loan, at least at the start.

Verify your home buying eligibility. Start hereWhat’s that in dollars?

So, how much might your mortgage interest cost on a conventional 30-year, fixed-rate mortgage? Let’s try an example. We’re basing it on the average rate for such a loan on the day this was written (7.522%) and on a property at the current median home price ($ in the second quarter of 2023). We’ll assume a 20% down payment.

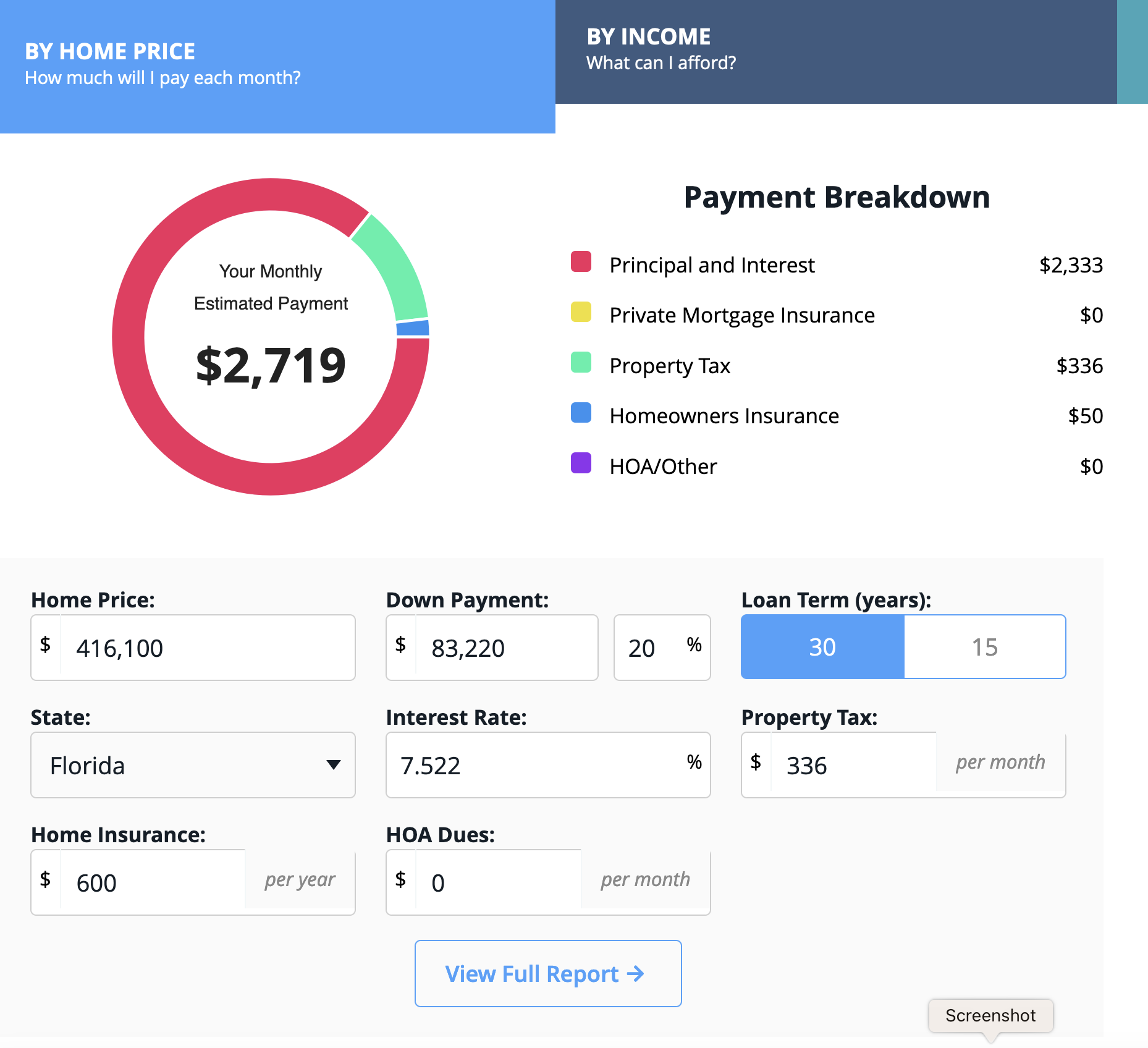

We fed those numbers into our mortgage calculator. And you can do the same with your own figures. Here’s what we got:

So, that’s $2,333 each month for the mortgage, plus property taxes and homeowners insurance. Did you spot the View Full Report button at the bottom? That provides the real low down:

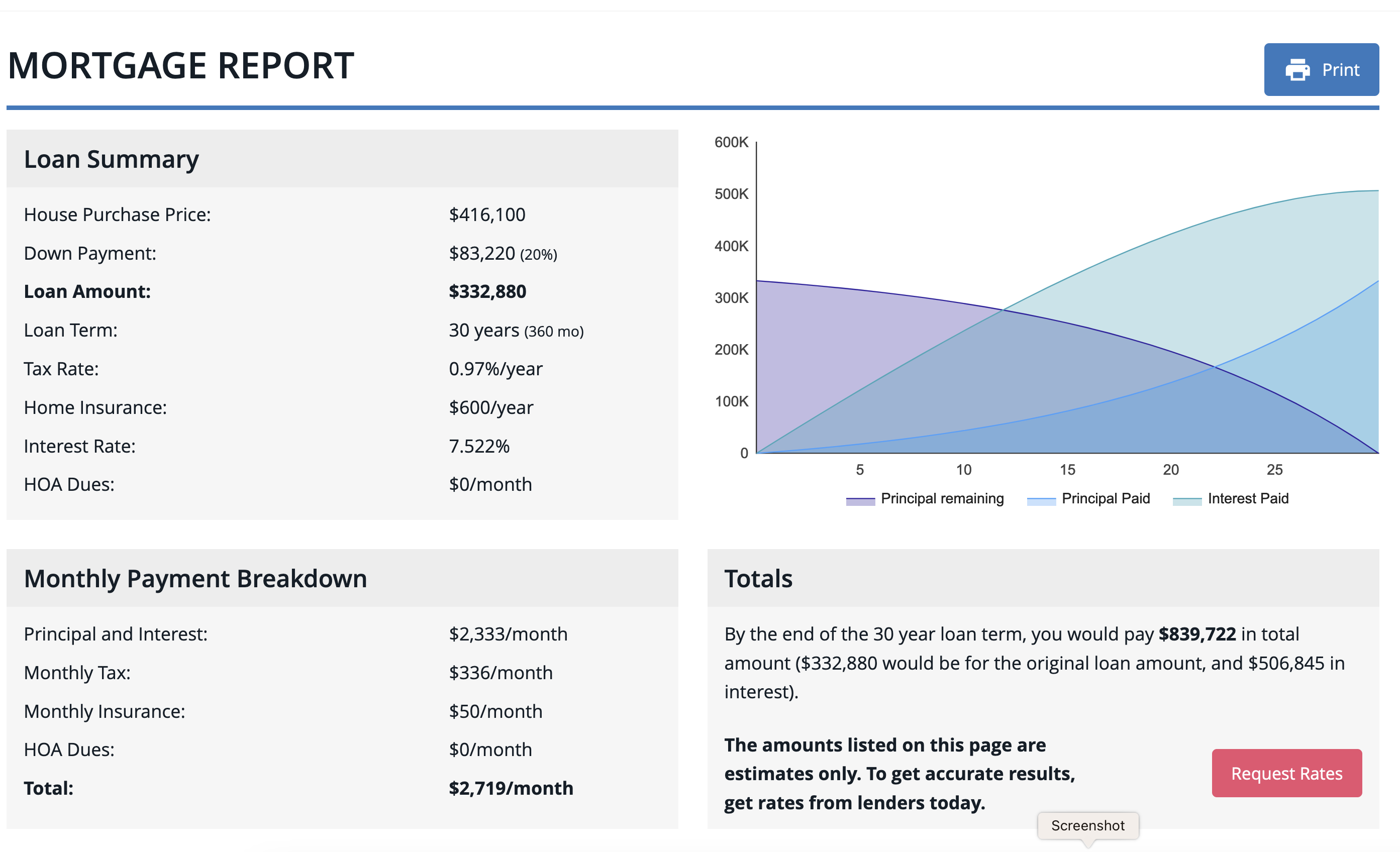

So, as the Totals section reveals, “By the end of the 30-year mortgage loan term, you would pay $839,722 in total amount ($332,880 would be for the original loan amount and $506,845 in interest).”

Yes, that sounds a lot. But you’re borrowing a considerable loan amount over a long period of time.

It’s actually good value, especially when you think that, at the end, you’re likely to own outright a hugely valuable asset. And you won’t have had to pay rent for the next 30 years to live somewhere else.

By the way, the graph top-right on that page shows amortization in action.

What factors determine the mortgage interest you pay?

There are two main groups of factors that affect the mortgage rates you’ll be quoted: Things you can change and things you can’t.

Verify your home buying eligibility. Start hereThe economy and markets

Let’s start with what’s outside your control. That’s mostly the economy and its effect on the bond market for mortgage-backed securities. It’s that market that largely determines current mortgage rates.

Generally, mortgage rates fall when the economy’s in trouble and rise when it’s thriving. Inflation also plays a role, with above-average price rises tending to drive higher interest rates.

Your financial circumstances

Now, for some things you can control. Lending is all about risk. Lenders know that some of their home loans will turn bad. But which?

So, they analyze your personal finances to discover how much of a risk you pose. And the bigger that perceived risk, the higher the interest rate they’ll quote you. Of course, if they think there’s a serious danger of your mortgage loan turning bad, they’ll simply decline your application.

So, what specifically do they look for? It’s mainly:

- A consistent and adequate source of income — That’s often easy to prove if you’re an employee. But it can be harder for the self-employed and those in the gig economy

- A history of managing debt well — That’s your credit score and credit report

- A manageable level of existing debts — How easily will you afford the new monthly mortgage payments once you’ve met all your other inescapable financial commitments each month? This is called your debt-to-income ratio or DTI

- The down payment amount — The bigger your down payment, the more skin you have in the game. And that means you’re less of a risk. So a high down payment helps get you a lower interest rate. However, most borrowers can easily get a mortgage with just 3% or 3.5% (zero for some) down. This is your loan-to-value ratio (LTV)

Each of those normally affects a lender’s calculations when deciding what mortgage interest rate to quote you. And, of course, you have a great deal of control over them.

For example, spending time before you apply, building your credit score and reducing your debt (especially card balances) can earn you an appreciably lower interest rate.

Verify your home buying eligibility. Start hereRate shopping

How would you like to save more than $1,000 a year for many years to come for just a few hours’ work?

It’s easy. And yet, a surprising number of mortgage borrowers pass on the opportunity.

In May 2023, federal regulator the Consumer Financial Protection Bureau (CFPB) released a report under the headline:

Mortgage data shows that borrowers could save $100 a month (or more) by choosing cheaper lenders

The CFPB found the spread among different lenders’ mortgage interest rates is “often around 50 basis points of the annual percentage rate.” Fifty basis points is 0.5%. So, it could be the difference between paying a rate of 7% or 6.5%. Try running those figures through our mortgage calculator!

The report also says that such differences apply in “virtually every segment of the mortgage housing market, including loans backed by Fannie Mae and Freddie Mac, Federal Housing Administration loans, U.S. Department of Veterans Affairs (Veterans Affairs) loans, as well as jumbo loans.”

And all you have to do to unlock such potential savings is request quotes from multiple lenders. Of course, your preferred lender may come up with the best deal. But suppose it doesn’t.

Fixed vs. adjustable-rate mortgage

Most Americans, especially first-time home buyers, opt for a fixed-rate mortgage (FRM). They’re prepared to pay a little more for the security of knowing that every monthly payment they make on their loan will be the same as the last one.

A fully amortized FRM is as predictable as anything gets. You pay the same $x each month until you finish paying down the loan — or sell the home or refinance the mortgage.

Verify your home buying eligibility. Start hereAdjustable-rate mortgages (ARMs) are very different. Or they can be after a few years.

An ARM almost always starts with a lower interest rate than an FRM. And that rate is fixed for an initial period, after which it can float in line with general interest rates, usually once each year.

So, a 5/1 ARM has a fixed rate for the first five years, a 7/1 ARM’s rate is fixed for seven years, and so on. The second numeral tells you how often the rate can be adjusted after the initial fixed-rate period expires. That numeral is most often a 1, meaning the rate can then float up or down annually (once a year).

That’s fine as long as mortgage rates remain low. But it can cause real pain when those interest rates shoot up, as they have done in recent years.

Luckily, that pain is usually moderated because most ARMs come with caps that limit how much their interest rates can rise. But even moderated pain is still pain.

Some home buyers can still be better off with ARMs. If you know you’ll be moving home within seven years and choose a loan type such as the 7/1 ARM, your mortgage interest rate will be fixed for as long as needed.

The bottom line on mortgage interest

At worst, mortgage interest is often seen as a practical necessity. The other option is to spend a lifetime paying rent, ultimately without the prospect of building valuable assets.

When mortgage rates are high, the weight of interest payments can become a substantial concern. But, if mortgage rates fall one day, refinancing is always an option, provided you remain creditworthy.

And there are things you can do to pay as low a mortgage interest rate as possible. Comparison shopping among several lenders could save you $100+ a month. Meanwhile, improving your credit score and reducing your existing debts can make another big difference.

Homeownership remains as much a part of the American dream as it always has. If you’re ready to fulfill your dream, don’t delay.

Time to make a move? Let us find the right mortgage for you