Declining affordability

If you follow the housing market, you know the last few years became a thunderdome for home buyers.

Fierce competition and low for-sale inventory led to surging prices. As conditions strained affordability, a declining share of borrowers could save enough for a down payment compared to before the pandemic.

In 2022, nearly two in five potential borrowers couldn’t make a 5% down payment, according to The Mortgage Reports. We dug into why affordability cratered so quickly and how you can find a loan for down payments of any size.

Verify your home buying eligibility. Start hereIn this article (Skip to...)

- Fewer borrowers can put down 5%

- Pandemic's impact on housing costs

- Housing market by the numbers

- Home loans if you can't pay 5% down

- Advice for home buyers

Fewer borrowers can put down 5%

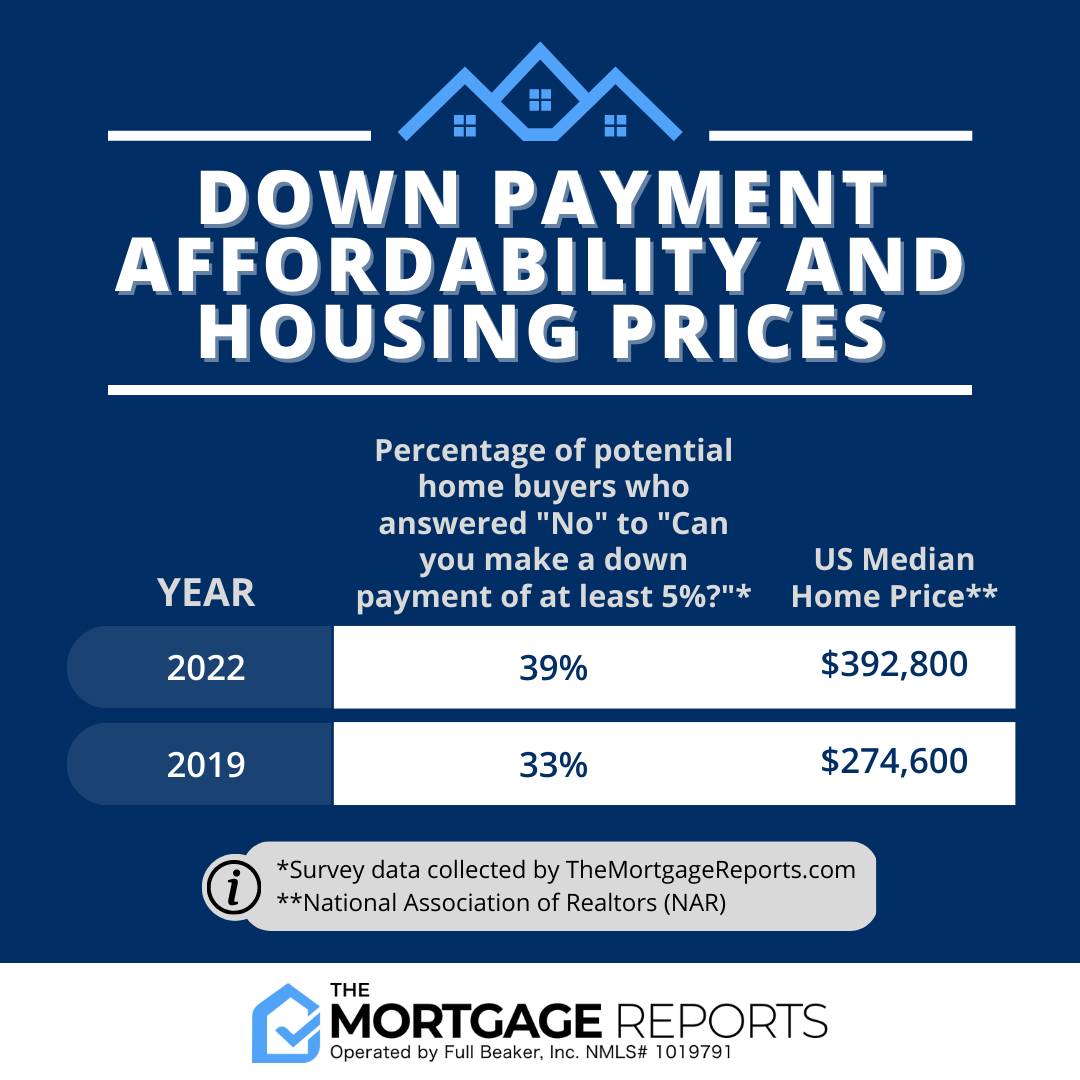

Proprietary survey data from TheMortgageReports.com showed 39% of potential home buyers could not make a down payment of at least 5% in 2022. However, that share stood at 33% in 2019.

The last few years brought record-setting home price growth, spurred by an extreme supply-demand imbalance and remote work shifting where people lived and bought houses. Add in decades-high inflation and increasing mortgage rates of the past 12 months, and it cumulatively made saving for larger down payments harder to achieve.

Check your home loan options. Start here“Economic uncertainty and the Federal Reserve’s monetary easing in response to the pandemic drove mortgage rates down to historic lows, which boosted consumer house-buying power,” said Ksenia Potapov, economist at First American.

“Between February and December 2020, home buyers gained an estimated $50,500 in purchasing power, outweighing the effect of higher home prices. As mortgage rates began to rise, purchasing power contracted and affordability declined by 78% between January 2021 and December 2022," she continued.

Fortunately, the old standby of needing at least 20% down is mostly a relic of the past. Today’s borrowers — particularly first-time home buyers — come with a different set of expectations, have more loan types available to better suit their needs and programs to help them with down payments.

The pandemic’s impact on housing costs

The Covid-19 pandemic caused a major shift in home buying dynamics and conditions, with the ripple effects still felt today.

Work-from-home employment removed the need to live in proximity to the office. With businesses physically shut down, people left densely packed city centers in droves for areas offering larger properties with more space and better prices. This flurry of buyers overwhelmed markets and exacerbated the already shallow pool of available homes for sale.

Verify your home buying eligibility. Start here“The Federal Reserve, in an attempt to keep the economy afloat against fears of a severe COVID-caused recession, kept the Fed Funds rates low and poured billions of dollars into mortgage-backed securities as part of its quantitative easing,” said Rick Sharga, CEO at CJ Patrick Company. “This led to historically low mortgage rates, which further stimulated demand at a time when the inventory of homes for sale dipped to record lows.”

The significant influx of demand juxtaposed with a dearth of for-sale listings caused bidding wars and resulted in skyrocketing property values. Homeowners rejoiced as their equity grew at breakneck speeds while prospective buyers toiled and pulled out all the stops to place winning offers.

Nationally, home prices spiked 18% in December 2021 compared to December 2020, according to the Federal Housing Finance Agency (FHFA). By comparison, that nearly tripled the top-end growth rate of what’s considered a more normalized marketplace. Annual appreciation oscillated between 4.89% and 6.8% from the first quarter of 2017 to the second quarter of 2020.

“Housing prices jumped during the pandemic as remote work and other situations affected where and how Americans wanted to live,” said Eddie Seiler, Mortgage Bankers Association (MBA) AVP of housing economics and Research Institute for Housing America executive director. “The low interest rates acted to attenuate the high house price growth with respect to monthly payments.”

Listen to Ivan on The Mortgage Reports Podcast!

2022 housing market by the numbers

Covid-19’s impact on the housing market rapidly drove up property values.

The U.S. median house price went from $274,600 in 2019, to $300,200 in 2020, to $357,100 in 2021, and to $392,800 in 2022, according to the National Association of Realtors (NAR).

Check your home loan options. Start hereThough that median dropped to $363,100 in January 2023 so “it's very possible that we're seeing a home price correction as affordability has been impacted by higher mortgage rates,” Sharga said.

Saving for a down payment is generally one of the top obstacles for renters trying to become homeowners. Part of that is the antiquated belief they need to bring at least 20% of the home’s purchase price to the closing table. However, down payment amounts vary greatly by loan type and borrower.

Over the course of 2022, home buyers had a median down payment of 13%, according to NAR. However, that median dropped as low as 8% for borrowers between the ages of 23 and 31. (It only surpassed the 20% threshold for borrowers older than 57 — who have had both longer to save and could draw from equity in their properties.)

The median also differed depending on whether it was your first purchase. The typical first-time home buyer put down 6% in 2022 while repeat buyers paid down 17%.

Home loans if you can’t pay 5% down

For anyone struggling with saving for a down payment, rest assured that you’re not alone. In fact, you have plenty of lending and assistance programs available to you.

The government-sponsored enterprises (GSEs) of Fannie Mae and Freddie Mac each have low down payment loans — HomeReady and Home Possible, respectively — that only require 3% down and come with more lenient underwriting standards. The Conventional 97 also allows for borrowers to put just 3% down.

Verify your home buying eligibility. Start hereMortgages backed by the Federal Housing Administration (FHA) are famously great options for first-time and lower-income buyers that only require 3.5% down. The FHA also cut borrower costs for 2023. Data from NAR shows that FHA loans made up 15% of all mortgages in 2022.

Military veterans have loans backed by the Department of Veterans Affairs (VA) available to them. VA mortgages typically have lower interest rates and you can get one with a 0% down payment. VA loans made up 9% of all mortgages in 2022, according to NAR data. USDA loans — backed by the Department of Agriculture — are aimed at low- and moderate-income borrowers in rural areas and also don’t need a down payment.

Some private lenders offer their own zero-down mortgages but each have special guidelines and qualifications that need to be met.

It’s important to note that loans with smaller down payments require private mortgage insurance (PMI). PMI can be removed once you reach 80% of your home’s loan-to-value ratio.

Additionally, down payment assistance programs provide grants or loan cash upfront to potential home buyers at the time of purchase. These vary by state and there are over 2,000 programs nationwide.

Several companies out there will provide you supplemental cash at closing in exchange for a percentage of your home’s future equity. However, “shared equity” programs should be approached with caution, Sharga warns. “These programs aren't heavily regulated and borrowers should make sure they carefully review and completely understand the terms they're signing up for.”

Advice for home buyers

Housing affordability tumbled over the past couple years and fewer potential borrowers can pay 5% down than before the pandemic. Fortunately, you have a bevy of mortgage options and assistance programs at your disposal.

“What we are seeing now is an increased amount of down payment assistance programs being issued nationally and locally to help new homeowners close the income gap and account for the deficit in available funds for down payments,” said Ralph DiBugnara, president at Home Qualified. “These programs are working in conjunction with Fannie Mae, Freddie Mac and FHA loans to offer buyers either low-or-no down payment options.”

When you’re ready to begin your home buying journey, reach out and talk to a local mortgage lender about your options.

Time to make a move? Let us find the right mortgage for you